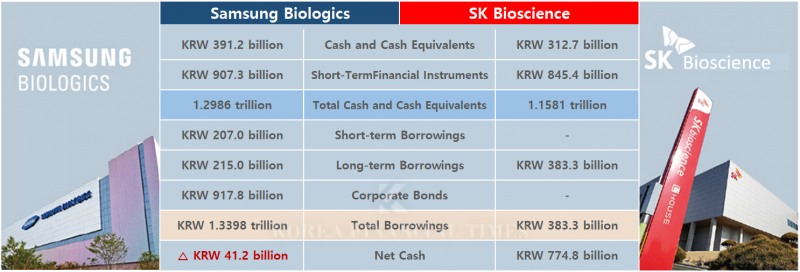

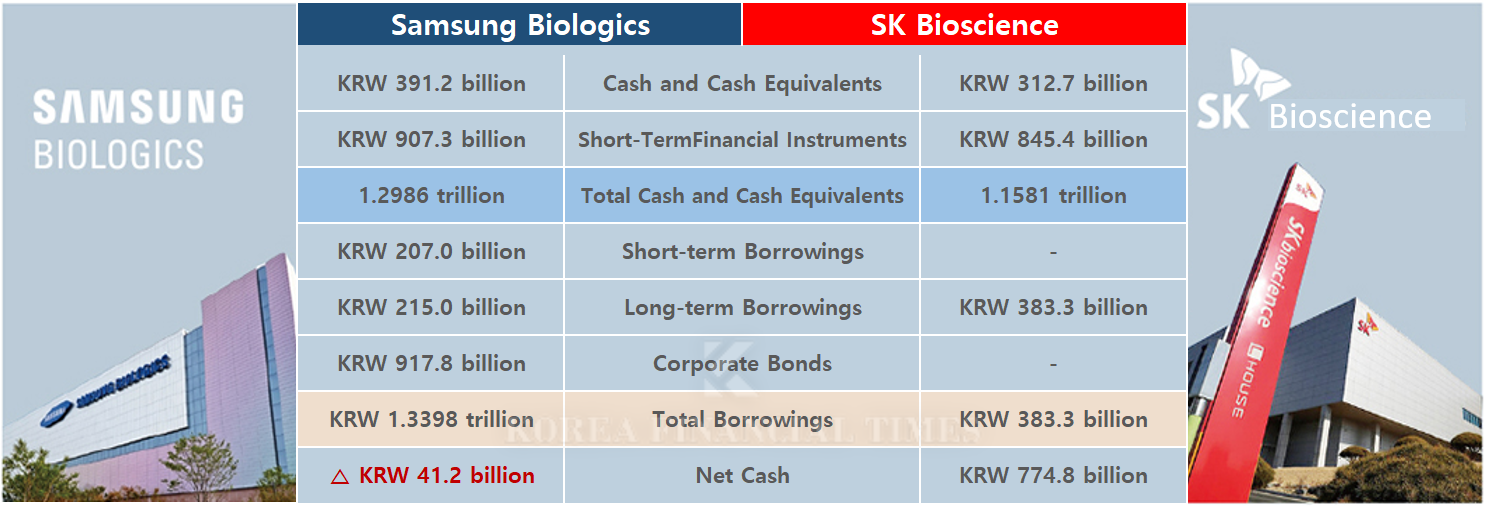

Comparison of Cash and Cash Equivalents and Borrowings of Samsung Biologics and SK Bioscience in 2024 (Consolidated Basis)

이미지 확대보기◇ Samsung Biologics Surpasses KRW 1 Trillion in Cash Assets

According to a Financial Supervisory Service disclosure on May 6, 2025, Samsung Biologics held KRW 1.2986 trillion in total cash and cash equivalents at the end of last year, comprising KRW 391.2 billion in cash and cash equivalents and KRW 907.3 billion in short-term financial instruments.This represents a decrease of about KRW 700 billion from the previous year, when the company held KRW 2.018 trillion in cash assets (KRW 367.9 billion in cash and KRW 1.65 trillion in short-term financial products). The reduction reflects efforts to improve the company’s financial structure. Samsung Biologics repaid approximately KRW 800 billion in borrowings and bonds in 2024, lowering its debt ratio to 59%.

Despite a smaller cash reserve, investment appetite increased. The company spent KRW 2.0012 trillion on facility investments, including CDMO plants, a 155.8% increase from KRW 782.2 billion in 2023.

Last month, Samsung Biologics began full-scale operations of its 180,000-liter Plant 5, raising total production capacity to 784,000 liters-the largest globally. The company plans to invest a total of KRW 7.5 trillion by 2032 to build its second Bio Campus (Plants 5–8), expanding capacity to 1.324 million liters. Internal discussions are also underway to establish dedicated production facilities for new modalities such as antibody-drug conjugates (ADC).

Strong cash flow underpins this investment drive. Samsung Biologics generated KRW 1.9604 trillion in cash from operating activities in 2024. While borrowings and bonds totaled KRW 1.3398 trillion, resulting in net debt of KRW 41.2 billion, operating cash flow comfortably covers liabilities.

This contrasts sharply with the domestic biotech sector’s funding squeeze. Venture capital data from The VC shows that investment deals in Korea’s bio, medical, and healthcare sectors dropped from 522 in 2021 to 225 last year, with investment amounts shrinking from KRW 3.7358 trillion to KRW 1.0934 trillion.

An industry insider commented, “Unlike other biotech firms, Samsung Biologics has a stable revenue base and cash flow. It is one of the rare companies that can withstand increased depreciation expenses from expanded facility investments such as Plant 5.”

◇ SK Bioscience Tops in Net Cash, Ready for M&A Expansion

SK Bioscience also boasts a strong cash position, with KRW 1.1581 trillion in cash and cash equivalents last year, up 11.1% from KRW 1.2741 trillion at the end of 2023.Notably, SK Bioscience’s net cash position is KRW 774.8 billion after deducting total borrowings of KRW 383.3 billion.

While Samsung Biologics leads in cash assets among KOSPI-listed biotech firms, SK Bioscience ranks first in net cash. The company accumulated substantial cash during the COVID-19 pandemic, generating billions in operating profit centered on its vaccine business. It also raised KRW 1.5 trillion through an initial public offering (IPO) in 2021.

With ample financial resources, SK Bioscience is actively pursuing business diversification and future growth through mergers and acquisitions (M&A).

SK Bioscience acquired the German CDMO company IDT Biologika for KRW 356.4 billion in June last year. In October, it purchased a controlling stake in U.S. biotech company PinA BioSolutions for KRW 4.1 billion. The company is also moving quickly to secure next-generation technologies, including a conditional acquisition of U.S.-based Sunflower’s shares.

SK Bioscience plans to continue investing in promising global biotech companies.

A company spokesperson stated, “We will secure competitiveness through investments and M&A in promising companies with excellent technologies, laying the foundation for a full-scale leap as a global company.”

Kim Nayoung, Korea Finacial Times (steaming@fntimes.com)

![[DCM] LX하우시스, 비건축부문 선방...사업포트폴리오 파워 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012216215009465a837df64942115218260.jpg&nmt=18)

![[DCM] 롯데쇼핑, 강도 높은 구조조정...투자 효율성 제고 절실](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012213330402565a837df64942115218260.jpg&nmt=18)

![[프로필] 장민영 기업은행장, 생산적금융 '적임' 자본시장 전문가 [2026 금융공기업 CEO 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012315011700719c1c16452b012411124362.jpg&nmt=18)

![[DCM] 10년물 회사채 2300억 몰렸다…LG유플러스, 통신 본업이 만든 신뢰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123111549027717fd637f543112168227135.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)