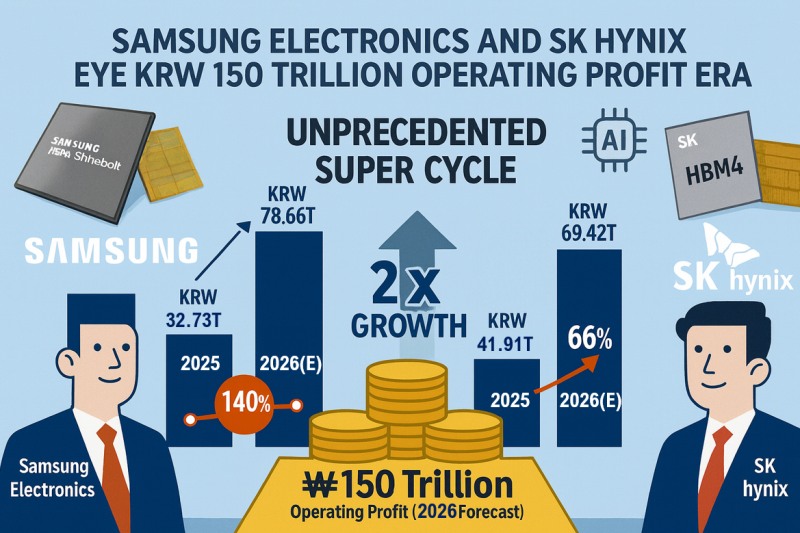

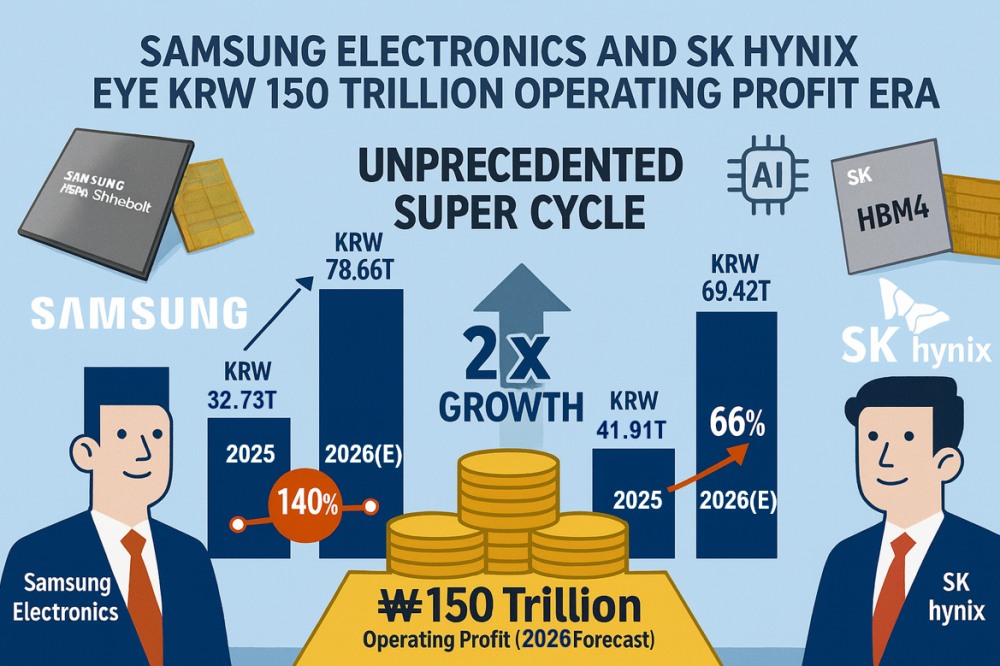

According to domestic securities firms' estimates, next year's operating profit for memory manufacturers is projected at KRW 69.42 trillion for SK Hynix and KRW 78.66 trillion for Samsung Electronics, representing increases of 66% and 140%, respectively, compared to this year. These are average values calculated by compiling data from 16 accessible domestic securities firms that updated their corporate analysis reports following both companies' earnings announcements last month.

Korea Investment & Securities, which presented the highest figures, projected combined operating profit of KRW 176 trillion (approximately KRW 81 trillion for SK Hynix and KRW 95 trillion for Samsung Electronics). This represents roughly 90% of the total operating profit (KRW 197 trillion) of all 614 KOSPI-listed companies excluding financial firms in 2024. Securities firms commonly believe that "the memory semiconductor super cycle will continue at least through next year."

The current semiconductor boom began with High Bandwidth Memory (HBM), the core of artificial intelligence (AI) computing. As memory manufacturers concentrate on HBM production, supply of general DRAM for servers, PCs, and mobile devices has become scarce, driving prices sharply higher. Furthermore, with memory companies intentionally delaying investments in general DRAM, this supplier-dominant phase is expected to continue for the next 2-3 years.

The majority view is that SK Hynix will continue to lead the memory semiconductor market in 2026 as well. When considering Samsung Electronics' DS (semiconductor) division alone, some estimates fall below SK Hynix's operating profit projections.

In September, SK Hynix announced it had established the world's first mass production system for next-generation HBM4. Last month, Kim Woo-hyun, SK Hynix's CFO, bolstered optimistic forecasts by stating, "Next year, not only HBM but also DRAM and NAND are virtually sold out."

SK Securities raised SK Hynix's target price to KRW 1 million in a report on November 3. Other securities firms remain cautious, maintaining targets in the KRW 650,000-700,000 range. Only SK Securities changed its valuation methodology from past net assets (PBR) to net profit (PER). The rationale is that while semiconductors were previously an industry with performance heavily influenced by economic cycles, they are expected to generate consistently high profits regardless of economic conditions going forward.

Kyobo Securities also aggressively set SK Hynix's target price at KRW 900,000. However, it maintained Samsung Electronics' target price (KRW 140,000) at similar levels to other securities firms. Choi Bo-young, a research fellow at Kyobo Securities, stated, "SK Hynix will transform into the memory industry's TSMC."

This signifies a shift from traditional memory manufacturing centered on low-price competition through mass production to a foundry-type business structure that supplies high-value-added products that others cannot easily produce through a "pre-order, post-production" method.

Not all forecasts are rosy. HBM profitability is an uncertainty factor. The company is changing its structure from producing "base die" in-house up to HBM3E to outsourcing it to TSMC starting with HBM4.

While SK Hynix stated that "next year's HBM prices are set at levels that can maintain profitability at current levels," cautious views exist. Mirae Asset Securities, which presented the lowest operating profit estimate (KRW 62.6 trillion), predicted that next year's HBM sales will grow only 7% while average selling price (ASP) will decline 7%.

Additionally, iM Securities pointed to declining IT front-end demand due to tariff impacts as a risk, presenting a relatively low operating profit estimate of KRW 62.628 trillion.

Samsung Electronics is also expected to see semiconductors significantly boost overall performance. The surge in general DRAM prices presents an opportunity for greater benefits to Samsung Electronics, which has abundant production capacity. Kiwoom Securities reflected this by projecting Samsung Electronics' next year's operating profit at approximately KRW 80.353 trillion, double this year's figure.

Park Yu-ak, chief research fellow at Kiwoom Securities, assessed, "Samsung Electronics has a considerably high proportion of general DRAM operating profit based on this year's figures, and the magnitude of performance improvement due to the cycle rebound will be greater than competitors."

Samsung Electronics has been showing a trend of recovering technological competitiveness, starting supply of HBM3E to Nvidia from Q3. Additionally, its foundry division has been securing consecutive large orders from external clients including Tesla, Apple, and Nintendo.

However, these positive factors have not been fully reflected in the stock price. While Samsung Electronics' stock price rose 94% this year, SK Hynix surged 260%, with Samsung's increase at about one-third of SK Hynix's. Currently, Nvidia is conducting quality tests on Samsung Electronics' HBM4. While positive signals are emerging both inside and outside the company, the precedent of HBM3E verification taking 18 months remains an uncertainty factor.

The non-memory (System LSI, foundry) division shows improvement trends, but not many forecasts predict a "turnaround to profitability" next year. Among 14 securities firms that estimated non-memory performance, 12 predicted "continued losses."

Samsung Electronics' stock price is expected to show more active movement after proving HBM competitiveness. Noh Geun-chang, head of the research center at Hyundai Motor Securities, stated, "Samsung Electronics' HBM4 will incorporate a base die that applies the foundry division's 4-nanometer FinFET technology, and synergy effects between memory and foundry will be realized."

Gwak Horyung (horr@fntimes.com)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![펩타이드 기술 강자 ‘이 회사', 비만·안질환까지 확장한다 [시크한 바이오]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821300702131dd55077bc221924192196.jpg&nmt=18)

![‘IB 명가' 재정비 시동…NH투자증권, 김형진·신재욱 카드 [빅10 증권사 IB 人사이드 (6)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603103406515dd55077bc221924192196.jpg&nmt=18)

![건강보험 손해율 악화·법인세 인상에 보험사 주춤…현대해상·한화생명 순익 반토막 [2025 금융사 실적 전망]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260219205719063188a55064dd1121160100217.jpg&nmt=18)

![압도적 ‘양종희' vs 성장의 ‘진옥동' 밸류업 금융 선두 다툼 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603032808988dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)