SK "HBM First" vs Samsung "Flexible Approach"

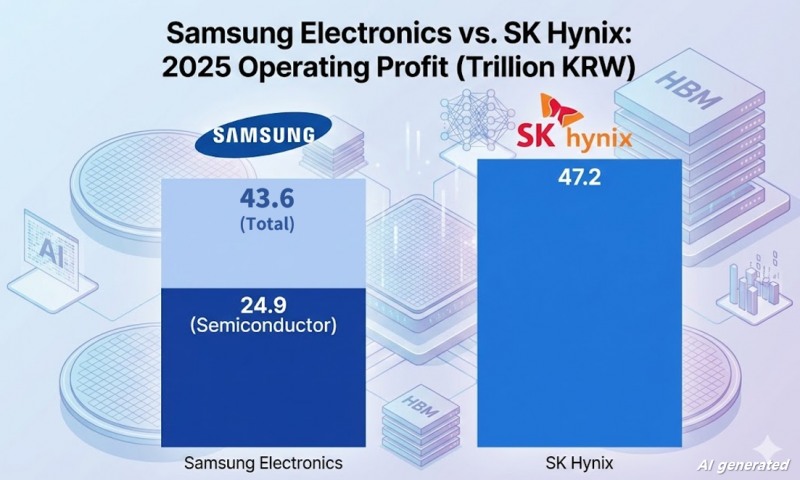

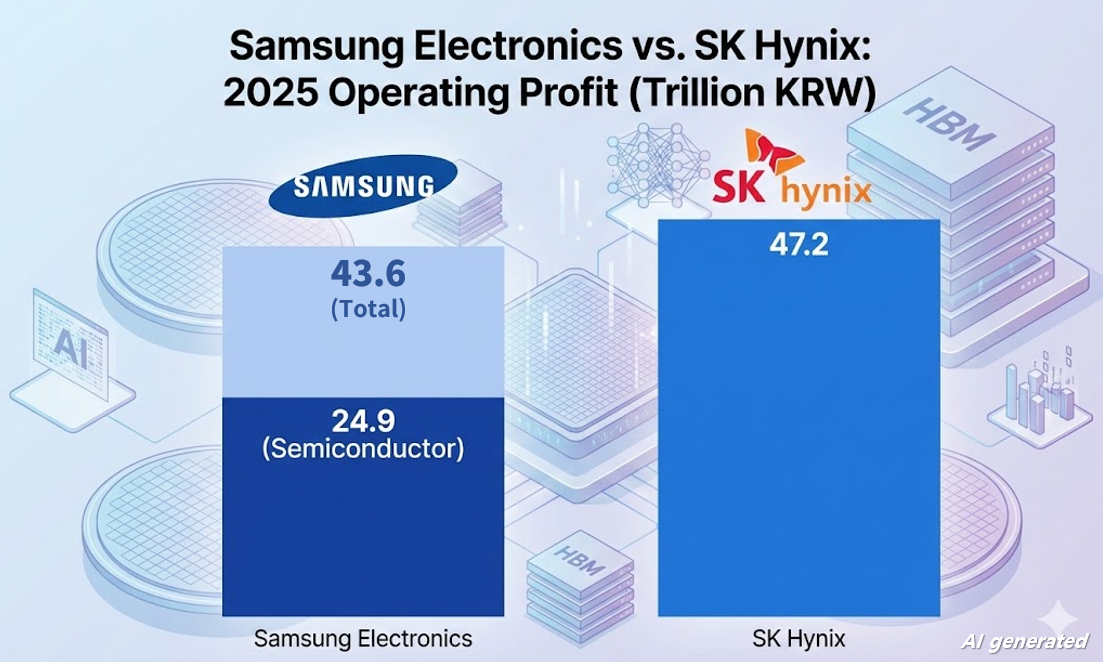

SK Hynix achieved KRW 97.1467 trillion in revenue and KRW 47.2063 trillion in operating profit last year. For the first time, it surpassed Samsung Electronics' profitability, which recorded KRW 333.6059 trillion in revenue and KRW 43.6011 trillion in operating profit during the same period. Samsung Electronics' DS (semiconductor) division posted an operating profit of KRW 24.9 trillion, approximately half that of SK Hynix. This is attributed to Samsung's late entry into the relevant market after losing HBM leadership in the first half of last year.

Rewritten with generative AI based on Korea Financial Times content / Source: Electronic disclosures from the Financial Supervisory Service and company earnings reports

이미지 확대보기The two companies' business strategies for this year also differ subtly. SK Hynix emphasized stable HBM supply, stating that "customer trust is more important than short-term results."

In contrast, Samsung Electronics stated, "From a profitability perspective, we need to operate our product portfolio with a focus on servers rather than HBM," while adding, "We will operate flexibly and in a balanced manner rather than with concentrated supply."

Samsung Electronics also said, "For application markets other than servers, we will respond with a focus on high value-added products." Accordingly, memory supply shortages are expected to intensify in the small IT device market, including smartphones, tablets, and laptops, for budget models excluding AI-enabled flagship devices.

Competition to Secure HBM4

During this earnings conference call, attention focused on the status of the 6th-generation High Bandwidth Memory "HBM4" business, which can gauge memory technology competitiveness. This was because speculation emerged that Samsung Electronics would begin supplying HBM4 for the first time next month, leading some to interpret that SK Hynix, the No. 1 player in the HBM market, might be losing its leadership.SK Hynix, which started its event one hour before Samsung Electronics, received questions about HBM4 competitiveness first and responded, "We are the pioneer who has collaborated with partners to develop the market since the HBM2E era," adding, "Customer trust in our mass production experience and quality, which goes beyond simply leading in technology, is a capability that cannot be surpassed in a short period." Then, seemingly conscious of Samsung Electronics, which preemptively applied 1c (6th-generation 10-nanometer class) DRAM technology, SK Hynix stated, "It's a major achievement that we satisfied customer performance requirements even with our 1b (5th-generation 10-nanometer class) process-based technology," and "We plan to secure yield rates at the HBM3E level." The company also stated, "We are targeting an overwhelming market share in HBM4 as well," and "Although some competitor entry is expected, our leadership and dominant supplier position will continue."

Samsung Electronics explained, "HBM4 is scheduled to ship starting in February," and "Despite heightened performance requirements from major customers, we are smoothly proceeding with customer evaluation without redesign and are currently at the qual (quality test) completion stage." First, it confirmed the rumors were true through a specific shipment schedule. Mentioning "redesign," which SK Hynix is known to have experienced, is also interpreted as a remark targeting its competitor. Samsung Electronics went on to emphasize its technological competitiveness, stating, "We will supply HBM4E samples to customers in the middle of this year," and "We have already delivered HBM4E samples with hybrid bonding applied, and some are being planned for commercialization."

"Expanding Capital Expenditure"

Regarding this year's capital expenditure (CAPEX), both companies stated "we will invest more than last year" but refrained from mentioning specific figures. This is interpreted as reluctance to expose their strategies based on capital expenditure scale.

Samsung Electronics stated it would continue its shell-first strategy of preemptively constructing clean rooms and flexibly proceeding with capital expenditure according to market conditions. Most of this year's capital expenditure will also be executed on equipment to be installed in pre-secured new fab clean rooms.

Special Dividends on Record-Breaking Performance

Following last year's record-breaking performance that exceeded expectations, both companies decided to implement additional shareholder returns.SK Hynix plans to pay KRW 1,875 per share, adding KRW 1,500 in additional dividends to the existing fourth-quarter dividend of KRW 375 per share. The 2025 dividend per share is KRW 3,000, totaling approximately KRW 2.1 trillion. In addition, the company decided to cancel 2.1% of its existing treasury shares valued at over KRW 12 trillion to enhance existing shareholder value.

Samsung Electronics decided to pay KRW 566 per share by implementing an additional dividend of KRW 196 on top of the existing dividend of KRW 370 per common share. This also has the significance of meeting the government's "dividend tax separate taxation" requirement that shareholders of high-dividend companies can receive.

The company is also proceeding with its share buyback and cancellation plan, which applies through this year. Accordingly, the shareholder return scale for 2025 includes KRW 9.8 trillion in regular dividends, KRW 1.3 trillion in additional dividends, and KRW 6.6 trillion in treasury share buybacks and cancellations.

Gwak Horyung (horr@fntimes.com)

![[DCM] ‘미매각 악몽’ 이랜드월드, 재무 부담 가중…고금리 전략 ‘의문부호’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012909073902617a837df64942115218260.jpg&nmt=18)

![[DCM] 심상치 않은 증권채…속내는 ’진짜’ IB 출현 기대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012818485407194a837df6494123820583.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)