While SK On has succeeded in raising funds through private placements, its financial instability continues to worsen. Adding to concerns, Chief Financial Officer Kim Kyung-hoon, a key figure behind the company’s investment strategy, is set to leave the company. In response, SK On plans to expand R&D investments and focus on securing orders in anticipation of a temporary downturn—or “chasm”—in the electric vehicle (EV) market.

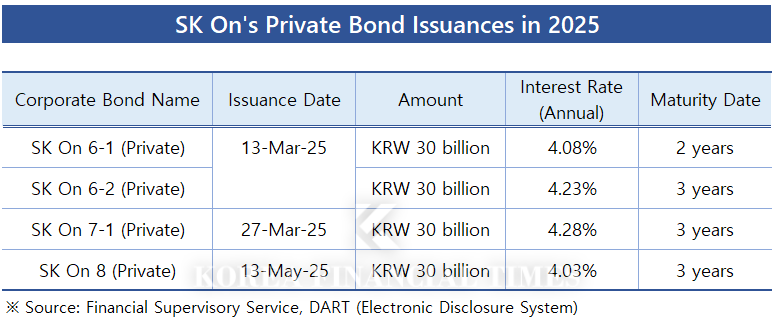

According to industry sources on May 27, SK On raised approximately KRW 120 billion this year through three separate private bond issuances for operating capital. Specifically, the company issued KRW 30 billion in three-year notes with a 4.03% annual interest rate on May 13 under the lead of Shinhan Investment Corp. Earlier, on March 27, it issued another KRW 30 billion in three-year notes at 4.28%, and on March 12, it secured KRW 60 billion in two tranches (KRW 30 billion each in two- and three-year notes) at 4.08% and 4.23%, respectively.

At the beginning of the year, SK On had sought a formal credit rating and explored the public bond market alongside other SK Group affiliates. However, due to a downturn in the secondary battery sector triggered by the EV “chasm,” and declining performance, the company ultimately veered away from a public offering.

Over the past three years, SK On has posted cumulative operating losses totaling approximately KRW 2.74 trillion. In the first quarter of this year, the company narrowed its losses compared to KRW 331.5 billion in the same period last year, but still recorded a KRW 163.2 billion operating loss.

As a result, the company turned to the private bond market, which allows for quicker issuance and poses less reputational risk compared to public offerings. However, private bonds typically carry higher interest rates and shorter maturities, meaning SK On may face increasing financial strain if its business performance does not improve.

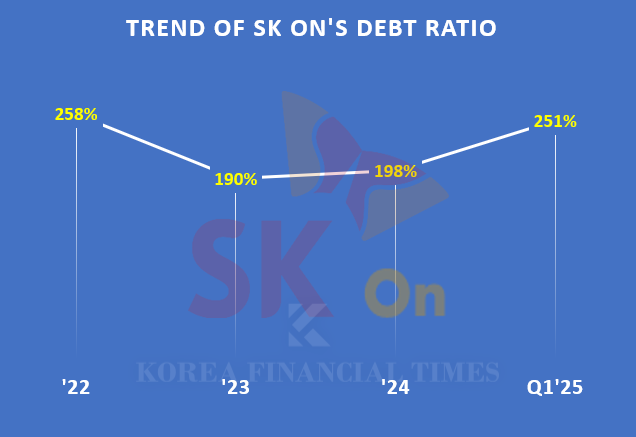

Actually, SK On’s debt ratio hit 258% in 2022, eased to 190% in 2023, but rose again to 198% in early 2024. In the first quarter of this year, the debt ratio further increased to 251%, surpassing the psychologically significant 200% threshold. Net debt, excluding cash-equivalent assets, also climbed from approximately KRW 16 trillion in 2022 to around KRW 20 trillion by the end of last year—highlighting the company’s growing reliance on borrowed capital.

Given these conditions, some securities analysts are warning of a potential credit rating downgrade. Korea Investors Service has flagged a net debt-to-EBITDA ratio exceeding 7x as a downgrade trigger. SK On has posted negative EBITDA since 2022, already satisfying this condition.

Compounding the challenge is the imminent departure of Vice President Kim Kyung-hoon, a key player in SK On’s financial strategy. A former executive at Lehman Brothers and other global investment firms, Kim helped SK On secure KRW 1.2 trillion in funding from an MBK Partners-led consortium in 2022, eventually driving investments totaling around KRW 5 trillion. He also played a critical role in SK On’s joint venture with Ford—BlueOval SK—securing a KRW 13 trillion loan from the U.S. government.

Source: SK On Business Report and others

SK On says it is committed to reversing its fortunes by investing in next-generation battery technology and ramping up order volumes. The company allocated KRW 77.6 billion to R&D in the first quarter of this year, a 10% increase compared to the same period last year. This investment is focused on securing a lead in all-solid-state battery technology.

SK On is currently developing two types of all-solid-state batteries—polymer-oxide composite-based and sulfide-based—targeting commercial production by 2028 and 2030, respectively.

CEO Lee Seok-hee stated, “The battery industry must prioritize R&D to deliver the technologies and products that customers demand,” adding, “We will not hesitate to invest in that.”

Recent increases in battery orders from the U.S. and Japan offer a positive outlook. SK On recently signed a contract with U.S. EV startup Slate Auto to supply 20 GWh of batteries from 2026 to 2031. Prior to that, the company inked a deal with Nissan to deliver 99.4 GWh of batteries from 2028 to 2033.

Additionally, its Kentucky plant, jointly built with Ford under the BlueOval SK partnership, and a Georgia-based facility under construction with Hyundai Motor Group, are both set to begin full-scale production in 2026.

Kim JaeHun (rlqm93@fntimes.com)

![‘리니지 제국'의 부진? 엔씨의 저력을 보여주마 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020123095403419dd55077bc211821821443.jpg&nmt=18)

![[DCM] 한화시스템, FCF 적자 불구 시장조달 자신감](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020204171101504a837df6494123820583.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)