John Rim, CEO of Samsung Biologics (left), and Seo Jung-jin, Chairman of Celltrion. / Photos courtesy of each company

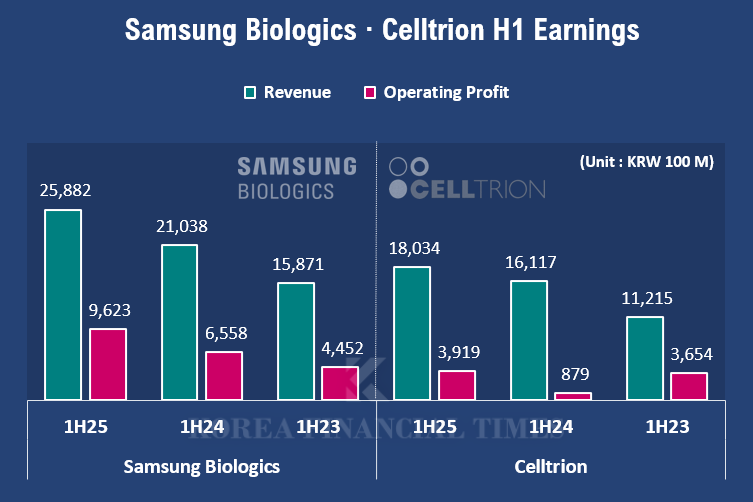

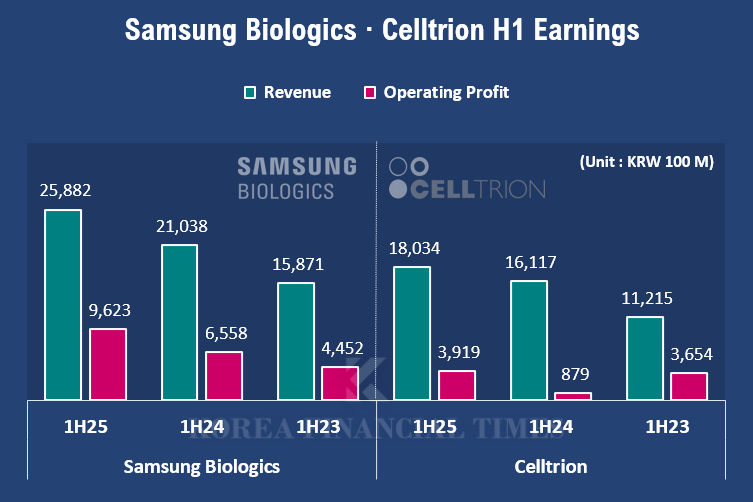

이미지 확대보기According to a disclosure on the 18th, Samsung Biologics’ consolidated revenue for the first half of this year came in at KRW 2.5882 trillion, up 23% from the same period a year earlier. It set another half-year record high, following last year. Operating profit rose 47% to KRW 962.3 billion over the period, with an operating margin of 37%.

Excluding its subsidiary Samsung Bioepis, the contract development and manufacturing (CDMO) business also posted record revenue. On a standalone basis, Samsung Biologics recorded revenue of KRW 2.0138 trillion, up 36%, and operating profit of KRW 907.1 billion, up 61%.

A Samsung Biologics official said, “Improved operational efficiency at Plants 1–3 and the ramp-up of the 240,000-liter Plant 4 underpinned the strong results.” The company’s total production capacity stands at 784,000 liters, one of the highest in the world. It is currently proceeding with permits and groundwork to break ground on Plant 6.

After bringing the 180,000-liter Plant 5 online last year in April, the company plans to add three more plants by 2032, targeting total production capacity of 1,324,000 liters. Buoyed by the robust performance, the company raised its full-year consolidated revenue growth guidance by 5 percentage points to 25–30%.

Graphic = Korea Financial Times / Source = Financial Supervisory Service (Consolidated Basis)

이미지 확대보기During the same period, Celltrion reported revenue of KRW 1.8034 trillion and operating profit of KRW 391.9 billion, up 12% and 346% year-on-year, respectively. Its operating margin was 22%. A Celltrion official said, “Stable sales of existing products in global markets and expanded sales of high-margin new products drove the earnings growth.”

Celltrion’s first-half operating profit fell from KRW 365.4 billion in 2023 to KRW 87.9 billion last year before rebounding to KRW 391.9 billion this year. By contrast, Samsung Biologics’ figures have steadily increased—KRW 445.2 billion in 2023, KRW 655.8 billion in 2024, and KRW 962.3 billion in 2025.

The companies also diverged in cash generation. Samsung Biologics’ cash flow from operating activities in the first half of 2025 was KRW 1.2063 trillion, up KRW 677.0 billion from last year. This reflects a sharp increase in cash generated from operations to KRW 1.5719 trillion year-on-year.

Cash flow from investing activities was negative KRW 790.5 billion, widening from KRW 267.9 billion last year due to increased spending on buildings and equipment. Cash flow from financing activities was negative KRW 72.4 billion, a smaller net outflow than last year’s KRW 234.7 billion, reflecting reduced short-term borrowings and repayments.

Celltrion’s cash flow from operating activities was KRW 301.5 billion, down KRW 29.0 billion from last year. While cash generated from operations increased by KRW 124.1 billion to KRW 514.0 billion, corporate tax payments rose by KRW 153.1 billion, resulting in cash outflows.

Cash flow from investing activities was negative KRW 170.3 billion, swinging to a net outflow from KRW 68.5 billion last year. Cash flow from financing activities was negative KRW 439.8 billion, with the net outflow widening from negative KRW 76.1 billion last year due to increases in short- and long-term financial liabilities.

The retention rate of employees who returned from leave and remained for at least 12 months was 60% at Samsung Biologics and 57% at Celltrion, a modest gap. The number of employees taking spousal paternity leave was 79 at Samsung Biologics and 33 at Celltrion, translating into 1.57% and 1.23% of total headcount, respectively, with Samsung Biologics again higher.

An industry official said, “A balanced management strategy that encompasses not only profit generation but also cash flows and employee welfare appears to be the key to sustainable corporate growth.”

Yang Hyunwoo (yhw@fntimes.com)

![[DCM] LX하우시스, 비건축부문 선방...사업포트폴리오 파워 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012216215009465a837df64942115218260.jpg&nmt=18)

![[DCM] 롯데쇼핑, 강도 높은 구조조정...투자 효율성 제고 절실](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012213330402565a837df64942115218260.jpg&nmt=18)

![[프로필] 장민영 기업은행장, 생산적금융 '적임' 자본시장 전문가 [2026 금융공기업 CEO 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012315011700719c1c16452b012411124362.jpg&nmt=18)

![[DCM] 10년물 회사채 2300억 몰렸다…LG유플러스, 통신 본업이 만든 신뢰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123111549027717fd637f543112168227135.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)