Despite pressure from the Trump administration to expand semiconductor investment in the US, Samsung appears to be leveraging major contract wins as a springboard for reviving its struggling non-memory business.

From Tesla to Apple

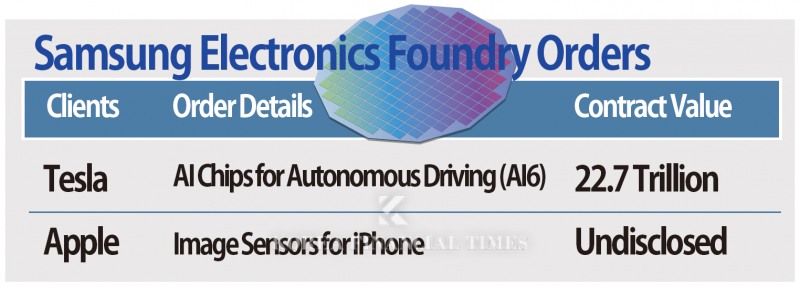

Samsung Electronics' foundry division has announced a series of order wins with global technology companies.US-based Apple announced earlier this month that it would "produce low-power, high-performance chips for use in iPhones and other Apple products at Samsung's foundry in Austin, Texas". Chief Executive Tim Cook announced this news alongside plans to invest a total of USD 600 billion (approximately KRW 830 trillion) in the US over the next four years during his White House visit.

Industry observers estimate Samsung Electronics successfully secured orders for camera sensors (CSI) for Apple's iPhone 18 series, set for launch next year.

An industry source explained: "Among smartphone components, the application processor (AP) has the highest added value, but Taiwan's TSMC is still producing these. That said, this Samsung order win is not meaningless."

Samsung Electronics has a vision of becoming a "comprehensive semiconductor company" handling both fabless (System LSI) and foundry operations. The problem is that this creates concerns among fabless clients about technology leaks, making them reluctant to place foundry orders with Samsung Electronics. This differs from TSMC, which focuses on foundry with the motto of "not competing with customers". For Samsung Electronics, securing a major global client like Apple could have the positive effect of enhancing industry trust.

Japanese company Sony has reportedly monopolised existing Apple CSI design and production. According to market research firm Counterpoint Research, Sony leads with a 45% market share based on global CSI shipment volume in 2024.

Samsung Electronics ranks second with a 19% share. Having secured Apple as a client, Samsung Electronics now has a greater chance of catching up to Sony.

Samsung Electronics also announced through regulatory filings at the end of last month that it had "signed a semiconductor foundry supply contract worth KRW 22.7658 trillion (USD 16.5 billion) with a major global company".

There was growing curiosity about which major global company had signed a contract with Samsung Electronics, but Tesla Chief Executive Elon Musk surprised the industry by directly revealing that "the major global company is Tesla". Musk also hinted at the possibility of additional cooperation, saying "USD 16.5 billion is merely the minimum amount".

The Tesla chip that Samsung Electronics' foundry will produce is 'AI6'. This will not only be installed in electric vehicles to enable autonomous driving functions, but also serve as a core chip to be deployed in Tesla's next-generation products including humanoid robots.

At its July 31 earnings conference call, Samsung Electronics highlighted its foundry supply deal with Tesla, calling it “a milestone that demonstrates the competitiveness of its advanced (2-nanometer) process technology.”

Turning Trump Pressure into Opportunity

The supply contracts Samsung Electronics secured with Apple and Tesla share the common feature of direct production at the foundry facility in Austin, Texas. This is interpreted as Samsung Electronics benefiting from the Trump administration's policy emphasising domestic US production of advanced strategic industries.There are also expectations that Samsung Electronics will expand its US semiconductor investment in response.

The company previously announced plans to invest over USD 40 billion in US foundry facilities in July 2024 during the Biden administration.

However, as semiconductor industry conditions remained sluggish for an extended period, Samsung Electronics decided to reduce the investment scale to USD 37 billion. Now there are forecasts that the company will return to an investment expansion stance following the Trump administration's arrival.

President Trump made a surprise announcement at Apple's US investment announcement event, saying he would "impose 100% tariffs on semiconductors". He added: "We will not impose them on companies that clearly promise US production".

As concerns grew about domestic companies including Samsung Electronics and SK hynix, the South Korean government stepped in to calm fears, stating it had "secured promises of most-favoured-nation treatment (15%) for tariffs on items including semiconductors" during mutual tariff negotiations with the US. Uncertainty remains as there has been no official confirmation from the US yet. An industry source said: "This is Trump-style negotiation strategy using tariffs as leverage to pressure local US investment. Considering various circumstances, Samsung Electronics may increase its US semiconductor investment."

KRW 8 trillion Loss This Year, But...

From Samsung Electronics' perspective, the current situation is not the worst-case scenario. This is because expanding US investment is also necessary from a business standpoint to secure major local clients.An industry source pointed out: "These Apple and Tesla foundry contracts were likely signed with Samsung Electronics accepting considerable losses in terms of supply pricing. Nevertheless, we can glimpse hope in terms of securing global big tech clients and seeking recovery opportunities through this."

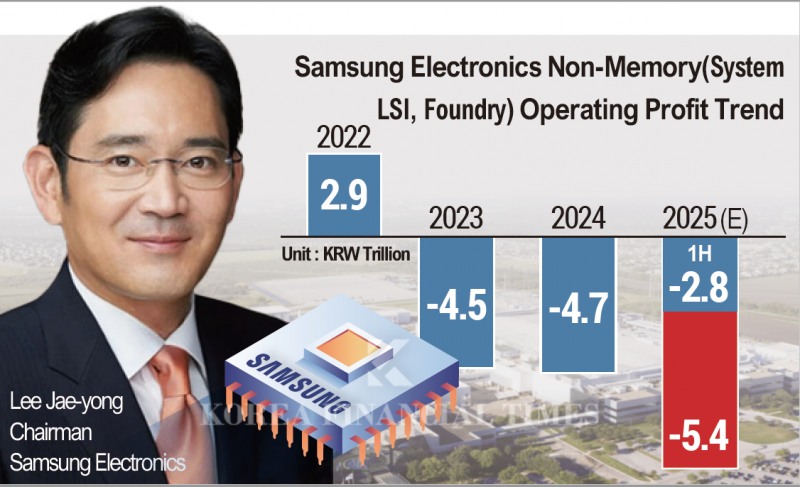

Samsung Electronics' non-memory division (System LSI, foundry) has indeed been struggling with massive losses since 2023. Samsung Electronics' non-memory losses are estimated at KRW 4.5 trillion in 2023, KRW 4.7 trillion in 2024, and KRW 2.8 trillion in the first half of 2025 (January-June).

There are gloomy forecasts that this year's loss scale could expand to approximately KRW 8.2 trillion. The cause of losses has been declining revenues due to problems securing major clients stemming from poor foundry yields.

Kim Rok-ho, senior analyst at Hana Securities, said, “By securing customers for its leading-edge foundry processes, Samsung Electronics has gained clearer visibility for mid- to long-term growth,” adding, “We expect the foundry division’s valuation to step up a level as earnings normalize by 2027.”

Gwak Horyung (horr@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)