(From left) Peter Thiel, Palantir co‑founder, and Alex Karp, Palantir CEO. / Photo credits: Peter Thiel Facebook, KT

이미지 확대보기A U.S. Defense-Recognized AI Data Company

Palantir is an artificial intelligence (AI)-based data analytics software company founded in 2003 by Peter Thiel, Alex Karp, and others. The company’s name was inspired by the “palantíri,” the far-seeing stones in J. R. R. Tolkien’s The Lord of the Rings.In the wake of the 9/11 attacks, amid heightened security concerns in the United States, the CIA’s venture capital arm In-Q-Tel invested USD 2 million in Palantir, after which U.S. government agencies such as the FBI, Department of Homeland Security, and the Marine Corps joined as clients.

Today, Palantir’s major customers reportedly include the U.S. Department of Defense (DoD), CIA, FBI, DHS, NSA, and FDA, as well as the U.K.’s Secret Intelligence Service (SIS), totaling 367 organizations.

Palantir has developed software that integrates and analyzes vast, dispersed data to identify threats in advance, applying it to national security. The company gained attention after it was revealed to have contributed to the May 2, 2011 operation in which U.S. special forces eliminated Osama bin Laden at a residence in Abbottabad, Pakistan. Palantir uncovered terrorist networks and hidden connections through intelligence collection and analysis. Its AI-enabled military-strategy technologies are currently used in war-torn countries such as Ukraine and Israel. The company has also reportedly contributed to crime pattern analysis for the Los Angeles Police Department and cyber fraud response at JPMorgan Chase.

Palantir founder Peter Thiel has made his political stance explicit, saying, “We support the prosperity and growth of the West. We will not sell our programs to adversaries such as China and Russia.”

“

We Endured Years of Ridicule” — Growth That Converted the Skeptics

On the 2nd (local time), Palantir closed at USD 157.09 (approximately KRW 219,298) on the Nasdaq Stock Market. Its initial reference price at the time of its Nasdaq listing on September 30, 2020, was USD 10.As Palantir has expanded its business from primarily government work into the private sector, its share price has more than doubled this year. Its current market capitalization stands at approximately USD 372.5 billion (about KRW 520 trillion), and the company continues to push ahead with research and development and global expansion on the back of robust capital strength.

Palantir recorded second-quarter revenue of USD 1.0 billion (approximately KRW 1.386 trillion) this year. The market had expected Palantir to reach the USD 1.0 billion quarterly revenue milestone in the fourth quarter, but analyses suggest that policy tailwinds from the Donald Trump administration pulled the timeline forward by two quarters.

Palantir is expected to continue posting steady revenue growth on the back of U.S. government contracts. According to the Washington Post on July 31 (local time), Palantir signed a major contract with the U.S. Army worth up to USD 10 billion (approximately KRW 14 trillion) over ten years.

Palantir CEO Alex Karp said in a letter to shareholders, “After years of investment and enduring ridicule, our business growth is now accelerating sharply; the skeptics have lost their power and capitulated.” He added, “The advent of large language models (LLMs), the chips that run them, and our software infrastructure are meshing to sustain a steep growth trajectory.”

Core Technology: A Data Analytics Platform Spanning Defense and the Private Sector

Palantir’s core software is Gotham. Gotham launched in 2008 for defense and intelligence agencies in collaboration with the CIA and designed to address post‑9/11 data-collection challenges. By visualizing maps, graphs and timelines, Gotham helps reveal hidden patterns and networks; it was cited in identifying bin Laden’s hideout and has been applied in the Russia–Ukraine war.The software that propelled Palantir’s explosive growth is Ontology. Ontology goes beyond analysis to model the meaning and relationships of discrete data—integrating heterogeneous sources such as spreadsheets, PDFs and images into a single schema to accelerate decision-making. One cited case: AT&T reportedly compressed a new-line installation project from about five years to three months using this approach.

To expand from a government-centric platform into one for private, Palantir introduced Foundry. The platform is used by hundreds of companies—including Morgan Stanley, Merck and Airbus—across sectors such as energy, aviation, shipbuilding and manufacturing. Revenue growth has been steeper in the commercial segment than in the government segment, and global commercial revenue has increased by more than 50% in just one year.

Why Is It Drawing Attention in Korea?

In the 21st century, the national security paradigm is rapidly shifting from hardware-centric approaches to software, data, and AI. In the defense industry, competitiveness is increasingly seen as hinging on software-based operating systems that fuse data and support AI-driven decision-making rather than on platform manufacturing capabilities alone.In Korea as well, the importance of AI and data is growing. Recently, in response to intensifying global AI competition, the Lee Jae-myung administration established a presidential committee to oversee national AI policy.

Domestic information technology (IT) companies are racing to secure proprietary datasets. Their goal is to enhance corporate competitiveness by building AI capabilities on top of the data they have secured.

To achieve these goals, building AI infrastructure is foundational, and there are signs of companies moving in step with Palantir’s capabilities, which specialize in AI-based data analytics.

Palantir has noted that Korea’s AI market is growing rapidly and that there is strong demand for AI and data analytics solutions across a variety of sectors, including manufacturing, finance, and defense.

In particular, while Korea has strengths in semiconductors and 5G, its AI ecosystem is still in a developmental stage. Palantir is therefore pursuing a strategy of providing customized AI solutions and leading AI innovation through partnerships with local companies.

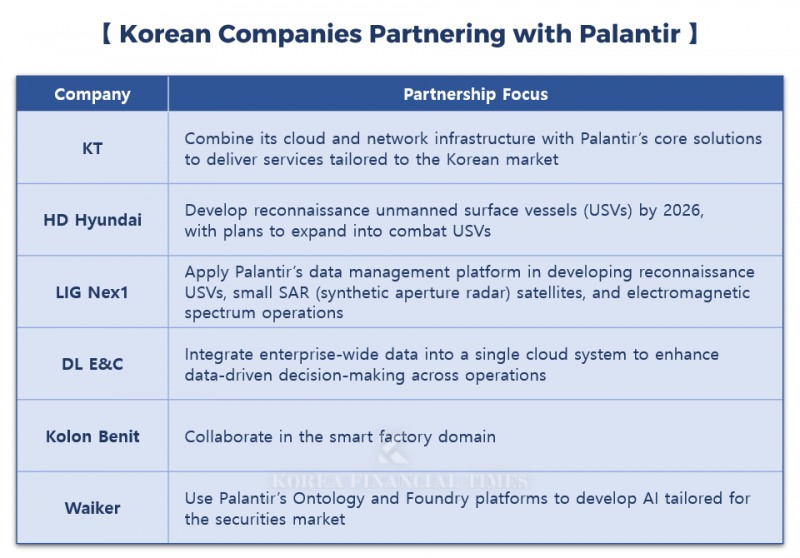

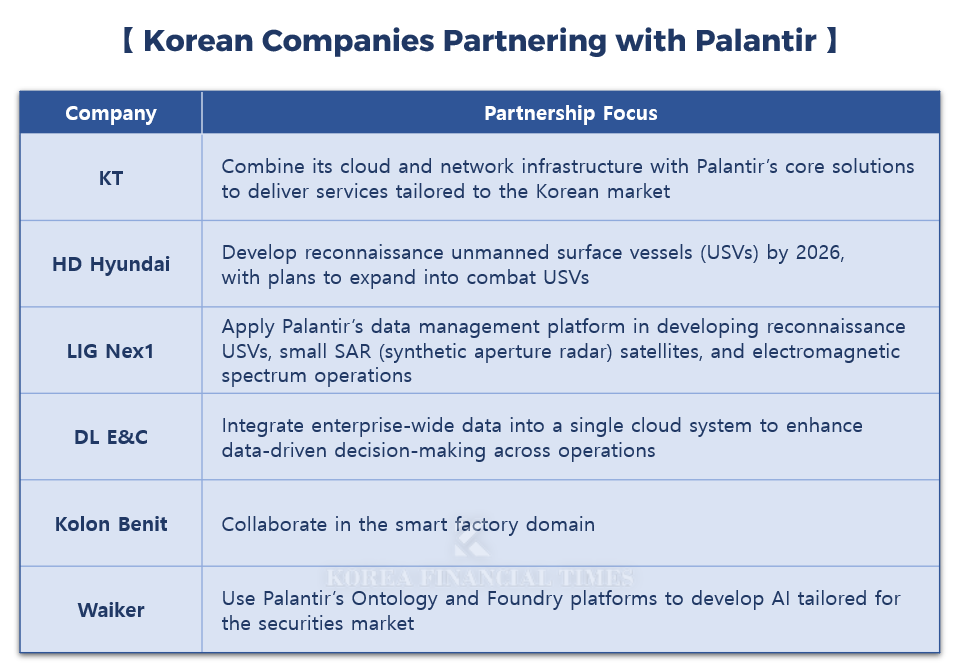

For example, KT, HD Hyundai, LIG Nex1, DL E&C, Kolon Benit, and the AI startup Waiker have each signed technology collaboration partnerships with Palantir.

In March, KT became Palantir’s first premium partner in Korea. KT plans to combine its cloud and network infrastructure with Palantir’s core solutions to provide services optimized for the Korean market.

Earlier, in April last year, HD Hyundai signed a memorandum of understanding with Palantir to develop an unmanned surface vessel (USV). The two companies plan to develop a reconnaissance USV capable of leading the global market by 2026 and subsequently expand development to combat USVs.

LIG Nex1 also signed an agreement with Palantir to utilize a big-data platform for future weapon systems in August last year. LIG Nex1 plans to apply Palantir’s data management platform to the development of reconnaissance USVs, small synthetic aperture radar (SAR) satellites, mine countermeasures, and electromagnetic spectrum operations (EMSO).

In 2022, DL E&C became the first in the construction industry to partner with Palantir to build “D-Lake,” a big-data-driven management platform. Through this system, the company integrates enterprise-wide data in a single cloud and aims to advance data-driven decision-making across all functions, including customer, product, design, construction, quality, and safety.

In addition, in November last year, Kolon Benit, the IT services arm of Kolon Group, signed a partnership with Palantir for collaboration in the smart factory domain. Last month, Waiker, a company specializing in AI application model development, began developing AI tailored to the securities market using Palantir’s Ontology and Foundry platforms.

An industry official said, “The reason Korean companies are partnering with Palantir is that customized AI data analytics and decision-automation capabilities are essential to digital transformation and enhanced competitiveness in Korea’s industries,” adding, “These are strategic choices aimed at achieving both business expansion and technological advancement in the domestic AI market.”

Jeong Chaeyun (chaeyun@fntimes.com)

![[DCM] JTBC · HL D&I 7%대...재무 취약기업 조달비용 급등 [2025 결산⑥]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013013251003407141825007d12411124362.jpg&nmt=18)

![NH투자증권, 순이익 '1조 클럽' 기록…윤병운 대표 "전 사업부문 경쟁력 강화" [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025021021370308671179ad439072211389183.jpg&nmt=18)

![다올투자증권, 연간 흑자 달성 성공…황준호 대표 실적 안정화 견인 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025081416515608997179ad439072111812010.jpg&nmt=18)

![[DCM] 이랜드월드, KB증권 미매각 눈물…NH증권이 닦았다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013006550302626a837df6494123820583.jpg&nmt=18)

![삼성생명 유배당 보험계약 부채 0원 두고 설왕설래…2025년 공시 촉각 [삼성생명 일탈회계 원복]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260129224736064028a55064dd118222261122.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)