Naver (CEO Choi Soo-yeon) has entered the era of annual revenue of KRW 10 trillion. It is the first domestic internet platform company to do so.

However, since 2022, a combination of slowing growth rates and expanding cost burdens has made it difficult to enjoy the 'high-growth premium' of the past. While the company has expanded its business beyond its core portal operations into shopping and content, capital burdens from investments have increased, while profitability relative to assets and market capitalization have weakened.

Some assess that Naver has transformed from a premium growth stock into an ordinary stable company.

According to Korea Ratings and NICE Credit Rating, Naver's credit rating has consistently maintained 'AA+ (stable)' since 2019.

Over the past six years, Naver's revenue has steadily grown. Particularly from 2020 to 2022, as new businesses including search platforms, commerce, fintech, content, and cloud grew rapidly, revenue recorded double-digit growth rates annually. Through 2021, operating profit and operating profit margin improved along with revenue expansion.

However, in 2022, despite revenue increasing by approximately 20% year-over-year, operating profit slightly declined (-1.6%), causing margins to contract. This is interpreted as profits from core operations failing to keep pace with revenue growth, as investments, M&A (mergers and acquisitions), and various one-time factors were all reflected simultaneously that year.

Massive M&A and investments weigh on profitability

In October 2022, Naver announced the acquisition of North American C2C (consumer-to-consumer) platform 'Poshmark,' completing the transaction in early the following year for approximately KRW 1.9 trillion. The Poshmark acquisition was the largest M&A since Naver's establishment.As Naver proceeded with successive large-scale acquisitions and investments for global expansion, including Poshmark, its capital cost burden grew.

The problem is that profits have not sufficiently kept pace with this investment expansion. Indicators showing how much the company earned relative to its asset holdings have noticeably weakened since 2022.

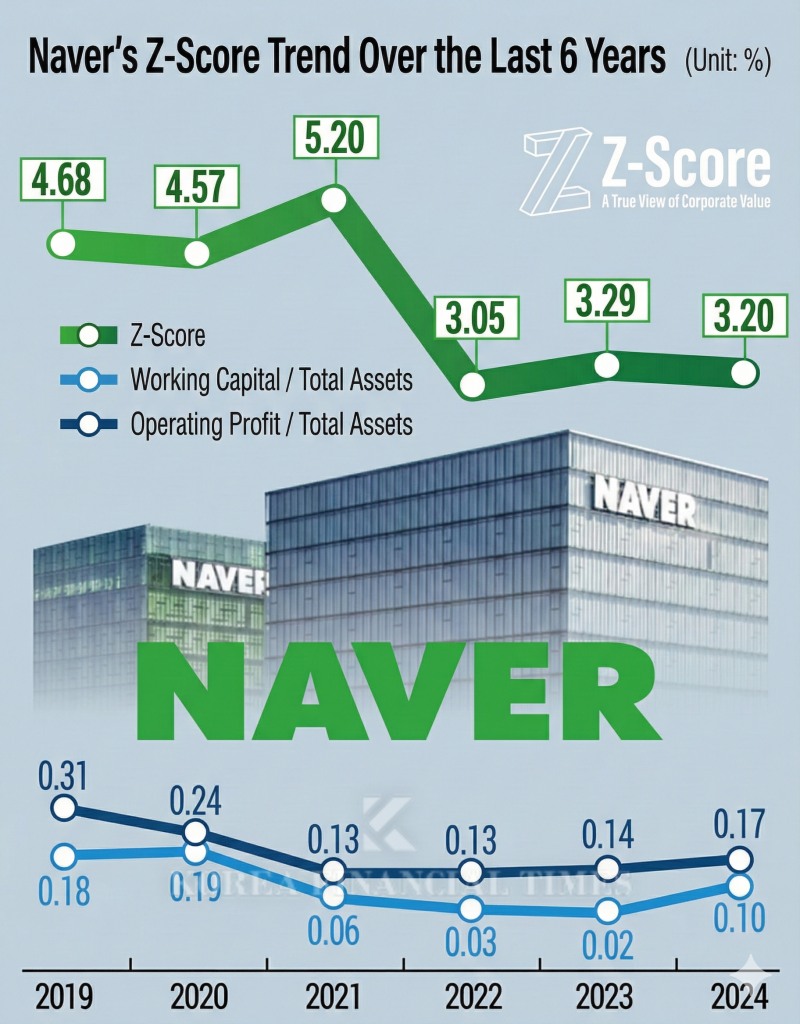

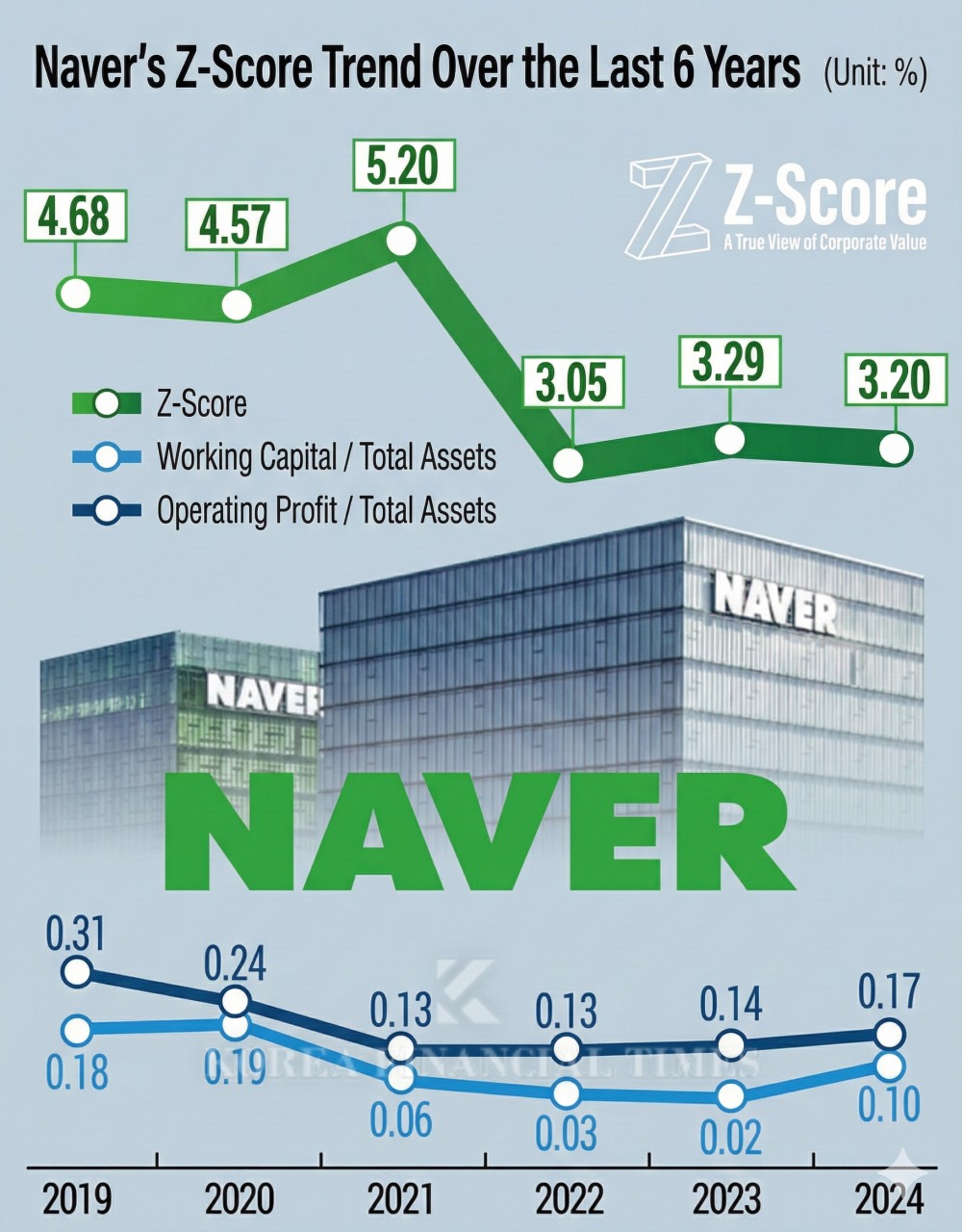

For instance, the 'operating profit/total assets' indicator fell from 0.31 in 2019 to 0.13 in 2022. During the same period, the 'revenue/total assets' indicator also declined from 0.35 to 0.24.

Additionally, the Line-Z Holdings integration process left additional optical illusions in Naver's income statement during 2021-2022. A base effect occurred where net profit appeared to plummet in 2022 after the one-time gain disappeared, which had temporarily increased significantly on the books during the 2021 process of revaluing Line shares.

However, even accounting for such accounting volatility, there are observations that Naver's financial constitution itself is difficult to view as being as solid as before.

Altman Z-Score reveals weakened financial strength

Naver's Altman Z-Score, confirmed by Korea Financial Times through the AI data platform DeepSearch, was calculated as ▲4.68 in 2019 ▲4.57 in 2020 ▲5.20 in 2021 ▲3.05 in 2022 ▲3.29 in 2023 ▲3.20 in 2024.After plummeting more than 1 point from the 5-point range in 2021 to the 3-point range in 2022, it has since struggled to recover from the early 3-point range. While not in the distress risk zone, this is the background for interpretations that the safety and growth premiums once evaluated as ultra-premium have been substantially diluted.

Working capital relative to total assets also declined from 0.18 in 2019 to 0.10 last year. Analysis suggests that as market capitalization—one of the components of the Altman Z-Score—significantly decreased, the market's perception of Naver's 'stability premium' has also faded.

Naver's market capitalization grew from KRW 30.7377 trillion in 2019 to KRW 62.0926 trillion in 2021, but plunged to KRW 29.1187 trillion in 2022 and currently hovers around KRW 40 trillion.

Since 2023, Naver's numbers have clearly been recovering. Both operating profit and operating profit margin escaped the 2022 bottom and showed an upward trend again, with last year recording all-time highs in both revenue and profit.

Nevertheless, the market's perception differs from 2021. There are assessments that compared to the size already committed to trillions in AI and cloud infrastructure and large-scale M&A, the profit growth rate is insufficient to again merit the label 'ultra-premium.'

The fact that the previously examined revenue and profit indicators relative to assets and Z-Score have not recovered to 2021 peak levels supports this view.

Google utilized generative AI 'Gemini' as a core means to strengthen search service competitiveness. In contrast, there are observations that Naver's AI investments remained at a level of broadly reinforcing each business division rather than making a clear decisive move centered on its portal.

In this process, there are criticisms that by expanding business into relatively unfamiliar areas such as content and shopping, the company failed to sufficiently boost return on investment.

The recent merger between Naver Financial and Dunamu raises similar concerns. Industry observers expect that partnering with the virtual asset exchange industry leader could enable construction of a massive financial platform encompassing payments, investments, and digital assets.

On the other hand, there are considerable concerns that considering regulatory uncertainty in the virtual asset market, price volatility, and high capital requirements, this adds another capital-intensive burden to Naver, which is already conducting large-scale investments in AI, cloud, content, and commerce. An industry insider stated, "Whether the merger with Dunamu will be a growth card that revives the premium or a risk that further solidifies the 'stable' label remains a question mark."

Ultimately, the key to whether Naver can regain the 'ultra-premium' label lies not in simple revenue growth. The essence is how much stable cash flow and high margins can be generated from the already deployed AI and cloud, global content, and fintech-digital asset businesses.

Simultaneously, work is needed to restore market trust by reducing concerns about platform regulations, data monopoly, and virtual asset risks. An industry insider stated, "When the company proves not only growth potential but also predictable governance structure and risk management capabilities, the premium attached to 'premium growth stocks' will again become Naver's."

Jeong Chaeyun (chaeyun@fntimes.com)

![코스피 6300인데···KB금융, 12거래일 연속 외인 '순매도' 이유는 [금융지주 밸류업 점검]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022621383900871b4a7c6999c121131189150.jpg&nmt=18)

![[속보] KAI 노조 "오늘 사장추천위 열린다"...사측 "확인 못해"](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260227135534054450d260cda7511817679169.jpg&nmt=18)

!['국장 ETF' 힘으로 코스피 상승…삼성운용 질주 [ETF 통신]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022608395305907179ad4390712813480118.jpg&nmt=18)

!['연임 특별결의' 도입 미룬 KB금융···'선제 조치' 타이틀 잡을 곳은 [2026 주총 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022519321609304b4a7c6999c121131189150.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714100604994de68fcbb3512411124362.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)