(From left) Kakao founder Kim Beom-su and Kakao CEO Chung Shina. / Photo courtesy of Kakao

According to legal sources on the 17th, the Special Prosecutor's team investigating Kim Keon-hee, the wife of Former President Yoon is planning to summon four individuals, including Kakao founder Kim Beom-su, for questioning as reference witnesses in connection with a controversial investment scandal involving a close aide to the First Lady.

The case centers on allegations that Kakao Mobility (CEO Ryu Geung-seon) arranged a large, questionable investment in IMS Mobility—a rental car company formerly known as BeMyCar—linked to Kim Ye-seong, widely referred to as the First Lady’s “butler.” Kakao Mobility reportedly invested around KRW 3 billion in the firm.

Following last year’s suspected share price manipulation involving founder Kim Beom-su and SM Entertainment, a new legal risk has surfaced for Kakao Mobility, further dampening morale within the Kakao Group.

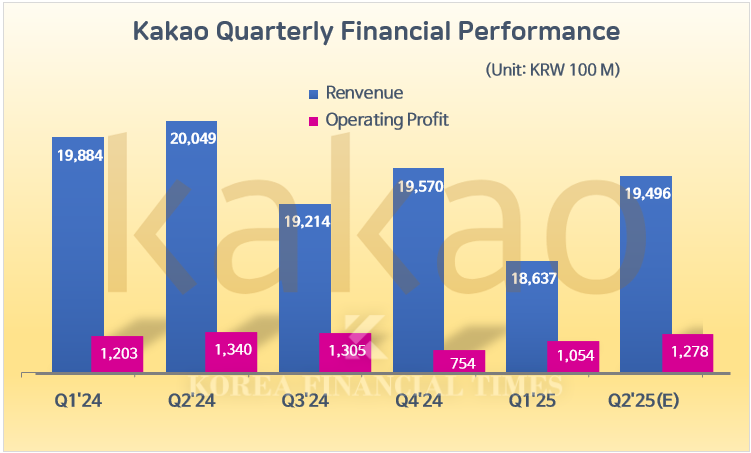

On top of this, Kakao’s earnings outlook has darkened. According to earnings consensus data from FnGuide, Kakao’s provisional second-quarter results for this year are expected to fall compared to the same period last year. For the second quarter, revenue is projected at KRW 1.9496 trillion and operating profit at KRW 127.8 billion, down 2.76% and 4.63%, respectively, from a year earlier.

As a result, Kakao urgently needs a game-changer to reverse the negative internal and external sentiment. The company plans to strengthen group cohesion and secure new revenue streams by fully accelerating its AI business, which it has identified as a future growth engine.

To this end, Kakao in February recruited Hong Min-taek, former CEO of Toss Bank, as its Chief Product Officer (CPO) and reorganized its AI division.

Kakao merged “Kanana X” and “Kanana Alpha”—previously in charge of AI services and AI development, respectively—into a single organization called “Kanana.” In addition, the company established an AI Studio to pursue new AI business opportunities and forge technical collaboration in AI services. The newly founded AI Studio is seeking to generate synergies with partners, including OpenAI.

Kakao also secured funding for its AI investments. On July 11, the company announced the sale of its entire stake in SK Square through a block deal (off-hours bulk trading).

The stake sold amounted to around 2,486,612 shares, raising nearly KRW 429.6 billion. At the time, Kakao’s investment arm, Kakao Investment, said: “The sale is intended to secure funds for future investments in AI and related areas.”

Furthermore, CEO Chung Shina outlined the company’s AI business vision in a Forbes Asia interview on July 9.

Chung stated, “I am confident that an all-in strategy for AI will be a catalyst for company growth,” explaining Kakao’s AI business strategies and direction.

CEO Chung also revealed plans to launch the AI agent (virtual assistant) co-developed with OpenAI in November. The companies had previously announced their intention to unveil the AI agent within this year, but this latest interview clarified that the launch is set for November.

Regarding the upcoming AI agent, Chung commented, “Even if users don’t know what AI is, it will autonomously perform tasks to make their lives more convenient. Going beyond simple responses, this next-generation virtual assistant will be able to make decisions and take actions on behalf of users.”

Attention is now focused on whether Kakao’s proprietary AI service “Kanana,” which will officially launch soon, will prove successful. In addition, Kakao plans to transform into an “AI super app” by enhancing search functions and restructuring its content.

Previously, at the announcement of the Kakao–OpenAI collaboration in February, Chung stated, “Our common goal is to popularize AI in the Korean market, enabling local users to widely utilize AI in everyday life. Interacting with the AI agent will go beyond simple Q&A; users will perform various tasks within the KakaoTalk ecosystem through function calls.”

Nam Hyo-ji, a researcher at SK Securities, wrote in a recent report, “If the Kakao–OpenAI collaborative AI agent is implemented successfully, it could boost traffic across the entire Kakao service ecosystem and improve profitability. Expectations are building ahead of the fourth-quarter KakaoTalk revamp and the release of the AI agent.”

Jeong Chaeyun (chaeyun@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)