Since 2016, SK Inc. has engaged in active investment activities. Investments included SK Materials (semiconductor materials), SOCAR (car sharing), SM Core (logistics) in 2016; ESR Cayman (logistics), SK Siltron (semiconductor materials), Plutus Capital (hydrogen investment) in 2017; Grab (car sharing), SK Pharmteco (bio contract development and manufacturing) in 2018; and Masan and Vingroup (Vietnam) in 2019, among others.

Furthermore, in 2020, Vice Chairman Jang Dong-hyun of SK Inc. announced plans to transform the company into an “investment-oriented holding company.” The goal was to boldly invest in promising companies in high-growth sectors, realize future capital gains, and reinvest these profits to create a virtuous investment cycle. An industry insider commented, “It was a meaningful declaration to move beyond the simple management of affiliates by a holding company,” adding, “There was even praise that it was a Korean version of Berkshire Hathaway.”

Former CFO Lee Sung-hyung was considered the right person to support these investment activities. He joined SK Innovation, led the corporate finance team at SK Securities, served as head of finance at SK Inc., and was CFO of SK Telecom. From 2017 to 2024, he served as CFO of SK Inc., gaining a deep understanding of the group’s overall businesses.

Kim Ki-dong, Chief Financial Officer (CFO) of SK Inc.

Vice President Kim Ki-dong is classified as a different type of CFO. Unlike his predecessor, who was investment-focused, Kim has stably managed overall finances.

Kim joined SK Engineering & Construction and held positions such as Head of Finance at SK Chemicals, Head of Finance at SK Discovery, and Head of Management Support at SK Chemicals. He has consistently worked within SK Discovery affiliates under Vice Chairman Chey Chang-won’s control. His transfer to SK Inc., the holding company led by Chairman Chey Tae-won, to take charge of financial affairs, was seen as highly unusual.

SK Inc. appears to expect Kim to fulfill the traditional CFO role, namely, maintaining financial soundness through cash liquidity management and debt control. The position of Portfolio Management (PM) head, overseeing investment activities for new growth engines, has been assigned to Vice President Kang Dong-soo. Former CFO Lee Sung-hyung had previously held both the CFO and PM head roles.

This change comes amid rapidly shifting internal and external conditions for SK. After the end of the pandemic, interest rates have risen to curb inflation, significantly increasing borrowing costs. In addition, SK is experiencing sluggish performance in all areas except semiconductors, including energy and batteries.

As a result, in December 2023, SK Group began a “rebalancing” under the supervision of Vice Chairman Chey Chang-won. This included supporting affiliates with quality assets (SK E&S + SK Innovation, SK Materials Airplus + Essencore → SK Ecoplant) and selling non-core assets (SK Specialty, SK PU Core).

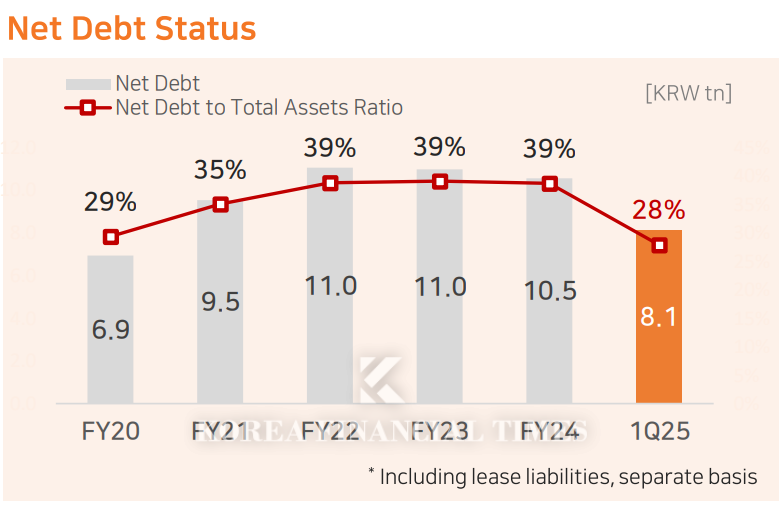

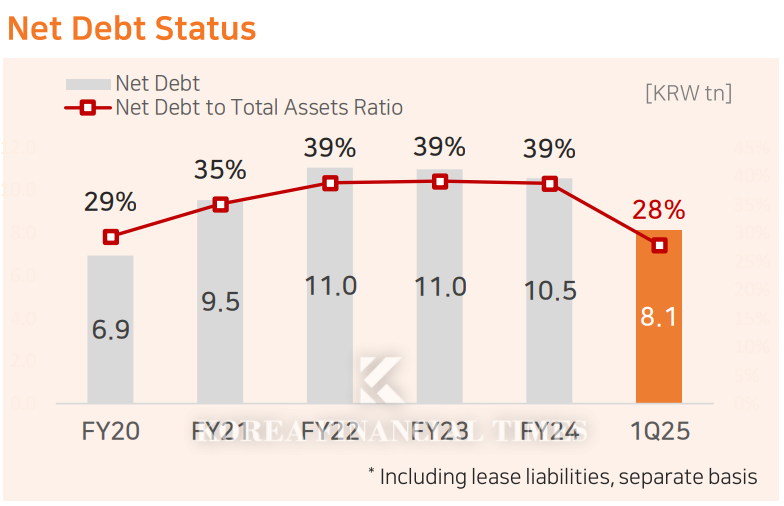

Restructuring some businesses has also yielded financial results. SK Inc.’s Net Debt (Interest-bearing Debt – Cash and Cash Equivalents), which soared to KRW 11 trillion at the end of 2022, decreased to KRW 8.1 trillion by the end of Q1 this year. The company’s Net debt to Total Assets Ratio dropped from 39% to 28%.

![기관 '알테오젠'·외인 '삼천당제약'·개인 '에코프로비엠' 1위 [주간 코스닥 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021323061707087179ad43907118235313.jpg&nmt=18)

![기관 'SK하이닉스'·외인 '삼성전자'·개인 '한화에어로스페이스' 1위 [주간 코스피 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021322573704878179ad43907118235313.jpg&nmt=18)

![[부의 지도] 이상훈 에이비엘바이오 대표, 주식자산 569% '폭증'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021606565602265a837df6494123820583.jpg&nmt=18)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213084839016295e6e69892f222110224112.jpg&nmt=18)

![[DQN] 국민은행, 4년 만에 순익 1위했지만···진정한 '리딩뱅크' 되려면 [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021604342702655b4a7c6999c121131189150.jpg&nmt=18)

![24개월 최고 연 3.10%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085033090215e6e69892f222110224112.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085723019015e6e69892f222110224112.jpg&nmt=18)

![천상영 신한라이프 대표, 수익성 저하 불구 지주 기여도 1위…올해 손해율 관리·이익효율성 제고 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260103180551057718a55064dd122012615783.jpg&nmt=18)

![24개월 최고 연 3.25%…흥국저축은행 '정기예금(강남)'[이주의 저축은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021318581601639957e88cdd521123418838.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)