Emart, once a textbook case of long-term share price decline, began gaining momentum in February this year. The catalyst was the announcement of its value-enhancement plan and a Q1 earnings surprise. Momentum continued with the easing of political uncertainties and the issuance of “livelihood recovery consumption coupons.” As of July 14, Emart’s stock stood at KRW 99,100—up 56.3% from KRW 63,400 at the end of last year.

Still, even taking this into account, Emart’s stock is viewed by many as undervalued. Its high dependence on large-format stores, whose competitiveness has declined, and underperformance by subsidiaries like SSG.com, Gmarket, and Emart24, have contributed to this.

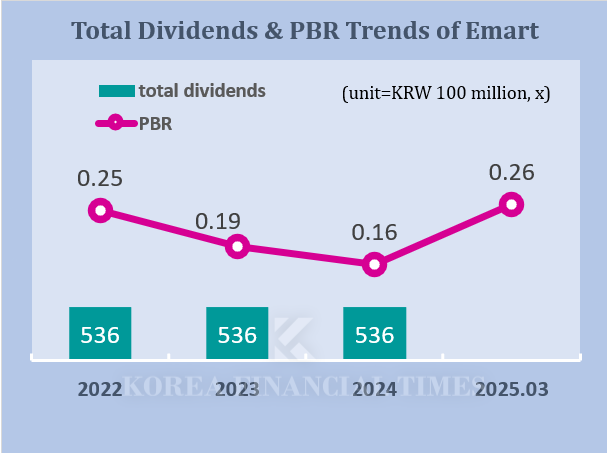

Nonetheless, Emart has consistently maintained dividend payouts despite declining performance and falling share prices. This year, it raised its minimum dividend from KRW 2,000 to KRW 2,500—a 25% increase—injecting an additional KRW 13.4 billion annually to support the dividend.

◇ Consistent Dividends Despite Shrinking Coffers

Emart recorded a standalone net loss of KRW 948.9 billion last year. The loss was largely due to an impairment loss of KRW 933.9 billion related to the revaluation of Gmarket, part of a joint venture with Alibaba. Previously, Emart had assessed its 80% stake in Gmarket at about KRW 3.4 trillion. After the impairment, the valuation was adjusted down to KRW 2.5 trillion. However, since impairment is a non-cash item, it has no immediate impact on cash flow.

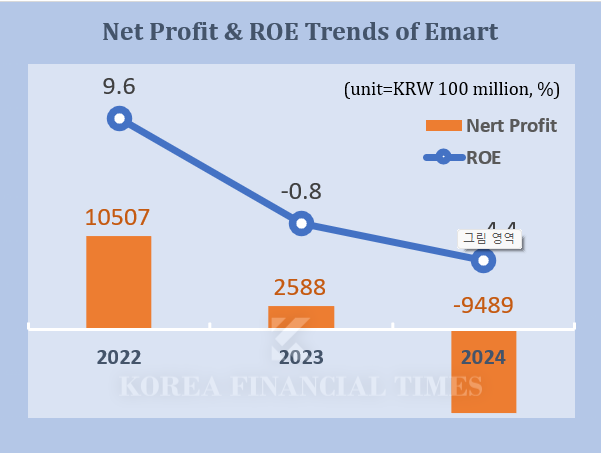

Even excluding the one-off Gmarket issue, Emart’s net profit dropped sharply—from KRW 1.0507 trillion in 2022 to KRW 258.8 billion in 2023. Notably, 2023 marked the company’s first operating loss since its founding.

Despite the poor performance, Emart has consistently paid out dividends of over KRW 50 billion annually, which has reduced its retained earnings. The company’s retained earnings fell from KRW 5.6913 trillion in 2022 to KRW 5.3585 trillion in 2023, and to KRW 4.6 trillion in 2024—a KRW 1 trillion decrease in two years. Meanwhile, the company’s dividend payout ratio has continued to rise: 20.7% in 2022, 28.5% in 2023, and 44.0% in 2024.

◇ Why Strengthen Dividends Amid Weak Results?

Why is Emart so committed to dividends despite deteriorating performance? There are several possible explanations. Emart’s ROE (Return on Equity) dropped from 9.6% in 2022 to –0.8% in 2023, and further to –4.4% in 2024. Over the same period, its PER (Price-to-Earnings Ratio) was 2.65x, –23.97x, and –3x, respectively.ROE indicates how effectively a company is using shareholders’ equity to generate profits. A high ROE implies efficient capital utilization. For shareholders, it’s a critical indicator of financial performance.

PER reflects how expensive or cheap a stock is relative to its earnings. A lower PER suggests potential undervaluation, while a higher PER implies possible overvaluation. Emart’s negative PER highlights its undervalued state, which may make it appear attractive to investors—though underlying risks must also be considered.

This should be viewed in light of the structural nature of the retail business. Retailers are heavily influenced by external conditions and have high fixed costs—stores, logistics centers, and labor. Since they operate on a resale model with thin margins, volatility in earnings is inevitable.

Thus, it’s common for retail companies to have low ROE and PER. For Emart, a stable dividend is one of the few ways to reassure shareholders. Reliable payouts serve to build trust and prevent share price erosion. In line with this, Emart introduced a policy-based dividend structure this year, promising to return 20% of standalone operating income to shareholders, regardless of bottom-line fluctuations—aiming to bolster investor confidence and share price stability.

◇ A Succession Strategy Also in Play?

In February this year, Shinsegae Group Chairman Chung Yong-jin completed the purchase of a 10% stake in Emart from his mother, Group Executive Chairwoman Lee Myung-hee.The transaction was executed after market close through a block trade, involving 2,787,582 shares at KRW 80,760 per share. A 20% premium was applied over the day’s closing price of KRW 67,300, as per rules governing family transactions. The total deal value was KRW 225.125 billion.

With this, Emart’s succession process within Shinsegae Group is effectively considered complete.

However, the method of acquisition warrants scrutiny. Chairman Chung financed most of the deal through a stock-secured loan. According to a filing with the Financial Supervisory Service, he pledged 5,172,911 shares to Korea Securities Finance Corp., raising KRW 215.8 billion at an interest rate of 4.4%.

This translates to an annual interest expense of approximately KRW 9.4 billion. Considering Chairman Chung’s total annual compensation last year was about KRW 3.6 billion, the debt burden is significant.

Given this, dividends become a critical tool for liquidity, suggesting that the succession process has influenced Emart’s dividend strategy.

◇ Tailwinds from Supplementary Budget, Fertility Rebound, and Turnaround…But Regulation Is a Risk

Emart’s business outlook for the second half of the year is positive. With the supplementary budget expected to stimulate domestic demand, Emart shares have been rising. A rebound in marriage rates—and thus fertility—also presents an opportunity for the retailer.Emart’s plan to establish a joint venture with China’s Alibaba Group adds to the optimism. The JV, Grand Opus Holdings, jointly controlled by Shinsegae and Alibaba, will operate Gmarket and AliExpress Korea, each holding a 50% stake. The combination of Gmarket’s domestic position and Alibaba’s pricing power through scale may serve to challenge Coupang’s dominance.

But regulatory pressure is building for offline retailers under the new administration. Key proposals include reinstating mandatory store closures for large discount chains, extending curbs on SSM expansion, and banning fixed-rent contracts for in-store tenants.

Kim Myung-joo, an analyst at Korea Investment & Securities, noted in a recent report: “Outbound travel remains weak this year, while the extra budget is improving consumer sentiment. Retail conditions will likely be better in the second half than the first.”

He added: “With effects from joint purchasing, structural reform, and the merger with Everyday Retail, we expect Emart to return to standalone operating profit in Q2. While the online division’s large losses are disappointing, a return to operating profit for the first time in four years is still a meaningful signal.”

Park seulgi (seulgi@fntimes.com)

![현직 복당설 속 전문성·공천 경쟁…용산구청장 선거 3大 변수 [6·3지방선거]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021317461705072b372994c951245313551.jpg&nmt=18)

![기관 'SK하이닉스'·외인 '삼성전자'·개인 '한화에어로스페이스' 1위 [주간 코스피 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021322573704878179ad43907118235313.jpg&nmt=18)

![기관 '알테오젠'·외인 '삼천당제약'·개인 '에코프로비엠' 1위 [주간 코스닥 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021323061707087179ad43907118235313.jpg&nmt=18)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213084839016295e6e69892f222110224112.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085723019015e6e69892f222110224112.jpg&nmt=18)

![24개월 최고 연 3.10%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085033090215e6e69892f222110224112.jpg&nmt=18)

![천상영 신한라이프 대표, 수익성 저하 불구 지주 기여도 1위…올해 손해율 관리·이익효율성 제고 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260103180551057718a55064dd122012615783.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)