Photo=S-Oil Mapo Office Building

According to the investment banking (IB) industry on the 24th, S-OIL is conducting a demand forecast for the issuance of public corporate bonds worth 350 billion KRW. The bond maturities are structured as follows: 3-year (200 billion KRW), 5-year (70 billion KRW), 7-year (30 billion KRW), and 10-year (50 billion KRW).

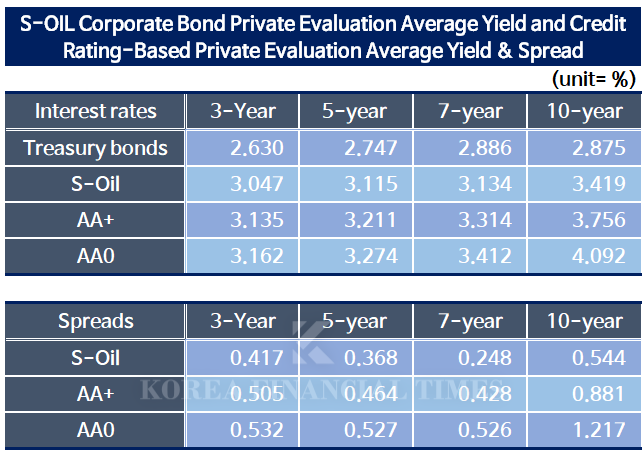

The company has proposed an interest rate band of -30 to +30 basis points (bp) relative to the average private bond evaluation yield for each maturity. Depending on demand forecast results, the issuance size may increase to a maximum of 440 billion KRW. The funds raised will be used entirely for debt repayment.

The joint bookrunners include Samsung Securities, NH Investment & Securities, Shinhan Investment, KB Securities, and Mirae Asset Securities. Daishin Securities, Hana Securities, and iM Securities are participating in underwriting.

S-OIL’s credit rating is AA+ according to Korea Investors Service (KIS), while Korea Ratings (KR) and NICE Investors Service rate it at AA0. However, both KR and NICE have assigned a “Positive” outlook, suggesting a likely upgrade to AA+.

Currently, S-OIL’s private bond evaluation yield for each maturity is lower than the AA+ average yield, indicating that its credit profile is stronger than AA0-rated bonds used for comparison.

For the 10-year bond, the AA+ credit spread (credit yield minus government bond yield) stands at 88bp, while S-OIL’s private bond evaluation yield spread is 54bp. The AA0 credit spread is significantly higher at 122bp.

Source=Financial Investment Association

The government bond yield currently shows a 10-year yield of 2.875%, which is lower than the 7-year yield (2.886%). Typically, longer-term yields are higher, but long-term rates often align with economic growth forecasts. This suggests market concerns about a potential slowdown in Korea’s economic growth.

In such periods, corporate bond issuance can become more challenging, as funds tend to flow into government bonds or high-credit corporate bonds. Even high-rated companies may find it difficult to issue long-term bonds in large amounts.

S-OIL’s bond yield levels indicate that it is among the highest-rated AA+ issuers. However, unlike government bonds, its 10-year bond yield is not lower than its 7-year bond yield. Looking at the credit spreads, they narrow progressively for the 3-year, 5-year, and 7-year bonds but widen significantly for the 10-year bond.

A higher credit spread for the 10-year bond may appeal to investors. Notably, no other domestic refining or petrochemical company issued a 10-year bond last year, nor has any done so this year prior to S-OIL’s issuance.

S-OIL’s Focus on Debt Management Amid Heavy Investment Burden

Another noteworthy aspect of S-OIL’s bond issuance is the size of the potential upscaling. Recently, companies have been able to increase their issuance volume by up to twice the initial demand forecast amount. However, S-OIL has set its maximum issuance size at 440 billion KRW, corresponding to the amount of its bonds maturing in March. If demand forecast results are unsatisfactory, the company plans to use its existing cash reserves to cover the remaining balance.This approach can be indirectly understood through credit rating agencies’ criteria for rating adjustments. While KR has assigned an AA+ rating, as of Q3 2023, S-OIL has met some conditions for a potential downgrade.

KIS and NICE have given a “Positive” outlook but have set downgrade triggers that could revert their ratings to “Stable.” This reflects the combination of increased debt due to large-scale investments (such as the Shaheen Project) and deteriorating profitability amid a downturn in the refining and petrochemical industries.

The “Shaheen Project” is part of a strategic initiative led by S-OIL’s largest shareholder, Saudi Aramco. In addition to issuing corporate bonds, S-OIL has been in ongoing discussions with Aramco and financial institutions regarding funding. However, the company appears to be maintaining a cautious stance on increasing its financial burden.

An IB industry insider commented, “S-OIL has historically had a lower credit spread compared to the average for its rating grade. While it has issued 10-year bonds since 2023, the issuance size has been gradually decreasing.” He added, “The longer the maturity, the higher the interest cost. Given the need to manage its debt scale, S-OIL is likely to remain cautious in significantly expanding its bond issuance.”

Lee Sungkyu (lsk0603@fntimes.com)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![펩타이드 기술 강자 ‘이 회사', 비만·안질환까지 확장한다 [시크한 바이오]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821300702131dd55077bc221924192196.jpg&nmt=18)

![‘IB 명가' 재정비 시동…NH투자증권, 김형진·신재욱 카드 [빅10 증권사 IB 人사이드 (6)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603103406515dd55077bc221924192196.jpg&nmt=18)

![압도적 ‘양종희' vs 성장의 ‘진옥동' 밸류업 금융 선두 다툼 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603032808988dd55077bc221924192196.jpg&nmt=18)

![리딩뱅크 승부처 기업금융…이환주 vs 정상혁, 정면승부 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603191602818dd55077bc221924192196.jpg&nmt=18)

![영업익 1조 눈앞 KB증권, 성장세 신한투자증권…"非은행 존재감 확대" [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603142504338dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)