Chey Tae-won, Chairman of SK

The holding company SK has three main revenue streams. These are: the IT service business (SK AX) absorbed by the holding company and used to strengthen group control, royalties received from affiliates for the use of the ‘SK’ brand, and dividends received from subsidiaries or investment companies.

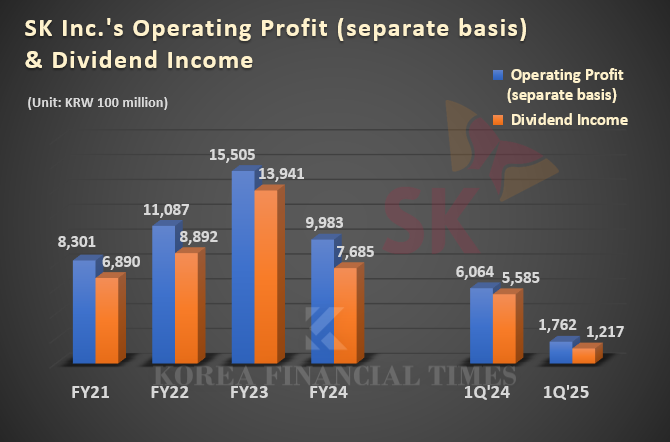

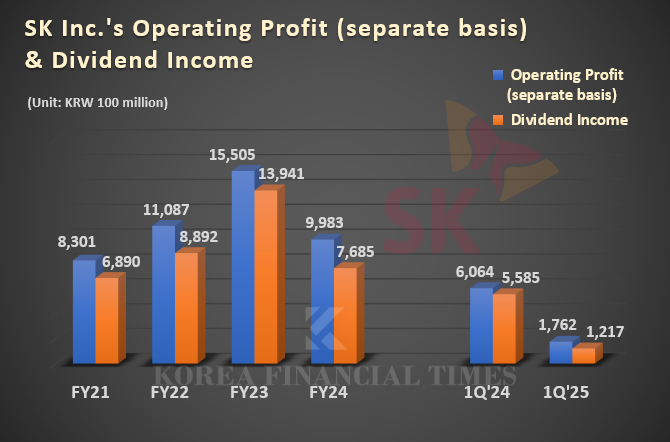

Among these, dividend income is the most significant, accounting for 80–90% of total operating profit. The sharp decline in SK’s earnings in the first quarter was due to a reduction in dividends received. The company’s dividend income was KRW 121.7 billion, a steep 78% drop from KRW 558.5 billion a year earlier.

The company most responsible for this sharp decline in dividends is SK Innovation E&S. Until October last year, SK E&S was a subsidiary in which SK held a 90% stake, serving as a cash generator, but it was merged with SK Innovation.

SK does not disclose the amount of dividends received by each company, but estimates can be made based on the total dividend amount and shareholding ratios. Last year, the company received KRW 768.5 billion in dividends, with about half—KRW 360 billion—coming from SK E&S. Given the absence of E&S dividends this year, it is not surprising that operating profit has plummeted.

However, the dividend effect from E&S has not disappeared entirely, as SK still receives dividends from SK Innovation, which absorbed E&S.

Following the merger, SK’s stake in SK Innovation increased from 36.2% to 55.9%. SK Innovation has resolved to pay a dividend of KRW 2,000 per common share for 2024, with a total dividend payout of KRW 297.6 billion. Accordingly, SK is expected to receive approximately KRW 166 billion in dividends. While this is a significant reduction compared to when it held E&S directly, it is not a complete loss. The dividend was paid in April and will be reflected in second-quarter earnings, not in the first quarter.

It is worth noting that SK Innovation’s dividend decision this time was an unusual move that broke with past principles. Although the company remained profitable in 2023, it resolved to pay a ‘zero dividend’ due to a sharp drop in earnings. However, despite recording a loss in 2024, it resumed dividend payments. After the merger with SK E&S, SK Innovation’s management pledged, “We will ensure a minimum dividend of KRW 2,000 going forward.”

An industry insider commented, “Transferring E&S to SK Innovation shows the holding company’s willingness to accept short-term losses to support SK On. In the long run, it depends on whether Innovation can realize its vision as a comprehensive energy company.”

Gwak Horyung (horr@fntimes.com)

![기관 '알테오젠'·외인 '삼천당제약'·개인 '에코프로비엠' 1위 [주간 코스닥 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021323061707087179ad43907118235313.jpg&nmt=18)

![기관 'SK하이닉스'·외인 '삼성전자'·개인 '한화에어로스페이스' 1위 [주간 코스피 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021322573704878179ad43907118235313.jpg&nmt=18)

![[부의 지도] 이상훈 에이비엘바이오 대표, 주식자산 569% '폭증'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021606565602265a837df6494123820583.jpg&nmt=18)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213084839016295e6e69892f222110224112.jpg&nmt=18)

![[DQN] 국민은행, 4년 만에 순익 1위했지만···진정한 '리딩뱅크' 되려면 [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021604342702655b4a7c6999c121131189150.jpg&nmt=18)

![24개월 최고 연 3.10%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085033090215e6e69892f222110224112.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085723019015e6e69892f222110224112.jpg&nmt=18)

![천상영 신한라이프 대표, 수익성 저하 불구 지주 기여도 1위…올해 손해율 관리·이익효율성 제고 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260103180551057718a55064dd122012615783.jpg&nmt=18)

![24개월 최고 연 3.25%…흥국저축은행 '정기예금(강남)'[이주의 저축은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021318581601639957e88cdd521123418838.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)