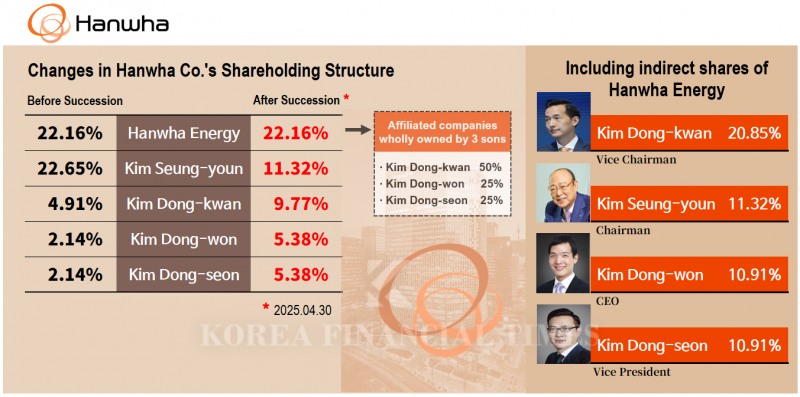

Hanwha Group has completed the third-generation succession. The group’s structure allows control over all affiliates by dominating Hanwha Corporation, the de facto holding company. This year, there have been changes in the shareholding structure of Hanwha Corporation.

In March, right after Hanwha Aerospace decided on a paid-in capital increase, Chairman Kim Seung-youn donated half of his Hanwha Corporation shares to his three sons (Dong-kwan, Dong-won, and Dong-seon). He transferred 4.86% to Vice Chairman Kim Dong-kwan and 3.23% each to President Kim Dong-won and Executive Vice President Kim Dong-seon.

As a result, the three brothers’ respective stakes in Hanwha Corporation rose to 9.77%, 5.38%, and 5.38%. Chairman Kim Seung-youn’s stake decreased to 11.32%.

Currently, the largest shareholder of Hanwha Corporation is Hanwha Energy (22.16%).

Hanwha Energy is 100% owned by the three brothers. The eldest, Vice Chairman Kim Dong-kwan, holds 50%, while President Kim Dong-won and Executive Vice President Kim Dong-seon each own 25%.

Calculating the indirect stake in Hanwha Corporation held through Hanwha Energy, Dong-kwan holds 11.08%, and Dong-won and Dong-seon each hold 5.54%.

Including these indirect holdings, Vice Chairman Kim Dong-kwan’s total stake rises to 20.85%, making him the largest shareholder of Hanwha Corporation. Dong-won and Dong-seon’s stakes each increase to 10.91%. In addition, Vice Chairman Kim Dong-kwan has received 770,992 Hanwha Corporation restricted stock units (RSUs), equivalent to about 1.03%, as performance bonuses from 2020 to the present. This is why it is considered that the third-generation succession has effectively been completed.

With this, Hanwha Group has become the only major conglomerate in Korea to have completed management succession to a 1980s-born heir. Vice Chairman Kim Dong-kwan was born in 1983 and is 42 years old this year.

Jeong Ki-sun, born in 1982 and known as a close friend in the business community, is still awaiting succession as Senior Vice Chairman of HD Hyundai. Lee Kyu-ho, Vice Chairman of Kolon Group, born in 1984, is also far from completing succession.

Shin Yoo-yeol, Executive Vice President of Lotte Group and eldest son of Chairman Shin Dong-bin, was born in 1986, but his stake in Lotte Holdings is only 0.02%.

The estimated gift tax the three brothers must pay due to this share transfer is around KRW 230.5 billion. Vice Chairman Kim Dong-kwan needs to raise about KRW 98.9 billion. Since the share transaction took place on April 30, the gift tax will be calculated based on the average share price for two months before and after the transaction date. While it should be calculated based on the average closing price from February 1 to June 30 this year, the calculation was made using the average closing price of KRW 54,742 from May 2 to May 30.

Vice Chairman Kim Dong-kwan can pay the gift tax in installments over up to six payments across five years. Each payment would be about KRW 16 billion to KRW 20 billion.

Last year, his total compensation was KRW 9.199 billion. He received KRW 3.083 billion from Hanwha Solutions and KRW 3.058 billion each from Hanwha Aerospace and Hanwha Corporation. His salary from Hanwha Ocean, where he serves as a non-executive director, was not disclosed as it was less than KRW 500 million.

The 2024 year-end dividend is estimated to be about KRW 2.9 billion. He received KRW 2.9 billion from Hanwha Corporation and KRW 15.96 million from Hanwha Aerospace. The total of his compensation and dividends is KRW 12.1 billion, but he is still short by KRW 4 billion to KRW 8 billion to cover the gift tax.

He may also take out additional stock-backed loans using his Hanwha Corporation shares as collateral. Currently, 1.3 million Hanwha Corporation shares are already pledged as collateral with Korea Securities Finance Corporation.

Since 2023, he has also deposited 343,000 shares inherited from his late mother, Seo Young-min, as tax collateral at the Jongno Tax Office.

He may also utilize his shares in Hanwha Energy, which is unlisted.

The investment banking industry values Hanwha Energy at KRW 4 trillion to KRW 5 trillion. If Vice Chairman Kim Dong-kwan uses his 50% stake as collateral, the value of his shares would be about KRW 2 trillion to KRW 2.5 trillion, which could also be used to secure loans.

Shin Haeju (hjs0509@fntimes.com)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![펩타이드 기술 강자 ‘이 회사', 비만·안질환까지 확장한다 [시크한 바이오]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821300702131dd55077bc221924192196.jpg&nmt=18)

![‘IB 명가' 재정비 시동…NH투자증권, 김형진·신재욱 카드 [빅10 증권사 IB 人사이드 (6)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603103406515dd55077bc221924192196.jpg&nmt=18)

![압도적 ‘양종희' vs 성장의 ‘진옥동' 밸류업 금융 선두 다툼 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603032808988dd55077bc221924192196.jpg&nmt=18)

![건강보험 손해율 악화·법인세 인상에 보험사 주춤…현대해상·한화생명 순익 반토막 [2025 금융사 실적 전망]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260219205719063188a55064dd1121160100217.jpg&nmt=18)

![‘재무통' 민왕일, 현대리바트 반등 승부수 던졌다[2026 새 판의 설계자들③]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821251308872dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)