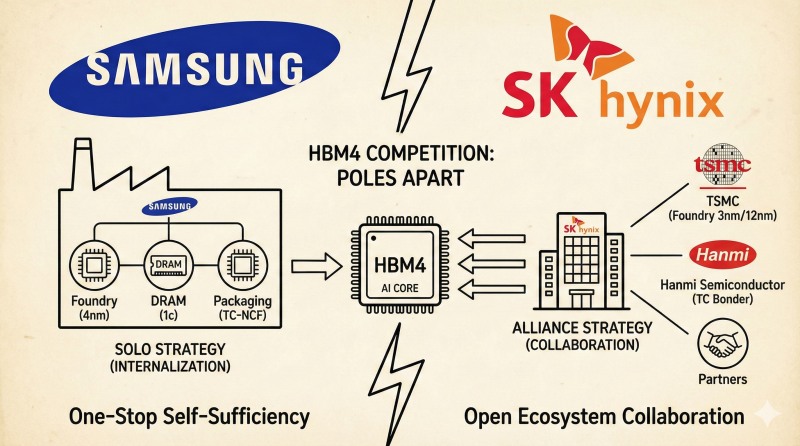

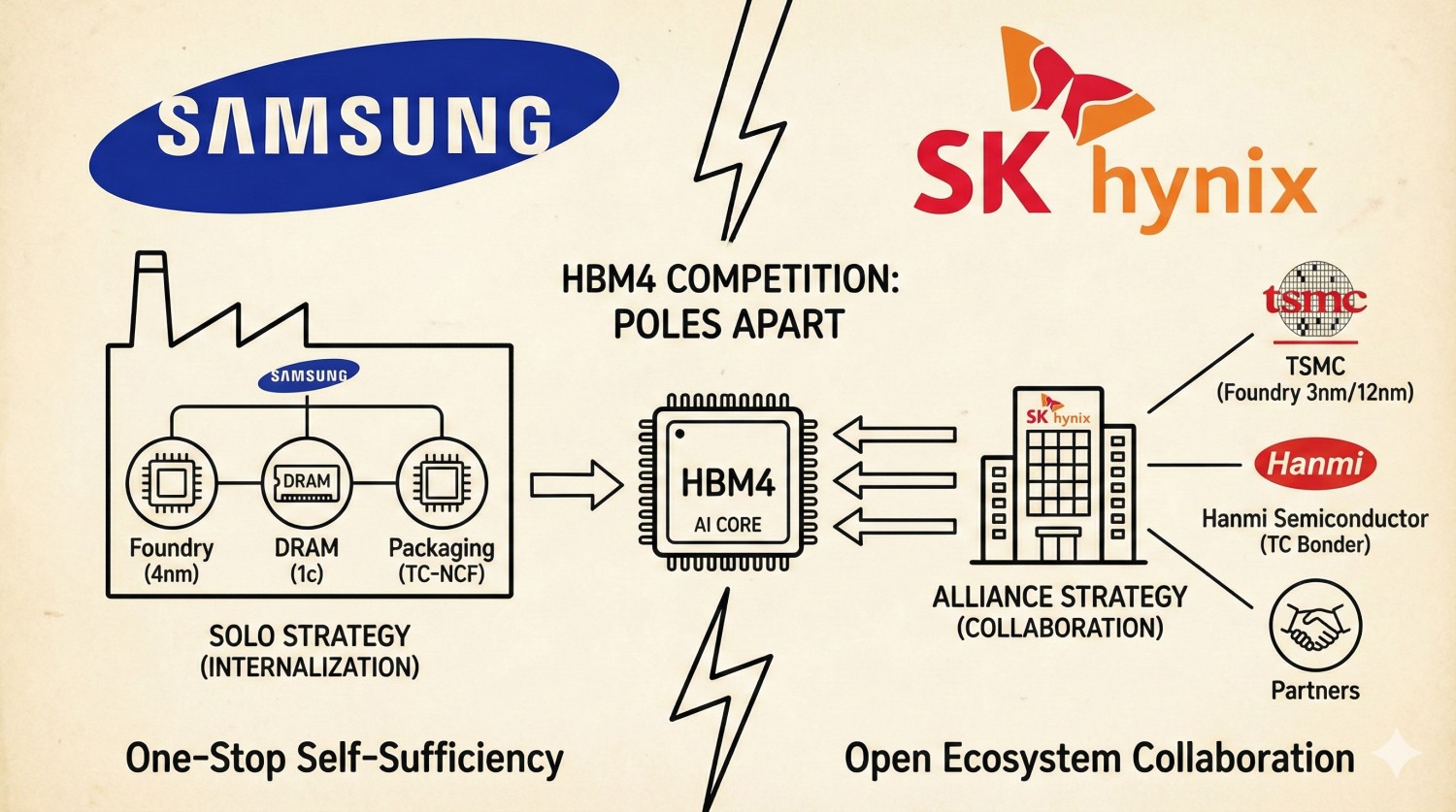

From base die to back-end processes, Samsung Electronics plans to secure technological superiority through an internalization strategy encompassing foundry and equipment. In contrast, SK Hynix is leveraging an open collaboration model that mobilizes the entire external ecosystem including TSMC and Hanmi Semiconductor, leading with verified quality and speed.

HBM plays the role of quickly delivering necessary data to GPUs responsible for AI computations within a certain time. No matter how fast the GPU calculates, bottlenecks occur if data is not delivered on time. HBM is a structure that innovatively increases data processing speed by vertically stacking multiple DRAM chips.

Individual DRAM chips that make up HBM are called 'core dies.' The chip located at the bottom layer is specifically designated as the 'base die (logic die).' The base die performs the critical role of directly connecting to the GPU, interpreting signals, and delivering commands to upper core dies.

Until HBM3E (5th generation), memory companies produced base dies using their own DRAM processes, but from HBM4 (6th generation), foundry (contract manufacturing) methods utilizing cutting-edge fine processes are being introduced to improve speed and power efficiency.

SK Hynix is entrusting HBM4 base die production to Taiwan's TSMC. This is because the company judged that process optimization collaboration with TSMC is essential to meet performance requirements demanded by customers. SK Hynix is known to plan to utilize TSMC's 3-nanometer (nm) and 12nm processes. Standard products for servers will be manufactured with 12nm, while customized products such as Nvidia premium GPUs and Google's custom chips (TPU) are expected to be produced with 3nm processes.

In contrast, Samsung Electronics produces HBM4 base dies using its own foundry 4nm process. Although negotiations with customers over price and volume are variables, if Samsung Electronics secures prices similar to SK Hynix, it can create a relatively higher profit structure through internalization.

Samsung Electronics, a latecomer in HBM, has a strategy of securing customers by leveraging technological capabilities. Samsung Electronics applies the 1c (6th generation) process to HBM4 DRAM.

This is choosing a process one generation ahead of SK Hynix, which maintains the 1b (5th generation) process applied to existing HBM3E for HBM4 as well.

The HBM4 performance disclosed by the two companies in October also shows differences.

Samsung Electronics specifically presented data transfer (I/O) speed and bandwidth at maximum 11Gbps and 2.8TB per second, respectively. SK Hynix only disclosed minimum levels as 'above 10Gbps' and 'above 2.6TB.' This means that even the minimum standards meet Nvidia's enhanced performance requirements.

An industry official said, "For Samsung Electronics, securing yield is key," adding, "As a leading HBM company, SK Hynix's intention to prioritize stable supply is evident."

Packaging (back-end process) strategies also differ significantly between the two companies. The core back-end process in HBM is a type of bonding process that connects stacked DRAMs. From HBM4 20-stack and above, hybrid bonding is required for yield stabilization, but previous generations are likely to maintain existing technologies.

SK Hynix uses the 'MR-MUF process' that fills the space between chips with liquid protective material after soldering. The TC (thermal compression) bonder equipment that temporarily fixes chips to substrates and chips to chips just before this process is supplied by Hanmi Semiconductor, Hanwha Semitech, and others. Since even slight misalignment causes defects, TC bonders for HBM4 are known as expensive equipment costing approximately KRW 4 billion per unit.

If SK Hynix can be likened to 'applying wood glue,' Samsung Electronics can be compared to 'attaching double-sided tape.' This is the 'TC-NCF' method that inserts film-type protective material between layers and proceeds with thermal compression. Samsung Electronics mainly receives TC bonder supplies from its subsidiary SEMES.

Gwak Horyung (horr@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)