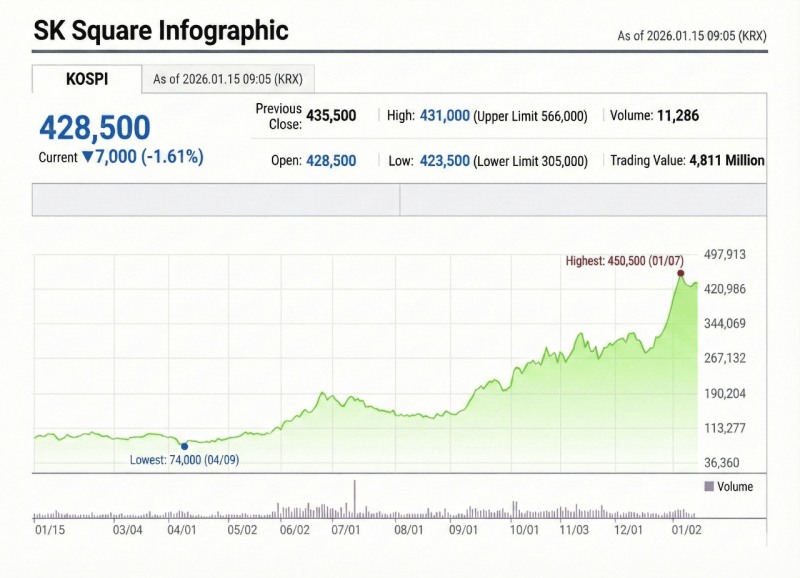

According to the Korea Exchange on the 14th, SK Square has newly entered the top 10 KOSPI market capitalization stocks. SK Square's stock price has been rising on the back of SK hynix's semiconductor boom. This is because the market has begun to recognize SK Square's AI and semiconductor big deals as realistic plans.

Activating 'Deal Machine'… Expanding Semiconductor Value Chain

The first investment target SK Square has focused on is the bottleneck point in AI technology development. As demand for AI data centers has exploded, power efficiency and cooling technology have emerged as key challenges for the global industry. SK Square plans to acquire a global specialist company in this field to complement SK hynix's HBM (High Bandwidth Memory) competitiveness.

Another axis is strengthening back-end (completion process) technology to better manufacture HBM. While HBM is the core memory for AI semiconductors, production efficiency drops without sufficient back-end and packaging capabilities. SK Square envisions acquiring specialized final assembly companies to maximize production efficiency at the new SK hynix plant in Yongin.

In this process, SK hynix's new plant in Cheongju (P&T7), worth a total of KRW 19 trillion, is expected to create synergies. This plant, which broke ground in April this year at Cheongju Technopolis and aims for completion by the end of 2027, will create a one-stop production line that packages and completes memory chips made at the existing Cheongju plant into HBM right next door.

Through this, the strategy is to enhance supply chain efficiency through linkage with plants in the Seoul metropolitan area including Yongin, while simultaneously aiming for regional balanced development effects by concentrating large-scale investments in the Cheongju region.

To this end, SK Square explored the market last year by making small investments of KRW 2-3 billion each in seven promising companies through its Singapore corporation TGC Square. The policy is to accelerate production line and AI infrastructure investments with full-scale acquisitions worth approximately KRW 1 trillion starting this year.

SK Square's moves are rapidly materializing. Acquisition negotiations with a U.S. AI power semiconductor company and a Japanese back-end equipment company are underway through TGC Square, and domestically, the acquisition of an SK hynix supply chain testing company is reportedly in its final stages.

Stimulated by Samsung's Big Deals… SK Counters with 'Memory Strengths'

Behind this rapid investment execution capability, Samsung Electronics' aggressive moves also played a role. Last year, Samsung conducted M&A worth a total of KRW 6 trillion by acquiring Germany's Flakt Group (HVAC) and ZF's ADAS (autonomous driving) business division.

In response, SK has come out to counter by putting forward its strength in the memory semiconductor ecosystem. At the group level, Vice Chairman Chey Jae-won is directly coordinating investment strategies centered on CEO Kim Jung-gyu, and work to strengthen AI governance with affiliates such as SK Telecom and SK Ecoplant is being carried out in parallel.

CEO Kim Jung-gyu emphasized, "AI is not simply technology, but a 'weapon of survival' that determines how quickly a company can learn and adapt."

Rebalancing Plus External Funding Secures 'Ammunition of KRW 2-3 trillion'

The background enabling SK Square to pursue such aggressive investment moves lies in the massive portfolio rebalancing that has continued over the past few years. As the profit structure of the group's traditional businesses has slowed, SK Square has embarked on improving its business structure to secure future growth engines.

As a result, it boldly sold off non-core assets by successively disposing of SK Shieldus, ADT CAPS, and Dreamus Company. Rather than simple business contraction, this was restructuring that reallocated secured resources to core areas centered on AI and semiconductors.

This strategy led to a sharp increase in cash assets. SK Square's cash assets increased from KRW 1270.9 billion in 2023 to KRW 1368.3 billion in 2024. As of the end of the third quarter last year, they had increased to KRW 1557.4 billion.

When adding hundreds of billions of won in dividends from SK hynix, additional inflows from asset securitization, and external funding, SK Square's available investment capacity is estimated at KRW 2-3 trillion. This is interpreted as a signal that the company has completely transitioned from defensive restructuring to an aggressive expansion phase.

Chey Jae-won and Kim Jung-gyu Duo Accelerate Investment Speed Race

(From left) SK Vice Chairman Chey Jae-won and SK Square CEO Kim Jung-gyu. /Photo=SK Innovation, SK Square

이미지 확대보기On top of this financial foundation and competitive environment, there was a change that added speed to the momentum this year. Specifically, the return of Vice Chairman Chey Jae-won to management and the new launch of CEO Kim Jung-gyu.

With the joining of these two leaders, SK Square is evolving from an opportunity-seeking investment company to an execution-focused investment organization, rapidly turning the reality of AI and semiconductor big deals into action.

If Vice Chairman Chey Jae-won secured investment resources through rebalancing, CEO Kim Jung-gyu has raised execution capability by specifying AI and semiconductor-centered investment strategies. The AI-dedicated organization newly established by CEO Kim Jung-gyu is shortening decision-making and is also building an AI cooperation system with SK Telecom and SK AX.

If SK Square's investments are realized, a rare investment portfolio will be completed that encompasses AI power efficiency, HBM packaging, and the memory ecosystem. However, risk management capabilities in areas such as global fundraising, technology integration, and the AI investment bubble are cited as key variables that will determine SK Square's actual performance going forward.

An industry insider said, "SK Square's focused investment in AI and semiconductors this time is timing that maximizes memory ecosystem strengths," adding, "However, considering global supply chain risks and the speed of technology integration, it will be more sustainable if weight is placed on long-term ecosystem building rather than short-term deals."

Jeong Chaeyun (chaeyun@fntimes.com)

![[DQN] ‘김동선 체제 4년’ 한화갤러리아, 사업확장 했지만 돈은 못 벌었다 [Z스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030120193900218dd55077bc212411124362.jpg&nmt=18)

![박인원의 ‘휴머노이드 선언’...두산 ‘3차 대변신’ 이끌까 [K-휴머노이드 대전] ③ ‘오너 4세’ 주도 두산로보틱스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030120284507035dd55077bc212411124362.jpg&nmt=18)

![[인터뷰] 최인욱 두산에너빌리티 WPC 센터장 “두산이 하면 대한민국 최초, 그 자부심으로 일합니다”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260303085809018500d260cda7512411124362.jpg&nmt=18)

![외국인, 급락장에도 금융주 '신뢰'···우리금융 114만주 이상 '순매수' [금융지주 밸류업 점검]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030319193107019b4a7c6999c121131189150.jpg&nmt=18)

![전국 해상풍력발전 24시간 모니터링…AI로 고장 예측 [두산에너빌 제주 WPC 가보니]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030120373904050dd55077bc212411124362.jpg&nmt=18)

![신원근 카카오페이 대표, 연간 흑자 등 성장 본궤도에 3연임…스테이블코인 등 결제시장 입지 확대 속도 [금융권 CEO 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030314111201562957e88cdd521121795145.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)