According to industry sources on the 9th, LG Chem is reviewing the conclusion of a PRS agreement with domestic securities firms, based on a portion of its stake in LG Energy Solution (LG Ensol). The financing amount is expected to exceed 2 trillion won, representing 2-3% of its 81.8% stake in LG Ensol.

EcoPro is reportedly pursuing a PRS agreement to raise 700 billion won in funds using EcoPro BM shares.

SK Innovation plans to secure 1.6 trillion won through PRS as part of its 5 trillion won capital expansion plan announced on July 30. Previously, its subsidiary SK On also signed a PRS agreement worth 1.5 trillion won last year.

Lotte Chemical also signed PRS agreements twice, in November last year and March this year. It first raised 660 billion won with a 40% stake in its US subsidiary LCLA, and then additionally raised 650 billion won by leveraging a 25% stake in its Indonesian subsidiary LCI.

PRS is a derivative contract that settles stock price fluctuations over a certain period, structured such that companies raise funds from financial institutions by using their owned shares as collateral.

From a corporate perspective, it is advantageous to utilize PRS when there is confidence in stock price appreciation. If the stock price rises above the initial reference price, the financial institution pays the profit to the company. If the stock price falls, the company must pay the difference to the financial institution. Financial institutions, without fear of principal loss, earn fees that are generally higher than interest rates. Companies take on the risk of additional costs or stock price declines, making it difficult to proceed without a strong conviction that the stock has "hit rock bottom."

Another reason companies favor PRS agreements is that they are not recognized as debt. For accounting purposes, they are treated as a sale of shares. However, in practice, most PRS arrangements are structured as "loans collateralized by shares," often including a re-purchase option after maturity.

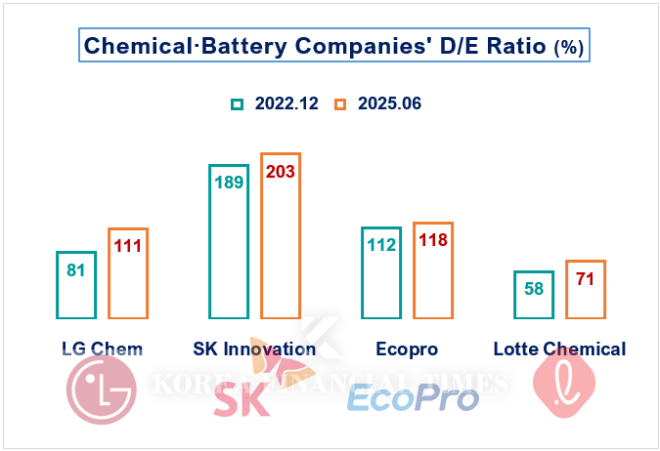

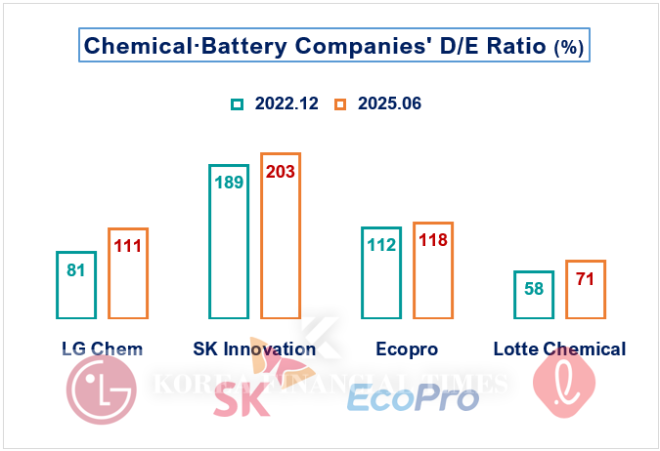

LG Chem, EcoPro, and SK Innovation are petrochemical and battery companies whose financial stability is being shaken by rising debt-to-equity ratios due to deteriorating industry conditions. Amid pressure from credit rating downgrades, it is not easy for them to access the corporate bond market, a traditional fundraising method.

LG Chem is experiencing increasing financial burdens due to the petrochemical downturn. Its profit generation capacity has sharply declined, yet large-scale investments are underway in battery cathode materials and eco-friendly materials for business transformation. Its debt-to-equity ratio has risen from 81.4% at the end of 2022 to 110.7% at the end of the second quarter of 2025.

It is reported that after Lotte Chemical experienced an Event of Default (EOD) in November last year, financial institutions have been demanding higher interest rates than before.

Gwak Horyung (horr@fntimes.com)

![[DCM] 롯데물산, 본업 잠식하는 건설·케미칼 리스크…변동금리 설계 대응](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020504290203014a837df6494123820583.jpg&nmt=18)

![박창훈 신한카드 대표, 조직 슬림화 방점에 수익성 주춤…올해 1위 탈환 기대 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260205140019021809efc5ce4ae211217229113.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)