For now, the domestic industry views it positively that the government has explicitly raised the need for petrochemical restructuring. Still, there is skepticism about whether the plan will actually accelerate company-led self-help measures.

Companies have already been suspending NCC operations since two to three years ago, making it hard to call the plan “game-changing.” Complicating matters, Korea’s large-scale petrochemical complexes are often operated through joint ventures with entangled interests, which makes crafting solutions even harder.

Joint ventures that posed no issues in boom times, now in trouble during the downturn…

In the Yeosu Industrial Complex in South Jeolla Province, all three of Korea’s major NCC operators—LG Chem, Lotte Chemical, and Yeochun NCC—are clustered together. It is the largest petrochemical complex in the country, with facilities capable of producing 6.27 million tons of ethylene, or 49% of national capacity.The biggest operator in the complex is Yeochun NCC, with production capacity of 2.29 million tons of ethylene and 1.29 million tons of propylene. The company’s recent cash crunch has pushed it to the brink of default, heightening tensions across the industry.

The crisis at Yeochun NCC surfaced as its two 50–50 major shareholders, Hanwha Solutions and DL Chemical, clashed.

Yeochun NCC has posted losses for 15 consecutive quarters from Q4 2021 through Q2 2025. Its cash reserves were effectively depleted by 2023. As its debt-to-equity ratio surged to 330% at the end of last year, it asked Hanwha and DL for support, and in March this year each injected 100 billion won via a paid-in capital increase.

However, when Yeochun NCC requested an additional 150 billion won each (300 billion won in total) in June, the dispute between the major shareholders escalated.

Hanwha approved a loan, but DL expressed opposition to further funding. DL Chairman Lee Hae-wook was quoted late last month as saying, “We can’t put money into a company for which there is no answer even if it falls into default.”

DL reversed course two weeks later and decided to extend additional loans, but industry watchers say the embers of conflict remain. The two groups are trading sharp barbs over Yeochun NCC’s feedstock supply contract. An industry insider said, “Providing loans instead of a capital increase is only a stopgap,” adding, “With little expectation of a cyclical upturn, the crisis is likely to persist.”

Yeochun NCC is thus being cited as a case that lays bare the limits of joint ventures.

In particular, critics say excessive dividends and aggressive investments during the boom years exacerbated its financial woes. According to Korea Ratings, Yeochun NCC paid out a total of 2.07 trillion won in dividends over five years from 2017 to 2021. In 2019, it also approved roughly 900 billion won in new investments, further adding to financial burdens.

Will Lotte and HD Hyundai pick up the pace on restructuring?

In the Daesan Industrial Complex in South Chungcheong Province, Lotte Chemical and HD Hyundai Oilbank are in talks to consolidate NCC operations. One option under discussion is for Lotte Chemical to transfer its facilities to HD Hyundai, with HD Hyundai making additional contributions in cash or in kind.Observers say Lotte and HD Hyundai have interests that are relatively aligned. As a refiner, HD Hyundai Oilbank can create additional value by channeling naphtha generated from crude refining into its own NCC. The two already operate an NCC joint venture, HD Hyundai Chemical, launched in 2014, in which HD Hyundai Oilbank and Lotte Chemical hold 60% and 40%, respectively.

Lotte Chemical, now in its third straight year of losses, has been executing an asset-light strategy since last year. Core divestment targets include its basic chemicals segment, including NCCs. The company aims to reduce the share of basic chemicals from around 70% to below 30% by 2030.

When Lotte Chemical faced a liquidity squeeze last year, Lotte Group stepped in directly, even pledging Lotte World Tower as collateral—underscoring the urgency of stabilizing finances.

Neither HD Hyundai nor Lotte Chemical denies that consolidation talks are underway. In its earnings call on the 31st of last month, HD Hyundai said, “We are reviewing various options for integrating facilities with Lotte Chemical.”

Lotte Chemical added on the 8th of this month, “As a rule, NCC integrations can deliver meaningful cash flow improvements.”

Will the 9-trillion-won Shaheen Project turn into a time bomb?

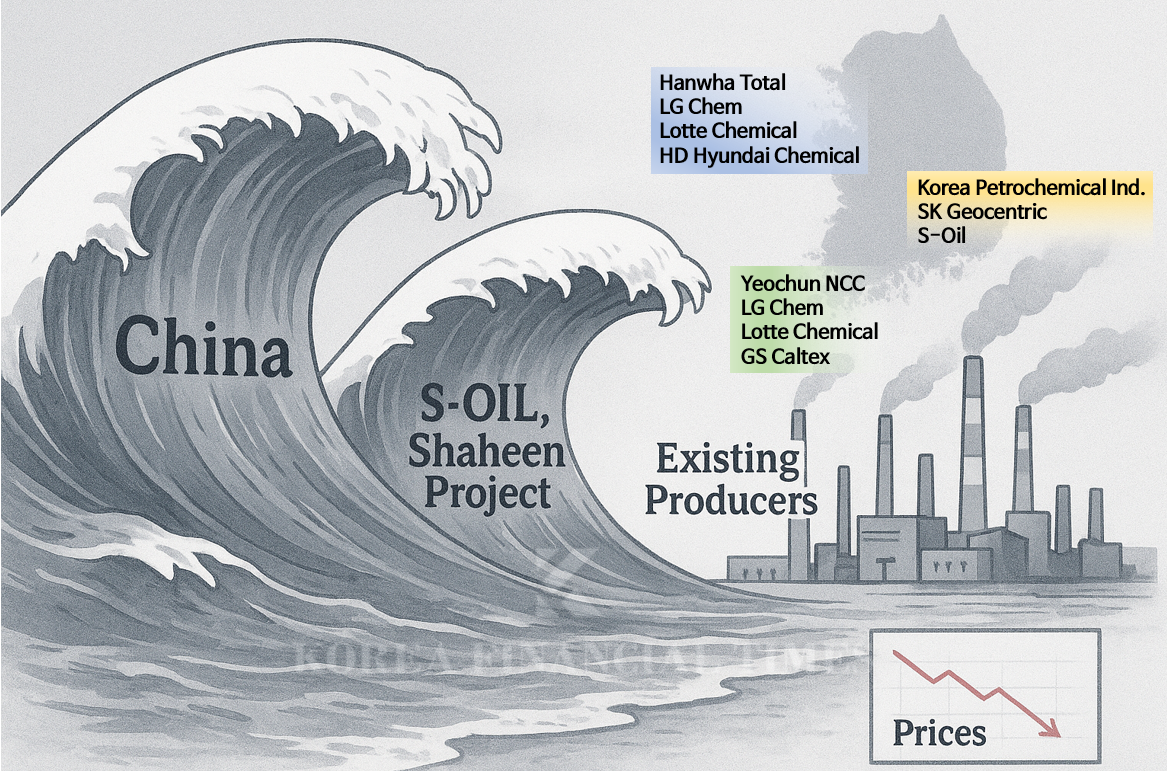

In the Ulsan Industrial Complex, SK Geocentric, an affiliate of SK Innovation, and Korea Petrochemical Ind. are exploring survival options. Since last year, the SK side has proposed scenarios including an absorption-type merger and integrated operation of facilities, but no definitive conclusion has been reached.A mega-project now underway in Ulsan could push Korea’s petrochemical industry to the edge in one stroke. S-OIL, together with its major shareholder Saudi Aramco, is investing 9 trillion won to build an integrated refining–petrochemical complex known as the “Shaheen Project.”

Slated for completion next year, the Shaheen Project will add 1.8 million tons of ethylene capacity—larger than the combined capacity of Korea Petrochemical Ind. (900,000 tons) and SK Geocentric (660,000 tons).

S-OIL chose greenfield investment rather than acquiring existing domestic assets to introduce new technology.

Whereas conventional NCCs produce chemical products using byproducts from crude refining, the S-OIL project will adopt technology to convert crude directly into petrochemical feedstocks (TC2C). Based on Aramco’s proprietary technology, it is said to achieve more than three times the feedstock yield of conventional setups.

The concern is that once the Shaheen Project goes into full operation, oversupply across the domestic petrochemical industry could become even more acute. An industry official emphasized, “With the added edge of Aramco’s crude cost competitiveness, S-OIL will enjoy a clear competitive advantage over existing players.”

Indeed, the industry views the Shaheen Project with apprehension. While ten major petrochemical companies have agreed—under a government-supported initiative—to reduce ethylene output by up to 3.7 million tons, S-OIL plans to add capacity equivalent to 1.8 million tons.

With global supply already outstripping demand due to China-driven capacity buildouts, a further influx of domestic volumes would likely intensify downward price pressure and increase the operating burden on existing producers.

Gwak Horyung (horr@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)