(From left) Park Seung-deok, CEO of Hanwha Solutions, and Park Jong-hwan, CEO of HD Hyundai Energy Solutions. /Photo courtesy of each company

이미지 확대보기Despite both companies delivering strong performances in the solar energy business during the first half of this year, there are concerns that their paths may soon diverge sharply. As the nation’s leading solar firms, their business areas, outlooks, and potential for future policy benefits differ substantially, demanding close observation.

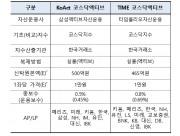

According to Korean Financial News’ analysis leveraging data from DeepSearch, the cumulative total shareholder return (TSR) of Hanwha Solutions and HD Hyundai Energy Solutions for the first half of 2025 has been calculated.

TSR measures the total return that shareholders can realize over a period, adding together share price appreciation and dividends, divided by the purchase price—a common indicator of both investment performance and shareholder rewards.

In the first half of this year, Hanwha Solutions posted a TSR of 98%, and HD Hyundai Energy Solutions 115%. An investor who put KRW10 million into either company on January 2 and held until June 30 would now have KRW19.8 million with Hanwha Solutions, and KRW21.5 million with HD Hyundai Energy Solutions.

HD Hyundai Energy Solutions achieved its 115% TSR exclusively through share price gains, as it hasn’t paid a dividend in the past two years since its 2022 year-end payout.

In contrast, Hanwha Solutions—despite recording a net loss of KRW1.369 trillion last year—distributed a year-end dividend of KRW300 per share and notched a 98% TSR through a 96% rise in share price and the dividend.

While such returns may stoke optimism around renewable energy, the outlooks for the two companies are split. One is positioned to bask in favorable solar market conditions in the latter half of the year, while the other may not be so fortunate.

Hanwha Solutions’ mainstay is the solar business, though it also encompasses chemical and construction units. Q CELLS (solar) accounts for 52% of revenue, whereas Chemicals—affected by an industry downturn—make up 35%, denting results recently.

Despite these headwinds, Hanwha Solutions delivered an operating profit exceeding KRW100 billion in the first half, turning around from a loss of over KRW300 billion last year. This was fueled by increased solar module sales and a narrowing deficit in the chemicals division.

However, during last month's Q2 earnings call, the company warned that its renewable energy business may swing to an operating loss in Q3.

Disruptions from cell quality issues at factories in Korea and Malaysia in June led to increased fixed costs, and the company foresees a Q3 operating loss in the low KRW100 billion range. However, A company spokesperson indicated the cell quality issue has been resolved, and exports to the US have normalized.

Uncertainty still lingers in Hanwha Solutions’ most important market—the United States—where fears persist that President Trump’s enactment of the “One Big Beautiful Bill Act (OBBBA)” could slow the residential energy market.

Nonetheless, the maintenance of the Advanced Manufacturing Production Credit (AMPC) and strengthened US restrictions on Chinese solar suppliers are expected to benefit Hanwha Solutions.

According to Samsung Securities analyst Cho Hyun-ryul, “Short-term earnings deterioration for Hanwha Solutions is inevitable, but after one-off factors in Q3 subside, a recovery is expected from Q4 onward.”

HD Hyundai Energy Solutions, which focuses on the domestic solar market, is considered comparatively stable.

A company representative said, “We expect new renewable energy policies under the new administration to kick off in earnest in the second half, supporting an even stronger performance than in H1.”

Kim Jin-hyung, analyst at DS Investment & Securities, forecasts, “HD Hyundai Energy Solutions is expected to post operating profits in excess of KRW10 billion in both Q3 and Q4. Rapidly rising solar demand in the US should also provide additional upside for the company.”

Shin Haeju (hjs0509@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)