This achievement by Hanwha Aerospace is no coincidence. It is the result of foreseeing that the deepening global security crisis would translate not just into massive orders but into profits.

Following the Russia-Ukraine war and Middle East conflicts, the expansion of global geopolitical risks since 2022 has led to a surge in global defense demand for ammunition and weapon systems. In this process, Hanwha Aerospace has consecutively secured high-profit, quality new orders for K9 and Chunmoo systems in Europe and the Middle East.

Over the past four years, Hanwha Aerospace's revenue has doubled and operating profit has expanded sixfold. However, despite continuous growth, the debt ratio appeared relatively high due to rapid short-term growth and accounting practices that record advances as liabilities. The standalone debt ratio was 132.58% in 2021 but rose to 393.10% in 2024.

Net debt surged from KRW 154.9 billion in 2021 to KRW 7,371.7 billion in 2024. This was influenced by the rapid increase in advances as the company secured orders worth KRW 31.4 trillion in the defense sector alone over a short period. Additionally, the company injected KRW 2 trillion into acquiring Hanwha Ocean shares and conducting a paid-in capital increase in 2023, and invested enormous funds in 2024, including contributing USD 500 million to Hanwha Future Proof and acquiring shares in Singapore-based marine equipment manufacturer Dyna-Mac.

Financial Distress Concerns Resolved in One Year

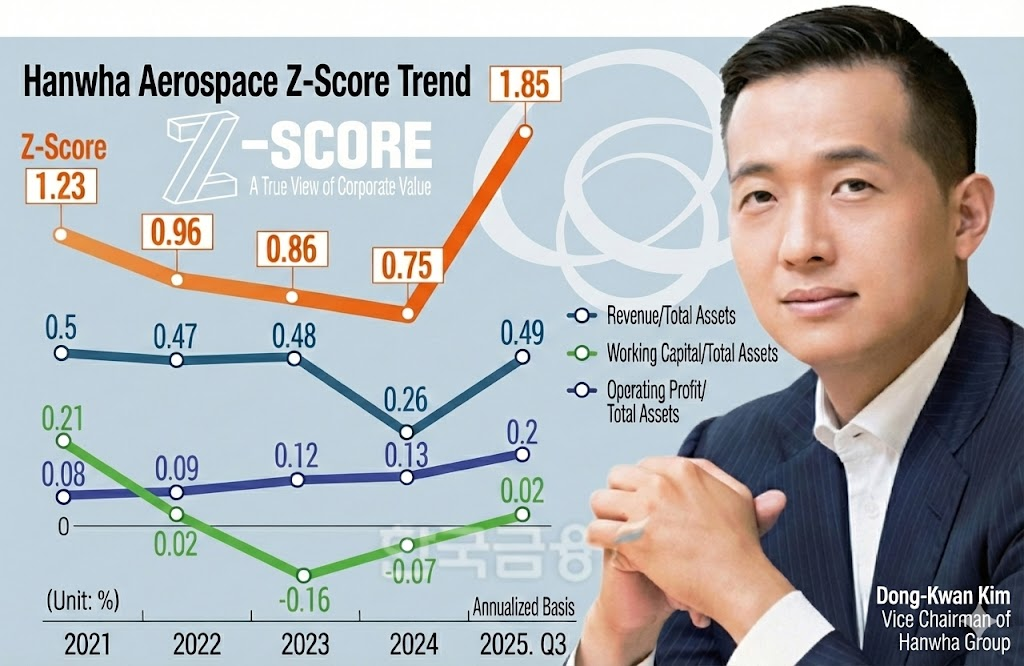

According to the Hanwha Aerospace Altman Z-Score confirmed by Korea Financial Times through artificial intelligence (AI) data platform DeepSearch, the score continuously declined: ▲1.23 in 2021 ▲0.96 in 2022 ▲0.86 in 2023 ▲0.75 in 2024.Then it surged to 1.85 on an annualized basis for the third quarter of 2025. Typically, a Z-Score below 1.8 is considered to indicate significant financial risk, but Hanwha Aerospace rebounded within a year and entered the safe zone.

"Revenue/Total Assets," which indicates a company's asset management capability and revenue generation power, fell from 0.50 in 2021 to 0.26 in 2024, but improved to 0.49 in the third quarter of last year. "Working Capital/Total Assets," which determines liquidity and asset management efficiency, also deteriorated from 0.21 in 2021 to -0.18 in 2023, but recovered to 0.02 in the third quarter of last year.

This improvement was driven by the record-breaking performance achieved last year. Hanwha Aerospace recorded cumulative revenue of KRW 18,281.7 billion and operating profit of KRW 2,281.7 billion through the third quarter of last year, achieving its highest-ever performance.

Additionally, the influx of approximately KRW 4 trillion through two paid-in capital increases conducted last year was decisive in resolving debt burdens.

Due to the nature of the defense market, once a country purchases a weapon system, the transaction is maintained for at least 30 years through long-term maintenance. Therefore, financial stability is considered important when evaluating the sustainability of defense product suppliers. Particularly, when intensive investment is needed, if the debt ratio rises quickly due to borrowing, it can be disadvantageous when competing with overseas defense companies such as those in Europe.

Hanwha Aerospace chose paid-in capital increases to secure financial soundness. It completed paid-in capital increases of KRW 1.3 trillion and KRW 2.9 trillion in April and July of last year, respectively. As a result, not only was the financial burden alleviated, but it became a decisive measure that enabled Hanwha Aerospace to emerge as a global defense company. Although there was significant criticism regarding shareholder value dilution when the paid-in capital increases were announced, the stock price has steadily risen since, with market capitalization once surpassing KRW 54 trillion.

Corporate Bond Demand Forecasting a 'Hit'… Market Confidence Rising

Recent market reactions toward Hanwha Aerospace have been even more enthusiastic. In the corporate bond demand forecasting conducted on the 7th, Hanwha Aerospace succeeded in attracting KRW 3.23 trillion, approximately 13 times more than the initially planned amount of KRW 250 billion. Accordingly, on the 15th, the company issued corporate bonds worth KRW 500 billion, twice the original planned amount.The market showed strengthening confidence as the "Market Capitalization/Total Debt" ratio, which looks at the debt ratio relative to corporate value, also rose. Hanwha Aerospace's corporate bond credit rating maintained 'AA- (stable)' since 2020, then was upgraded to 'AA- (positive)' in June of last year, and to 'AA (stable)' in November of the same year.

The profitability indicator "Operating Profit/Total Assets" also continuously improved: ▲0.08 in 2021 ▲0.09 in 2022 ▲0.12 in 2023 ▲0.13 in 2024 ▲0.20 in the third quarter of 2025.

The order backlog is also steadily increasing. It recorded KRW 19.9 trillion in 2022, KRW 27.9 trillion in 2023, KRW 32.4 trillion in 2024, and KRW 31 trillion in the third quarter of last year. The stock price, which was around KRW 34,000 in early 2020, recorded a closing price of KRW 1,255,000 on the 23rd. This represents a surge of 3,591.18% in six years.

Shin Haeju (hjs0509@fntimes.com)

![24개월 최고 연 5.15%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-1월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123173802029085e6e69892f121162063.jpg&nmt=18)

![한화에어로스페이스 6년새 주가 3500% 급등 ‘괴력’ [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012311224704807dd55077bc212411124362.jpg&nmt=18)

![[주간 보험 이슈] 예별손보 예비입찰에 2곳 이상 참여…예보 지원 여부가 매각 가늠좌 外](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250904161637023789efc5ce4ae12116082156.jpg&nmt=18)

![12개월 최고 연 3.20%…NH저축은행 'NH특판정기예금' [이주의 저축은행 예금금리-1월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123192428010886a663fbf34175192139202.jpg&nmt=18)

![[DCM] ‘빚 갚기’ 몰두한 롯데·CJ·한진…투자는 LG엔솔만 1조 넘었다 [2025 결산⑤]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012609350403962141825007d12411124362.jpg&nmt=18)

![기관 '레인보우로보틱스'·외인 '에코프로비엠'·개인 '알테오젠' 1위 [주간 코스닥 순매수- 2026년 1월19일~1월23일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012322245909782179ad439072211389183.jpg&nmt=18)

![12개월 최고 연 3.20%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-1월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123172457041555e6e69892f121162063.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)