Korea Financial Times calculated Ecopro BM's Altman Z-Score for the past five years (2019-2024) using the corporate data platform DeepSearch.

The Altman Z-Score is an indicator that predicts bankruptcy possibility based on corporate financial statements.

It is one of various indicators used by investors and financial institutions to assess corporate credit risk or decide on investments and loans. Generally, for manufacturing companies, a Z-Score of 3 or above is considered stable, while below 1.8 indicates high bankruptcy possibility.

Ecopro BM's Altman Z-Score declined slightly from 3.87 in 2019 to 3.47 in 2024 over five years. By year: ▲8.18 in 2020 ▲9.57 in 2021 ▲5.26 in 2022 ▲8.02 in 2023, showing significant fluctuations.

This pattern resembles the flow of the electric vehicle battery market, which is Ecopro BM's main focus. Annual sales, an external indicator, increased every year from KRW 616.1 billion in 2019 to KRW 6.9009 trillion in 2023. During the same period, total assets grew from KRW 650.4 billion to KRW 4.3618 trillion.

In contrast, operating profit, which shows qualitative performance, showed a different trend. Ecopro BM's operating profit steadily increased from KRW 37.1 billion in 2019 to a record high of KRW 380.7 billion in 2022. Retained earnings also increased from KRW 93.0 billion to KRW 432.2 billion during the same period.

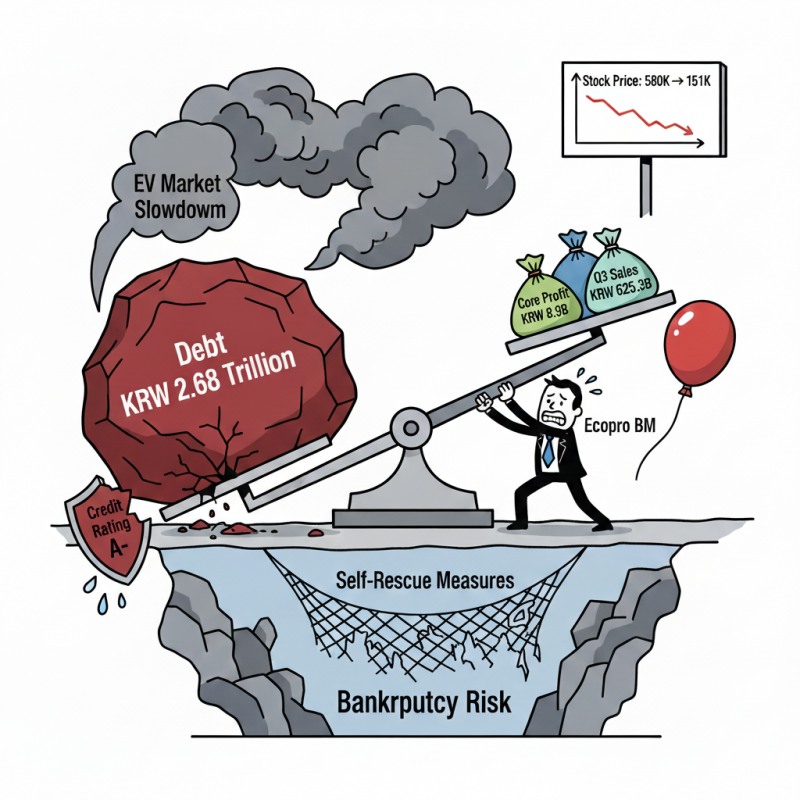

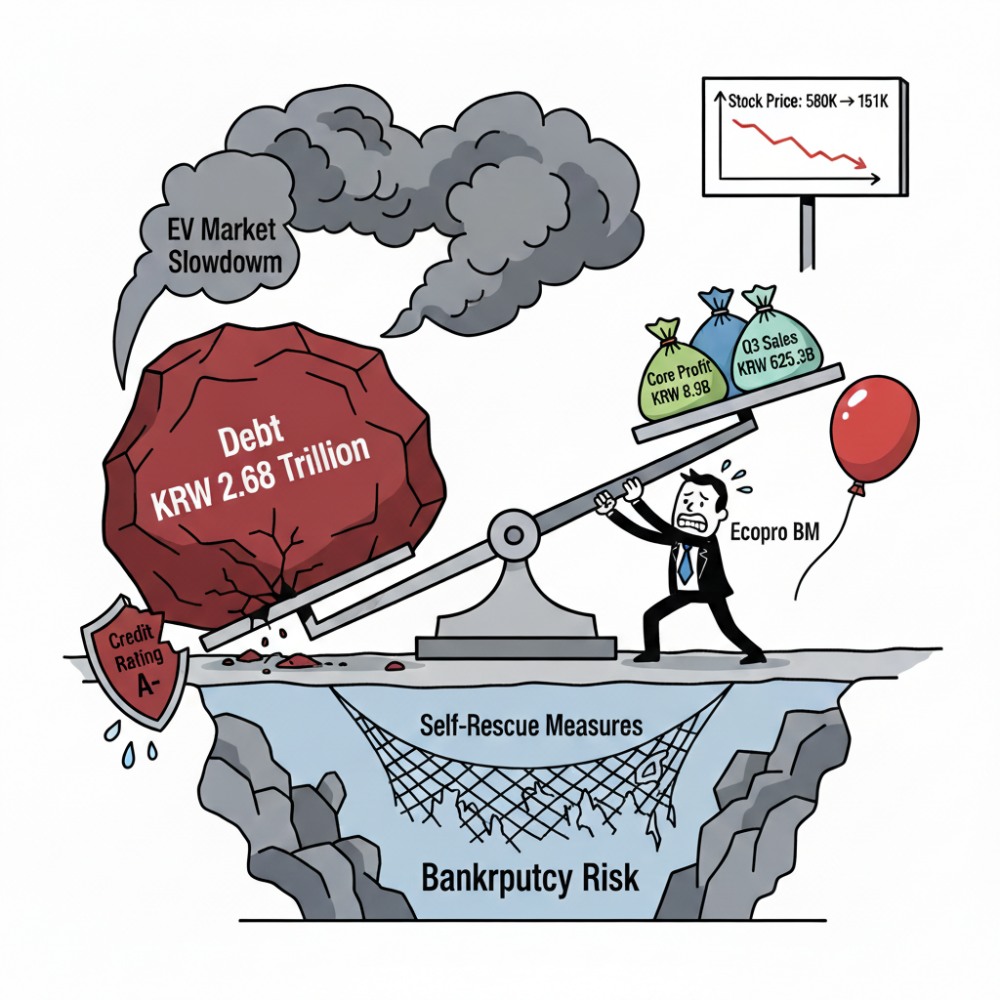

However, in 2023 when the EV chasm materialized in earnest, operating profit was cut in half to KRW 156.0 billion, and in 2024 it plummeted to KRW 34.1 billion. Retained earnings also peaked at KRW 432.2 billion in 2022, then declined for two consecutive years to KRW 375.4 billion in 2023 and KRW 275.4 billion in 2024. Sales also plunged to KRW 2.7668 trillion in 2024.

Ecopro BM's stock price volatility is also significant. The stock price, which was around KRW 40,000 in 2019, once rose to the KRW 580,000 range in early 2023. It repeatedly fluctuated in the KRW 100,000-130,000 range in the first half of this year.

◇ Short-term borrowing burden and weakened cash generation

The problem is the increased financial burden along with deteriorating profitability. The battery industry, due to its order-based characteristics, tends to boldly expand facility investments to increase market share. Manufacturers sometimes engage in aggressive orders, accepting losses to secure market share.Ecopro BM also increased borrowing during its growth phase to secure CAPEX funds for expanding cathode material production. However, as expected results did not materialize due to deteriorating market conditions, the financial burden grew.

The company's short-term borrowings increased more than threefold from KRW 377.8 billion at the end of 2021 to KRW 1.0729 trillion at the end of 2024. Current liabilities exceeded KRW 1 trillion, reaching KRW 1.5479 trillion in 2022. In 2021, when total assets first surpassed KRW 1 trillion, the debt ratio doubled year-over-year to 140%. In 2023, when total assets exceeded KRW 4 trillion, the debt ratio expanded to approximately 175%.

Cash situation also deteriorated due to worsening performance and increased financial burden. Net borrowings grew from KRW 1.2349 trillion at the end of 2022 to KRW 2.1822 trillion at the end of 2024, and expanded to KRW 2.6864 trillion by the end of March 2025.

◇ Credit rating downgrade raises order disruption concerns

Recent circumstances are not favorable. The company reported Q3 consolidated sales of KRW 625.3 billion and operating profit of KRW 50.7 billion on the 4th. While sales increased 19.8% year-over-year, they decreased 20% quarter-over-quarter.Operating profit increased 3.5% quarter-over-quarter and turned to black year-over-year, but this figure includes KRW 41.8 billion in investment gains related to acquiring stakes in Indonesian nickel smelter PT ESG. Excluding this, Q3 operating profit is approximately KRW 8.9 billion.

Ecopro BM's profitability has not yet recovered due to weak performance in EV cathode materials, which account for more than half of sales. The company is expanding its ESS cathode material business and investing in global bases including Ochang and Pohang domestically, as well as Hungary and Quebec, with the goal of establishing an annual production system of 720,000 tons of cathode materials by 2028.

However, with immediate business recovery difficult and financial burden growing, investor sentiment is wavering as even the credit rating has been downgraded. Korea Ratings downgraded Ecopro BM's unsecured bond credit rating from 'A (negative)' to 'A- (stable)' in June. It cited declining profitability due to industry slowdown and falling selling prices, and increased financial burden as reasons for the downgrade.

Min Won-sik, researcher at Korea Ratings, diagnosed, "The capacity for meaningful improvement in operating cash flow (OCF) in the short term is limited, and free cash flow (FCF) deficit will continue due to heavy capital requirements," adding, "Although various self-rescue measures including capital expansion are being pursued, it is difficult to significantly reduce financial burden through substantial debt reduction."

A credit rating downgrade can negatively affect not only increased financing costs such as public bonds but also future order business. This is because ordering parties view contractor financial soundness as an important judgment factor.

Ecopro BM's position is that it is focusing on improving its constitution by reducing fixed costs and streamlining production lines. It also focuses on securing liquidity by improving cash flow.

Kim Jang-woo, Ecopro BM's CFO (Vice President), emphasized at the recent Q3 earnings conference call, "As of the end of Q3, we hold approximately KRW 320 billion in cash and have secured liquidity of approximately KRW 540 billion, including KRW 220 billion in financial institution borrowing limits," adding, "Internal cash flow is improving, so we have sufficient capacity to secure additional liquidity."

He added, "We are concurrently reviewing fundraising for responding to new orders and improving financial structure, and will flexibly pursue fund management strategies according to industrial and financial market changes."

Securities Industry: "Supply/Demand Over Performance; Exercise Caution with Chase Buying"

Accordingly, market views on the recent sharp stock price increase remain conservative. The stock price once recovered to the KRW 170,000 range, approaching the KRW 180,000 range, the highest in the past year, but fell to the KRW 150,000 range after the Q3 earnings announcement.On the 7th, the stock price closed at KRW 151,100, down 4.4% from the previous day.

The securities industry interprets the previous stock price increase as recovery in investor sentiment toward secondary battery stocks rather than business growth momentum. It advises cautious judgment until specific results of the ESS cathode material business are confirmed.

Kim Hyun-soo, researcher at Hana Securities, stated in a report, "The core logic for this year's stock price rebound was halting quarterly sales decline, but as sales are decreasing quarter-over-quarter for consecutive Q3 and Q4, short-term stock price upside momentum will be limited," adding, "However, considering that market capitalization is low despite high shipment volume compared to competitors, we recommend buying on corrections below KRW 15 trillion market cap."

Jang Jung-hoon, researcher at Samsung Securities, diagnosed, "While liquidity is flowing into the secondary battery sector, among stocks that fell after the 2023 peak, Ecopro BM has relatively not recovered, so investor sentiment appears to have concentrated," adding, "Since performance has not particularly improved, it is reasonable to interpret this as supply concentration on stocks that were weak."

He continued, "Domestic battery companies' utilization rates depend more on EV demand than ESS, and the September increase in EV production has significant front-loading aspects ahead of subsidy abolition, so it could be an optical illusion," adding, "If stock price movements are based on sentiment or supply rather than performance, caution is needed when chasing purchases."

Kim JaeHun (rlqm93@fntimes.com)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![펩타이드 기술 강자 ‘이 회사', 비만·안질환까지 확장한다 [시크한 바이오]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821300702131dd55077bc221924192196.jpg&nmt=18)

![‘IB 명가' 재정비 시동…NH투자증권, 김형진·신재욱 카드 [빅10 증권사 IB 人사이드 (6)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603103406515dd55077bc221924192196.jpg&nmt=18)

![건강보험 손해율 악화·법인세 인상에 보험사 주춤…현대해상·한화생명 순익 반토막 [2025 금융사 실적 전망]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260219205719063188a55064dd1121160100217.jpg&nmt=18)

![압도적 ‘양종희' vs 성장의 ‘진옥동' 밸류업 금융 선두 다툼 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603032808988dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)