Based on last year's achievements, Hyundai Mobis plans to accelerate its leap to become a global top-tier "mobility platform provider" this year by strengthening its competitiveness in core future business components such as robotics and electrification.

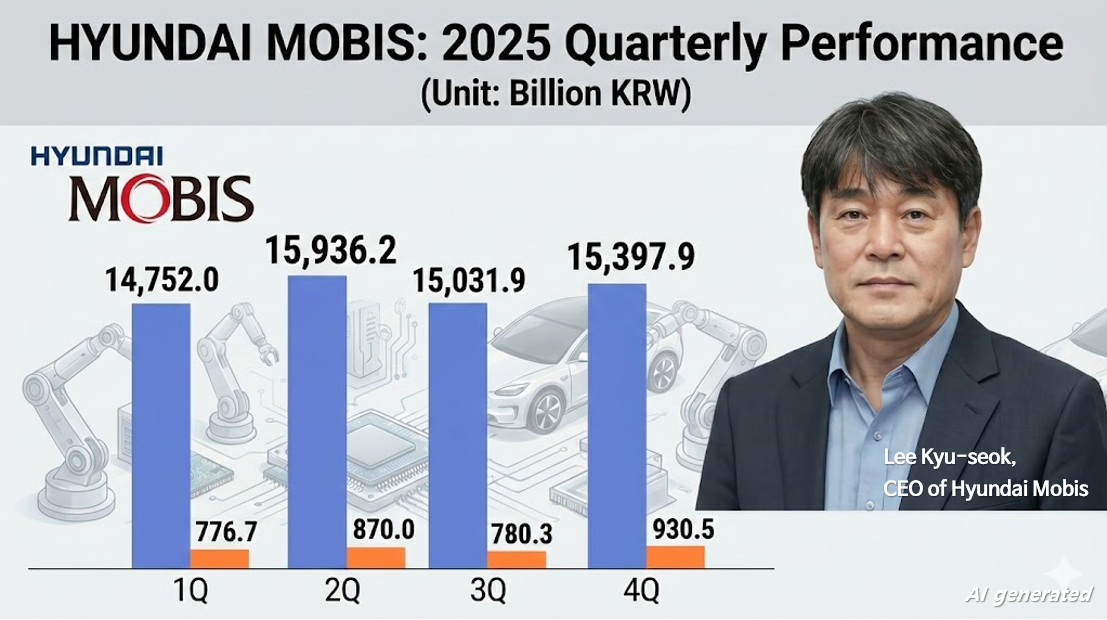

Record-breaking performance driven by strong manufacturing sector last year

Hyundai Mobis announced through a disclosure on the 28th that it achieved consolidated revenue of KRW 61.1181 trillion and operating profit of KRW 3.3575 trillion last year. These figures represent increases of 6.8% and 9.2% respectively compared to the previous year, both reaching record highs.Last year's performance was driven by the manufacturing sector, including module assembly and component manufacturing. Revenue from this business segment recorded KRW 47.8001 trillion, up 5.9% year-on-year.

A Hyundai Mobis official explained, "Revenue growth was led by the full-scale operation of North American electrification plants and the growth of high-value-added core components such as electronic parts," adding, "Despite the impact of U.S. tariffs, company-wide profit improvement activities led to enhanced profitability."

Hyundai Mobis' electrification component competitiveness also translated into orders from non-affiliate companies. Last year's non-affiliate orders totaled approximately USD 9.168 billion, exceeding the initial target of USD 7.448 billion by approximately 123%.

A Hyundai Mobis official explained, "We expanded new business opportunities through securing large-scale electrification projects from non-affiliate companies last year," adding, "We secured a sustainable order base by strengthening partnerships with key customers."

The A/S parts business segment also recorded revenue of KRW 13.318 trillion due to continued strong global demand and favorable exchange rate effects, an increase of 10.2% compared to the previous year.

Expanded cooperation with global companies in robotics and other sectors

Hyundai Mobis plans to accelerate its leap as a global "provider" this year by strengthening its existing electrification component competitiveness and preemptively securing core components for future businesses such as robotics. To this end, Hyundai Mobis invested approximately KRW 300 billion in areas such as robotics and autonomous driving last year.

Earlier this month at CES 2026 in Las Vegas, Hyundai Mobis announced a series of strategic collaboration plans with global specialists in the future mobility sector. This is assessed as laying the groundwork for expanding its portfolio centered on the group's future businesses such as robotics and SDV (Software-Defined Vehicle) this year.

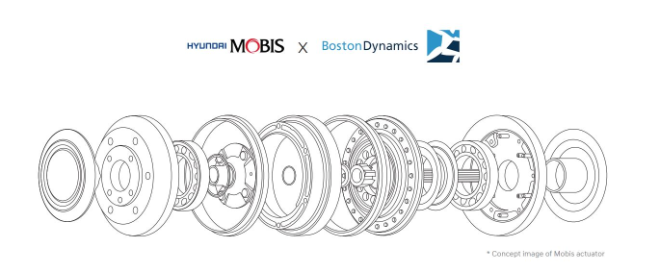

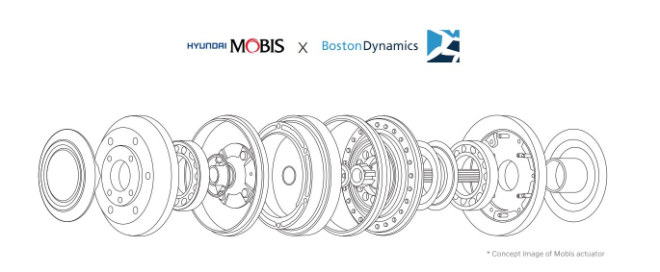

Based on its automotive component design capabilities and accumulated mass production experience, Hyundai Mobis decided to first enter the robot actuator market, which is most similar to this field. Actuators are core driving devices that receive signals from controllers and perform operations, accounting for approximately 60% of the material costs of manufacturing humanoid robots.

Starting with actuators, Hyundai Mobis will expand its R&D scope to core components such as hand grippers, sensors, controllers, and battery packs. The plan is to accumulate meaningful validation data by securing various demonstration opportunities and establish a robotics core component portfolio that meets market demands early on.

Humanoid robot actuators that Hyundai Mobis will supply to Boston Dynamics. / Photo=Hyundai Mobis

이미지 확대보기In addition, the company plans to showcase integrated Advanced Driver Assistance System (ADAS) technology based on system integration, sensor fusion, image recognition, and System-on-Chip technology with global semiconductor leader Qualcomm. The policy is to maximize synergy by applying Qualcomm's application processor semiconductor chips to Hyundai Mobis' controllers and software.

The company will also steadily carry out facility investments such as strengthening technological competitiveness and expanding global bases for building a future portfolio.

A Hyundai Mobis official explained, "Last year's R&D investment reached a record high of KRW 1.8765 trillion to expand our future portfolio," adding, "We will continue this trend this year, and R&D investment is expected to exceed KRW 2 trillion for the first time this year."

Full-scale 'selection and concentration' for future growth

While strengthening future businesses such as robotics, SDV, and autonomous driving, Hyundai Mobis plans to accelerate business structure reorganization by implementing selection and concentration strategies in earnest, including non-core businesses.To this end, Hyundai Mobis announced through a disclosure the previous day (27th) that it signed an MOU with global automotive parts company OP Mobility to sell its lamp business unit. Although rumors of selling the lamp business unit circulated in the past, Hyundai Mobis did not provide clear clarification. This year, as it began full-scale portfolio reorganization, the company officially announced the sale.

OP Mobility, headquartered in France, is a leading automotive parts company with 150 production sites in 28 countries worldwide and annual revenue of EUR 11.65 billion (approximately KRW 20 trillion, as of 2024). The two companies will begin negotiations in earnest with the goal of signing a main contract in the first half of this year, and details including transaction structure and scale will be determined in the future negotiation process.

Regarding the background of pursuing this lamp business transaction, a Hyundai Mobis official explained, "The concern of 'how to find a differentiated survival strategy in the future mobility market' lies at the heart," adding, "It is because we judged that it is difficult to strengthen business competitiveness and profitability with the department store-style portfolio of past internal combustion engine automotive parts business, and ultimately difficult to guarantee sustainable future growth."

The official also stated, "We have consistently emphasized the business efficiency policy of 'concentrating capabilities on future core businesses and products and transforming the revenue structure centered on high-value-added areas' through CEO Investor Days and other occasions," adding, "We will intensively invest resources made efficient through this process into high-value-added and future growth businesses to further enhance competitiveness, and strengthen responsible management based on trust from employees and customers through a sustainable value-up strategy."

Kim JaeHun (rlqm93@fntimes.com)

![[DCM] ‘미매각 악몽’ 이랜드월드, 재무 부담 가중…고금리 전략 ‘의문부호’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012909073902617a837df64942115218260.jpg&nmt=18)

![[DCM] 심상치 않은 증권채…속내는 ’진짜’ IB 출현 기대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012818485407194a837df6494123820583.jpg&nmt=18)

!['운명의 날' 함영주 하나금융 회장, 사법리스크 벗을까 [금융사 CEO 이슈]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012823385403246b4a7c6999c121131189150.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)