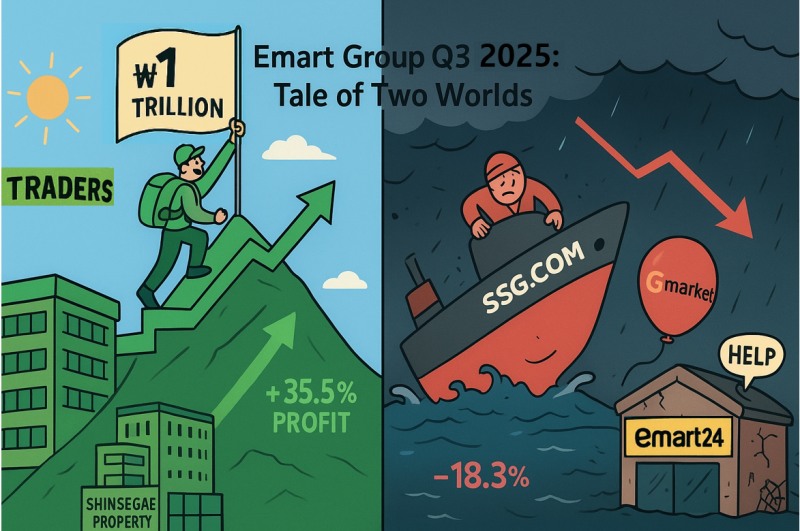

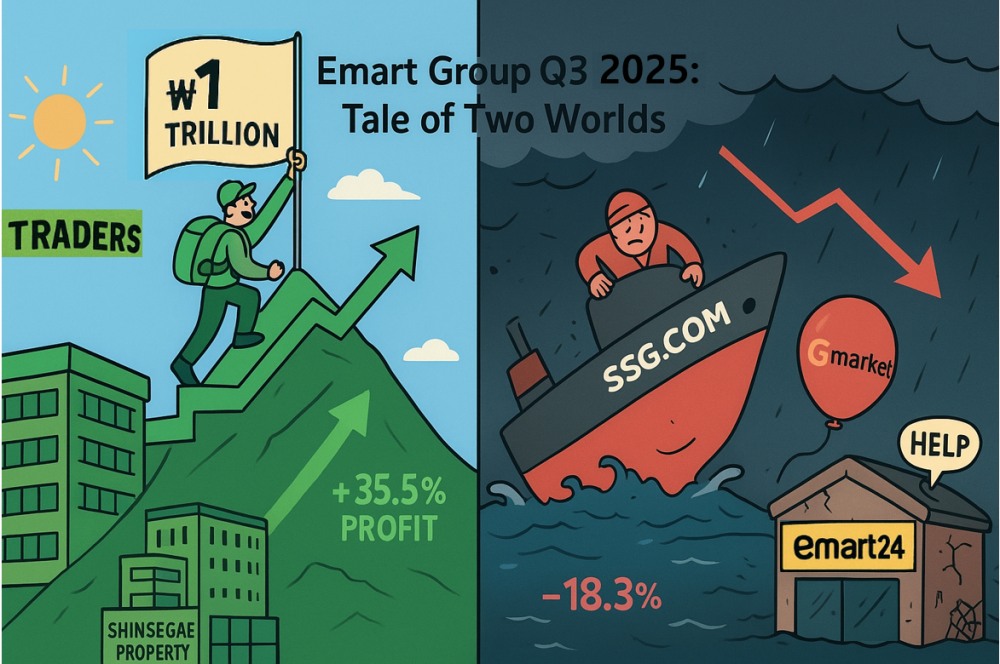

According to the Financial Supervisory Service's electronic disclosure system on November 11, Emart's consolidated revenue decreased 1.4% year-over-year to KRW 7.4008 trillion. However, with operating profit increasing, the company continued its earnings improvement trend following its return to profitability in Q2. Cumulative operating profit for the first three quarters reached KRW 332.4 billion, up 167.6% from KRW 124.2 billion in the same period of 2024.

On a separate basis (Emart, Traders, No Brand, Everyday), total sales in Q3 2025 decreased 1.7% year-over-year to KRW 4.5939 trillion, while operating profit fell 7.6% to KRW 113.5 billion. An Emart official said, "Despite temporary factors such as the timing difference of Chuseok, the profitability enhancement measures we have been pursuing continuously contributed to defending our performance."

By business division, discount stores (Emart) recorded total sales of KRW 2.9707 trillion in Q3 2025, down 3.4% year-over-year, with operating profit decreasing 21% to KRW 54.8 billion.

Traders broke through the milestone of KRW 1 trillion in quarterly total sales for the first time. Q3 total sales increased 3.6% year-over-year to KRW 1.0004 trillion, and operating profit rose 11.6% to KRW 39.5 billion. Traders has established itself as a core growth pillar driving Emart's profitability improvement with its steady growth momentum.

Notably, the Magok store (opened in February) and Guwol store (opened in September), both opened this year, achieved profitability from their first month and settled in successfully. This strengthened Traders' competitiveness along with external growth.

An Emart official commented, "The strategy centered on the private brand 'T Standard,' which combines differentiated products focused on bulk buying and value for money with global sourcing capabilities, led to enhanced core competitiveness and became Traders' distinctive strength even amid high inflation." In fact, T Standard's Q3 sales increased 25% compared to the same period last year.

Specialty stores (No Brand) recorded total sales of KRW 254.8 billion, down 2.9% year-over-year, with operating profit decreasing 25% to KRW 8.3 billion. SSM business Everyday's total sales decreased 0.6% year-over-year to KRW 367.8 billion, while operating profit increased 62% to KRW 10.2 billion.

Looking at major consolidated subsidiaries' performance, e-commerce divisions SSG.com and Gmarket, and convenience store Emart24 all recorded poor results this quarter.

SSG.com's net sales decreased 18.3% year-over-year to KRW 318.9 billion, with operating losses expanding by KRW 25.7 billion to KRW 42.2 billion. Gmarket also saw net sales decrease 17.1% year-over-year to KRW 187.1 billion, with operating losses expanding by KRW 6.4 billion to KRW 24.4 billion.

Emart24 recorded sales of KRW 552.1 billion, down 2.8% year-over-year, with operating losses expanding by KRW 7.7 billion to KRW 7.8 billion.

In contrast, Shinsegae Property, Shinsegae Food, and Chosun Hotel & Resort posted stable results. Shinsegae Property's net sales increased 46.8% year-over-year to KRW 114.6 billion, with operating profit rising by KRW 34.8 billion to KRW 39.5 billion. An Emart official explained, "We achieved solid results thanks to strong business performance centered on Starfield, which customers consistently visit, and participation in various development projects."

Shinsegae Food's net sales increased 1.4% year-over-year to KRW 390.8 billion, with operating profit rising by KRW 1.5 billion to KRW 10 billion. Chosun Hotel & Resort's revenue increased 12.7% to KRW 210.8 billion, with operating profit rising by KRW 2.6 billion to KRW 22 billion. The company showed stable growth momentum as operating profit expanded through improved occupancy rates and average room rates.

An Emart official stated, "Q3 results demonstrate that our core business competitiveness is strengthening without being shaken by external variables. We will continue our stable growth trajectory based on core business competitiveness while strengthening benefits that customers can feel, centered on the three pillars of price, products, and space."

Park seulgi (seulgi@fntimes.com)

![현직 복당설 속 전문성·공천 경쟁…용산구청장 선거 3大 변수 [6·3지방선거]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021317461705072b372994c951245313551.jpg&nmt=18)

![기관 'SK하이닉스'·외인 '삼성전자'·개인 '한화에어로스페이스' 1위 [주간 코스피 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021322573704878179ad43907118235313.jpg&nmt=18)

![기관 '알테오젠'·외인 '삼천당제약'·개인 '에코프로비엠' 1위 [주간 코스닥 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021323061707087179ad43907118235313.jpg&nmt=18)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213084839016295e6e69892f222110224112.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085723019015e6e69892f222110224112.jpg&nmt=18)

![천상영 신한라이프 대표, 수익성 저하 불구 지주 기여도 1위…올해 손해율 관리·이익효율성 제고 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260103180551057718a55064dd122012615783.jpg&nmt=18)

![24개월 최고 연 3.10%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085033090215e6e69892f222110224112.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)