After joining Hanwha Group, Hanwha Ocean overcame long-standing financial difficulties inherited from its Daewoo Shipbuilding & Marine Engineering days, returning to profit within just 17 months. The company also became the first Korean shipyard to win a contract for maintenance of U.S. Navy vessels.

Both the normalization of management and expansion into global markets were promises made by Hanwha Group Vice Chairman Kim Dong-kwan in 2023. However, Hanwha Ocean still faces a major challenge: an urgent need for a credit rating upgrade.

Daewoo Shipbuilding & Marine Engineering officially changed its name to Hanwha Ocean on May 23, 2023. At that time, five Hanwha Group affiliates-Hanwha Aerospace, Hanwha Systems, Hanwha Impact Partners, Hanwha Energy (then Hanwha Convergence), and Hanwha Energy Singapore-invested a total of KRW 2 trillion to acquire a 49.3% stake, completing the acquisition.

Currently, Hanwha Aerospace is the largest shareholder of Hanwha Ocean, holding a 46.28% stake. Recently, Hanwha Aerospace increased its shareholding by acquiring all Hanwha Ocean shares held by Hanwha Energy and Hanwha Energy Singapore, as well as part of the stake owned by Hanwha Impact Partners.

This additional acquisition by Hanwha Aerospace is aimed at facilitating a credit rating upgrade for Hanwha Ocean.

On April 8, An Byung-chul, CEO & Head of Strategy at Hanwha Aerospace, stated, “Hanwha Ocean’s credit rating remains relatively weak, and considering the situation of competitors supported by European governments, it is impossible to win orders based solely on product performance and price competitiveness.”

He emphasized the intention to bolster Hanwha Ocean’s credit standing by leveraging the high AA- (Stable) credit rating of its parent company. Ultimately, however, it is also necessary for Hanwha Ocean to enhance its own credit profile.

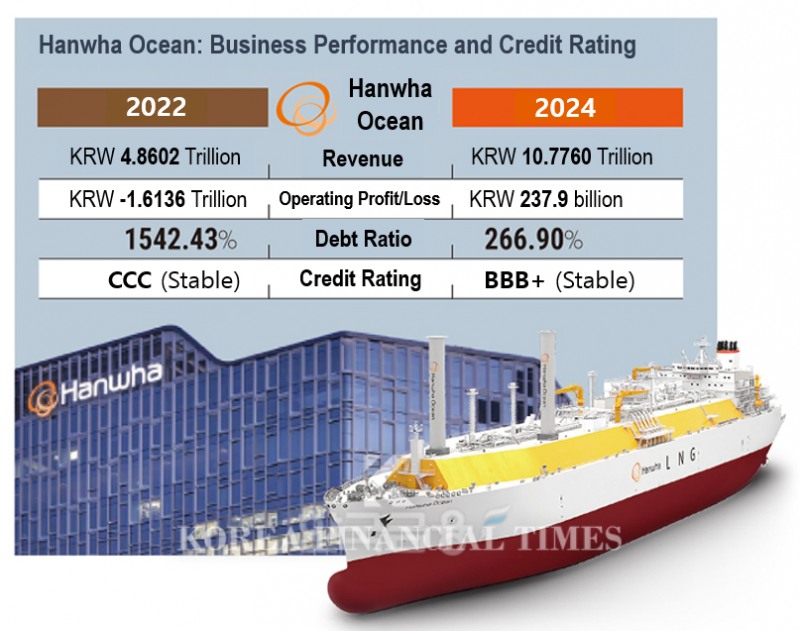

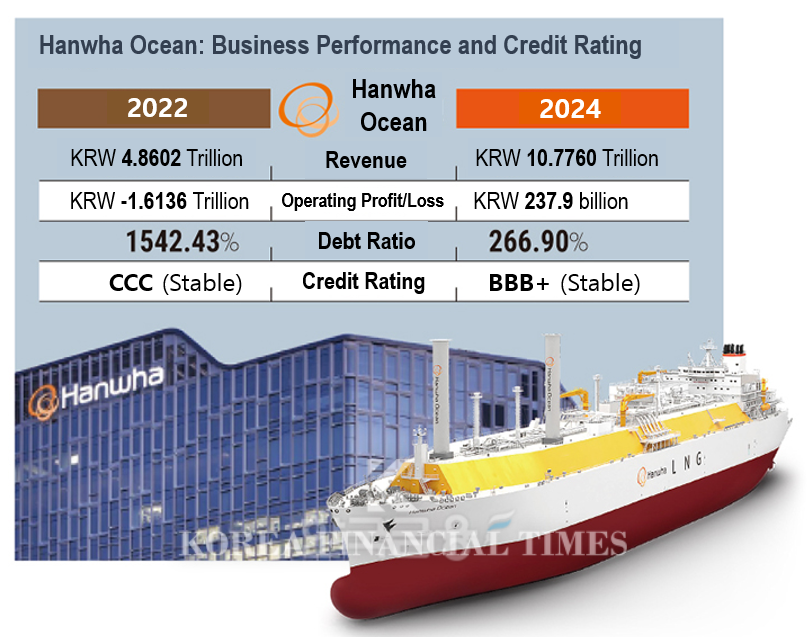

Hanwha Ocean’s current corporate bond credit rating stands at BBB+ (Stable). This is an improvement from the CCC (Stable) rating it held between 2017 and 2022, but remains three notches below competitor HD Hyundai Heavy Industries, which holds an A+ (Stable) rating. A BBB+ rating indicates that while the company is expected to meet its debt obligations, its overall ability to repay debt could deteriorate in the event of adverse changes in the business environment.

An industry insider commented, “If a shipbuilder’s credit rating is low, the company not only faces difficulties in securing financing and increased financial costs, but also risks disadvantages in order competition. Given the long-term contract nature of the shipbuilding industry, a low credit rating can undermine trust in the company’s sustainability, making it difficult to even participate in bidding for new contracts.”

As of the end of last year, Hanwha Ocean’s debt ratio stood at 266.90%. This was a 43.62 percentage point increase from the previous year, but was largely due to increased borrowing in response to a surge in business activity amid a shipbuilding boom. Nevertheless, the company managed to overcome past deficits and achieved an operating profit of KRW 237.9 billion last year, successfully returning to profitability.

Previously, Hanwha Ocean recorded massive operating losses of nearly KRW 2 trillion in both 2021 and 2022, severely weakening its financial soundness. The debt ratio soared from 379.04% in 2021 to 1,542.43% in 2022. However, after joining Hanwha Group, the company reduced its net loss to KRW 196.5 billion by the end of 2023 and improved its debt ratio to 223.28% through a group-level capital increase.

Shin Haeju (hjs0509@fntimes.com)

![기관 '한미반도체'·외인 'NAVER'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013022473402636179ad439071182357237.jpg&nmt=18)

![[DCM] 한화시스템, FCF 적자 불구 시장조달 자신감](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020204171101504a837df6494123820583.jpg&nmt=18)

![‘리니지 제국'의 부진? 엔씨의 저력을 보여주마 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020123095403419dd55077bc211821821443.jpg&nmt=18)

![12개월 최고 연 3.20%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 1주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260130181142061535e6e69892f18396169112.jpg&nmt=18)

![[카드 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)