The SK Group announced its rebalancing plan in August last year, coinciding with a major leadership reshuffle at SK Square. Han, formerly head of the Investment Support Center, took the helm as CEO. The board of directors was also reconstituted with investment and finance professionals.

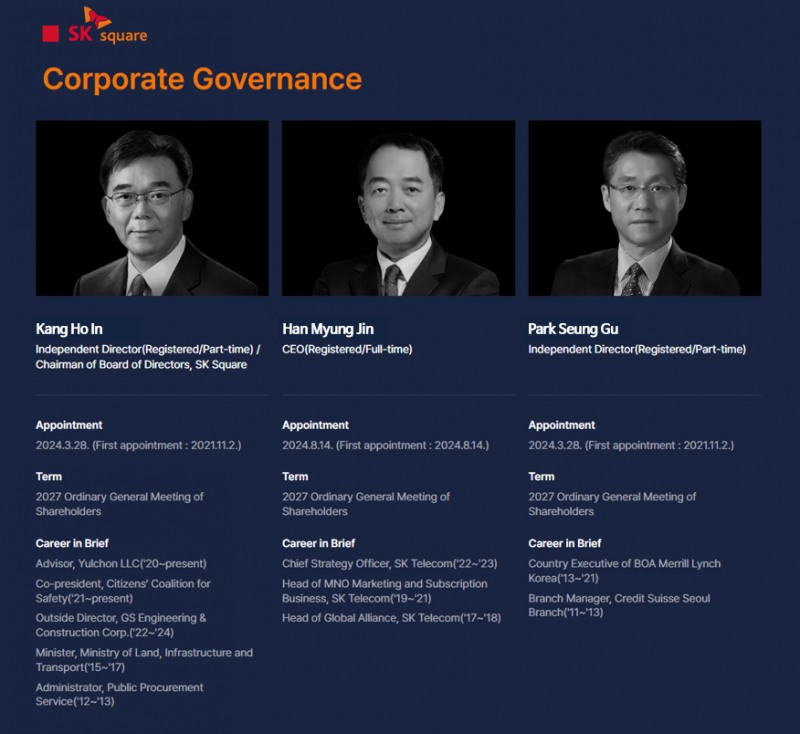

As of 2025, SK Square’s board comprises six members: one inside director (CEO Han Myung Jin) and five outside and non-executive directors—all with strong backgrounds in investment, finance, and law. Han has been an investment expert who has held key positions since joining SK Telecom in 1998, including Chief Strategy Officer (CSO), Head of MNO Marketing Group and Subscription CO, Director of Global Alliance, and Head of Global Business Development.

Jung Jai Hun, Chair of the Governance Committee of the SK SUPEX Council (specializing in management and legal affairs), was appointed as a non-executive director on SK Square’s board. Serving concurrently as President of External Affairs at SK Telecom, Jung is well known within the group as a business and risk management expert.

What stands out is that all four outside directors are all investment and finance specialists. The outside directors include Kang Ho In, Legal Counsel at Yulchon LLC (specializing in administration and economics); Park Seung Gu, former CEO of Bank of America Merrill Lynch Korea (investment and finance); Ki Eun Sun, professor in the Department of Business Administration and Accounting at Kangwon National University (accounting and finance); and Hong Ji Hoon, former head of White & Case’s Seoul office (legal and finance).

Kang Ho In, Park Seung Gu, and Ki Eun Sun were reappointed last year following their initial appointment in 2011, while Hong Ji Hoon was appointed for the first time this year.

Chairman of the board Kang Ho In, who formerly served as head of Korea's Public Procurement Service and Minister of Land, Infrastructure and Transport, brings significant economic expertise to corporate investment matters.

Park Seung Gu’s extensive investment career includes involvement in SK Hynix’s acquisition during his tenure as Credit Suisse’s Seoul branch head.

Ki Eun Sun is an accounting expert formerly with Samil PwC who worked at the Tax Law Research Center of the Korea Institute of Public Finance. She currently serves as an associate professor in the Department of Business Administration and Accounting at Kangwon National University and as an outside director at Daol Investment & Securities.

Hong Ji Hoon led the Seoul office of White & Case, the law firm founded in New York in 1901, for nearly ten years. He is known not only in the domestic legal community but also in the capital markets as an expert in asset finance and global finance and investment.

The reason SK Square appointed a board composed entirely of investment and finance experts is widely interpreted as a strategy to accelerate the AI-centred rebalancing currently underway at the SK Group level.

Established in 2021 via the spin-off from SK Telecom, SK Square inherited a portfolio including SK Hynix, Wave, SK Shieldus, One Store, and 11th Street, prioritizing value enhancement through planned initial public offerings (IPOs).

However, the company faced setbacks as multiple IPO attempts by subsidiaries such as SK Shieldus, One Store, Wave, and 11th Street stalled, alongside deteriorating earnings impacting liquidity.

Since taking office, CEO Han has aggressively restructured the leadership of key subsidiaries, appointing new CEOs such as Park Tae Young at One Store, Lee Jae Hwan at T map Mobility, and Kim Yong Jik at FSK L&S, driving organizational efficiency. In April, financial expert Park Hyun Soo, former chief business officer at 11th Street, was named CEO.

At his inauguration, Han stated: “We renewed leadership across key portfolio companies and restructured SK Square’s core organization for greater efficiency. We will prepare sound investments focusing on semiconductors to transform our portfolio.”

Operational improvements have accelerated this year, with major initiatives including the proposed merger of Wave and TVing, the sale of T map Mobility’s Seoul Airport limousine and Goodservice units, the divestment of One Store’s Rock Media, and Dreamus Company's sale of its iRiver business—measures that have streamlined the portfolio and unlocked capital.

As a result, SK Square reported a more than 70% year-on-year im.provement in operating profit across its major ICT portfolio companies in Q1

Alongside operational streamlining, SK Square is actively investing in AI and semiconductor startups. Recently, in joint ventures with SK Hynix, Shinhan Financial Group, and LIG Nex1, the company completed investments in five to six AI and semiconductor firms in the U.S. and Japan.

An SK Square official commented, “With a board composed entirely of experts in investment, portfolio management, and finance, we expect to enhance corporate value through operational efficiency and strategic investments.”

Meanwhile, SK Square’s provisional earnings for Q2 stood at KRW 922.9 billion in sales and an operating profit of KRW 1.3069 trillion, surging 96.9% and 68.7% year-on-year, respectively.

Kim Soo-hyun, an analyst at DS Investment & Securities, said, “With normalized earnings and ongoing improvement in profitability at core portfolio companies like 11th Street and T map Mobility, SK Square’s core business is regaining strength. The ample cash reserves also suggest continued expansion in AI and semiconductor investments, positioning the firm well for future growth.”

Jeong Chaeyun (chaeyun@fntimes.com)

![[DCM] JTBC · HL D&I 7%대...재무 취약기업 조달비용 급등 [2025 결산⑥]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013013251003407141825007d12411124362.jpg&nmt=18)

![NH투자증권, 순이익 '1조 클럽' 기록…윤병운 대표 "전 사업부문 경쟁력 강화" [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025021021370308671179ad439072211389183.jpg&nmt=18)

![다올투자증권, 연간 흑자 달성 성공…황준호 대표 실적 안정화 견인 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025081416515608997179ad439072111812010.jpg&nmt=18)

![[DCM] 이랜드월드, KB증권 미매각 눈물…NH증권이 닦았다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013006550302626a837df6494123820583.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)