HD Hyundai plans to issue a total of KRW 150 billion in corporate bonds on the 16th. The bonds will consist of KRW 70 billion with a three-year maturity, KRW 70 billion with a five-year maturity, and KRW 10 billion with a seven-year maturity. All proceeds will be used for debt repayment. If the demand forecast on the day is successful, the issuance can be increased up to KRW 180 billion.

This is the second corporate bond issuance this year. Previously, in February, HD Hyundai issued bonds worth KRW 300 billion. Although the company initially aimed to raise KRW 150 billion, the demand forecast attracted funds amounting to ten times the target, resulting in a doubling of the initial public offering amount.

At that time, the company issued bonds with a spread of about 27 basis points (bp) over government bonds, allowing it to raise funds at a relatively low interest rate.

Currently, HD Hyundai’s corporate bond credit rating is ‘A+ (Stable)’. It received A+ ratings from the three major domestic credit rating agencies: Korea Ratings, Korea Investors Service, and NICE Investors Service. All maintained the regular evaluation rating received in February this year.

HD Hyundai is the pure holding company of the group, generating revenue through dividend income from affiliates, rental income from the Global Research and Development Center (GRC), and trademark income. As of the first quarter, on an individual basis, cash and cash equivalents amounted to KRW 38.3 billion, and short-term borrowings stood at KRW 1.1649 trillion.

Park Hyun-jun, chief researcher at NICE Investors Service, stated, “It is expected that the company can smoothly respond to ordinary funding needs by utilizing rental and trademark income,” and assessed that “the company’s short-term liquidity risk is very low.”

Recently, HD Hyundai announced plans to merge HD Hyundai Construction Equipment and HD Hyundai InfraCore to launch ‘HD Construction Equipment,’ which is likely to have a positive impact on HD Hyundai’s profitability improvement.

In the past, HD Hyundai acquired Doosan InfraCore (now HD Hyundai InfraCore) from Doosan Heavy Industries & Construction (now Doosan Enerbility), maintaining a structure with two listed companies operating construction equipment businesses within the group.

Through an integrated corporation worth KRW 8 trillion, the company can resolve business overlaps and simplify the governance structure, leading to strengthened competitiveness in the construction equipment sector and cost reduction effects.

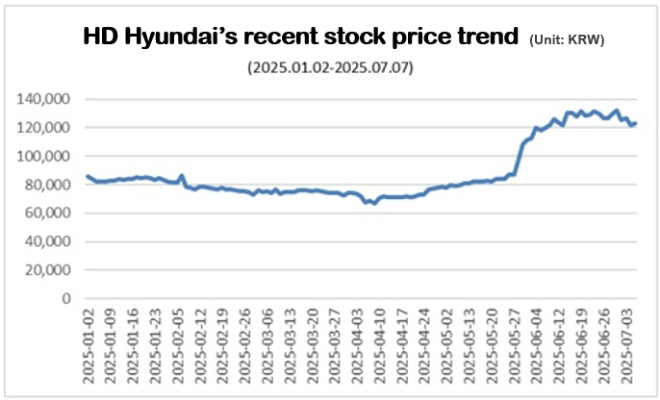

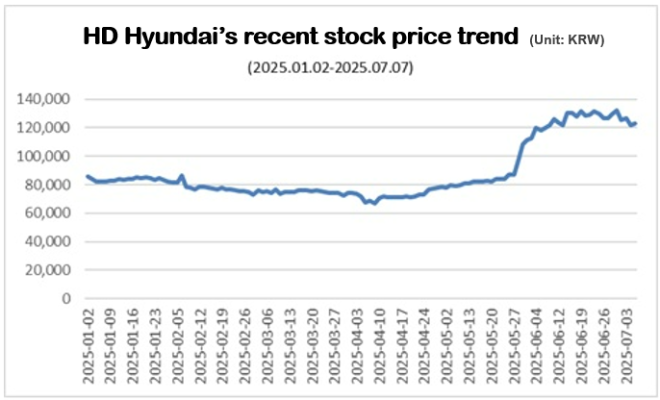

Recently, NICE Investors Service forecasted that the impact of this merger on the credit ratings of both companies would be limited and that business stability would improve. Following the announcement of the merger plan on the 1st, HD Hyundai’s stock price reached a new high for the year at KRW 132,400, and closed at KRW 134,300 on the 8th.

Shin Haeju (hjs0509@fntimes.com)

![[DCM] JTBC · HL D&I 7%대...재무 취약기업 조달비용 급등 [2025 결산⑥]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013013251003407141825007d12411124362.jpg&nmt=18)

![NH투자증권, 순이익 '1조 클럽' 기록…윤병운 대표 "전 사업부문 경쟁력 강화" [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025021021370308671179ad439072211389183.jpg&nmt=18)

![다올투자증권, 연간 흑자 달성 성공…황준호 대표 실적 안정화 견인 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025081416515608997179ad439072111812010.jpg&nmt=18)

![[DCM] 이랜드월드, KB증권 미매각 눈물…NH증권이 닦았다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013006550302626a837df6494123820583.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)