APLP had secured a 5.02% stake in LIG Nex1 in September 2024, but after repeated buying and selling, they reduced their stake to 3.89% by late November. However, they have resumed additional purchases this year.

Regarding this, APLP has stated that their investment purpose in LIG Nex1 is "simple investment." Currently, LIG Nex1 is the only company APLP has invested in on the domestic securities market.

Some in the business community are suggesting the possibility of APLP making a shareholder proposal at the upcoming LIG Nex1 shareholders' meeting on the 31st, citing past cases of active management intervention in companies where they held stakes.

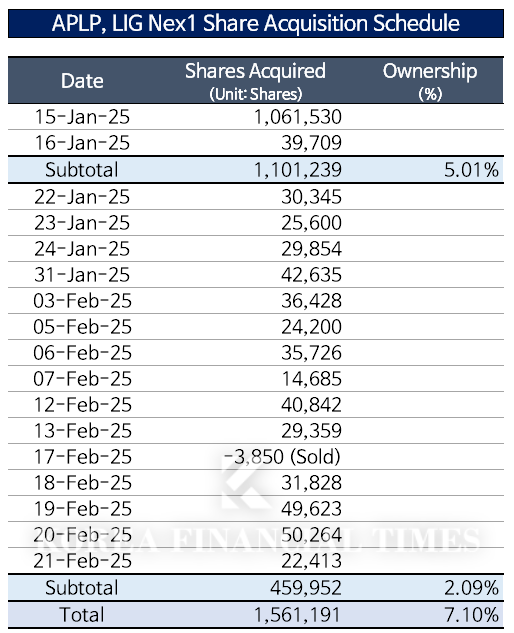

APLP recently increased their stake in LIG Nex1 from 5.01% to 7.10%. From January 22 to February 21, they conducted a total of 15 share transactions, purchasing a total of 2.09% stake in the market, except for one instance. On February 17, they sold 3,850 shares. With this, they surpassed the previous 4th largest shareholder, the Government of Singapore, and are now only 0.28% behind the 3rd largest shareholder, GIC Private Limited.

According to Article 147 of the Capital Markets Act, holding 5% or more of a listed company's shares classifies one as a "major shareholder." APLP became a major shareholder of LIG Nex1 shares from January this year. On January 15, APLP purchased 1,061,530 shares of LIG Nex1, and the next day, on the 16th, they additionally purchased 39,709 shares, exceeding the 5% stake.

Source=Financial Supervisory Electronic Service Disclosure System

Generally, a limited partnership means providing investment without participating in management activities. Simple investment also implies no intention to influence management rights, with the main purpose being simple voting rights exercise and profit realization.

However, in the case of APLP, as a shareholder of Seven & i Holdings, the holding company of the convenience store chain 7-Eleven in Japan, they urged Seven & i Holdings to actively participate in acquisition negotiations proposed by the Canadian retailer Alimentation Couche-Tard (ACT), judging that Seven & i Holdings' restructuring plan to sell its supermarket business was insufficient.

Currently, the agenda for the LIG Nex1 shareholders' meeting includes the re-appointment of three existing outside directors and the appointment of one new outside director.

There is also an agenda to change the business purpose. They plan to delete the role as a "general partner (GP) of an institutional private equity fund" and add "processing, assembly, regeneration, modification, maintenance, and improvement" to the existing "manufacturing and sales of communication, electronic, electrical, mechanical equipment for ships and naval vessels" to specify the maintenance, repair, and overhaul (MRO) business.

A LIG Nex1 official said, "It is difficult to disclose the shareholder letters submitted to this shareholders' meeting."

Shin Haeju (hjs0509@fntimes.com)

![[부의 지도] 이상훈 에이비엘바이오 대표, 주식자산 569% '폭증'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021606565602265a837df6494123820583.jpg&nmt=18)

![[DQN] 국민은행, 4년 만에 순익 1위했지만···진정한 '리딩뱅크' 되려면 [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021604342702655b4a7c6999c121131189150.jpg&nmt=18)

![최우형號 케이뱅크, IPO 이후가 본 게임…기업금융 승부수 통할까 [금융사 2026 상반기 경영전략]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260211150253032195e6e69892f5910240225.jpg&nmt=18)

![12개월 최고 연 5.0%…세람저축은행 '펫밀리 정기적금'[이주의 저축은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021319014404723957e88cdd521123418838.jpg&nmt=18)

![[DCM] LG 3.61%로 조달금리 가장 높아…한화와 25bp 差 [1월 리뷰②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021601593602809141825007d122461258.jpg&nmt=18)

![30조 엔의 예산, 1.8조 엔의 시늉: ‘호송선단 방식’에 가로막힌 미완의 위기 대응 [김성민의 일본 위기 딥리뷰]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031321473103554c1c16452b012411124362.jpg&nmt=18)

![올해 초등학교 입학하는 자녀 독감·교통사고 걱정된다면…응급실비용 보장하는 자녀보험 [금융상품 돋보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260217134024096308a55064dd11251906169.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)