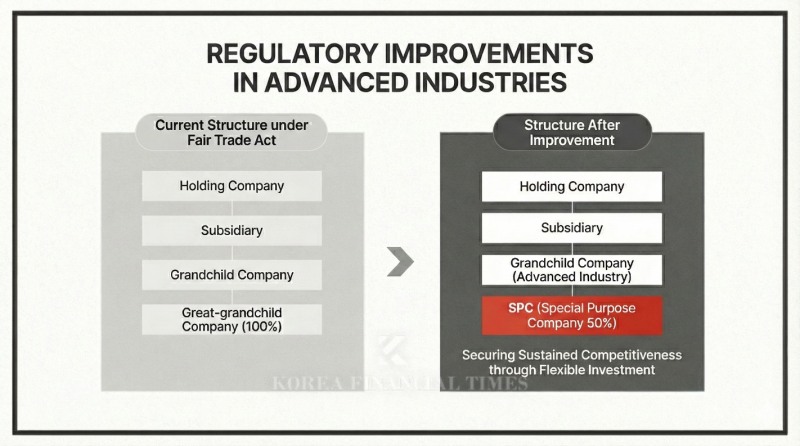

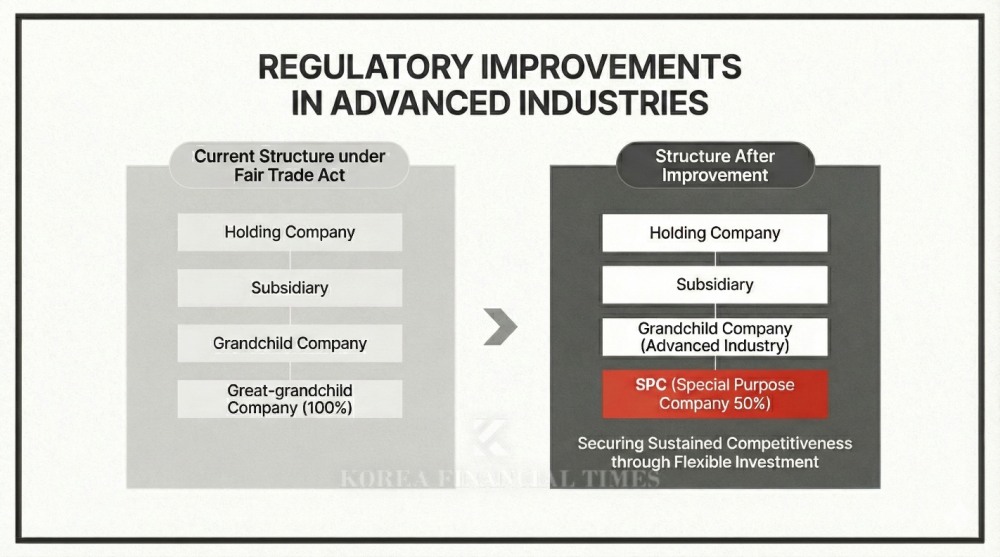

The government is pursuing a plan to ease the mandatory equity ratio for great-grandchild companies of grandchild companies in the semiconductor sector from 100% to 50% or more through special provisions under the National Advanced Strategic Industries Act. The final plan is scheduled to be confirmed by the National Assembly.

SK Hynix stands out as a company that will benefit from this policy. As a grandchild company of SK Group's holding company, SK Hynix will be able to establish a special purpose company (SPC) and attract external investment through regulatory easing. This will significantly reduce the initial investment costs for semiconductor factory construction. The existing method of expanding borrowing raises concerns about financial risks, while paid-in capital increases carry the possibility of declining controlling shareholder equity ratios. Notably, the National Growth Fund, which will launch next year with participation from the government, financial institutions, and the general public, plans to participate as an external investor.

SK Hynix currently has abundant cash thanks to the recent semiconductor boom. As of the end of the third quarter, cash and cash equivalents (including short-term financial instruments) stood at KRW 27.854 trillion, a 2.6-fold surge from KRW 10.858 trillion a year earlier. However, the company maintains that its own cash alone is insufficient for the investment amount that must be injected immediately to gain an edge in the global AI speed race.

Chey Tae-won, Chairman of SK Group, met with President Lee Jae-myung in mid-last month and stated, "KRW 600 trillion in investment in the Yongin semiconductor fab alone will continue going forward." This represents a five-fold increase from the KRW 120 trillion projected investment announced in 2019. In mid-this month, Kwak Noh-jung, CEO of SK Hynix, also told President Lee, "If we wait to earn money before investing, we'll miss the timing." President Lee responded, "We discussed the funding investment issue I talked about with Chairman Chey," adding, "It makes sense."

As regulatory easing subsequently gained momentum, some political circles and civic groups raised claims that "Isn't this customized preferential treatment for SK?"

In response, SK Hynix posted fact-check materials on its website and YouTube, stating, "This is a fundamental question of how to make advanced industry investment sustainable in a rapidly changing environment," and "It's not about a specific company or individual case." Regarding criticisms about undermining the principle of separation between financial and industrial capital, the company countered, "This is a temporary structure for investing in large-scale production facilities like semiconductor factories," and "It is completely different in nature from means to expand business areas or change governance structures."

At the SK Group level, the company is actively emphasizing that AI infrastructure investment is core to national competitiveness. SK is the entity that has announced the most concrete domestic AI ecosystem cooperation plan for AI business through Blackwell GPUs supplied by NVIDIA. SK plans to build the country's largest 'AI Factory' equipped with over 50,000 NVIDIA GPUs by the end of 2027 and provide a GPU-as-a-service model. This will be provided not only to SK affiliates but also to developers participating in the government-led sovereign AI project.

Gwak Horyung (horr@fntimes.com)

![기관 '알테오젠'·외인 '삼천당제약'·개인 '에코프로비엠' 1위 [주간 코스닥 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021323061707087179ad43907118235313.jpg&nmt=18)

![기관 'SK하이닉스'·외인 '삼성전자'·개인 '한화에어로스페이스' 1위 [주간 코스피 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021322573704878179ad43907118235313.jpg&nmt=18)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213084839016295e6e69892f222110224112.jpg&nmt=18)

![24개월 최고 연 3.10%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085033090215e6e69892f222110224112.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085723019015e6e69892f222110224112.jpg&nmt=18)

![24개월 최고 연 3.25%…흥국저축은행 '정기예금(강남)'[이주의 저축은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021318581601639957e88cdd521123418838.jpg&nmt=18)

![천상영 신한라이프 대표, 수익성 저하 불구 지주 기여도 1위…올해 손해율 관리·이익효율성 제고 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260103180551057718a55064dd122012615783.jpg&nmt=18)

![[DQN] 이환주號 국민은행, 위험밀도 1위·RoRWA 3등···진정한 '리딩뱅크' 되려면 [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021604305006368b4a7c6999c121131189150.jpg&nmt=18)

![24개월 최고 연 5.15%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213090100052385e6e69892f222110224112.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)