SK Innovation announced that the proposal to approve the merger agreement with SK E&S at the extraordinary general meeting of shareholders on the 27th was passed by 85.75% of the shareholders present.

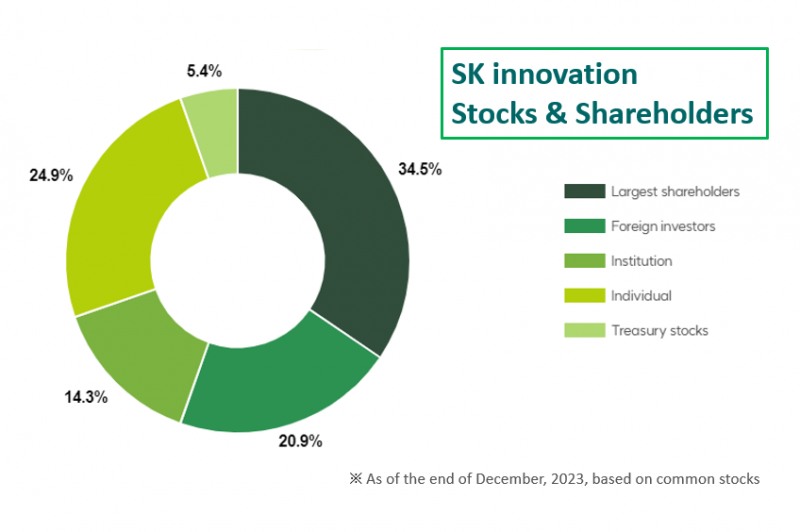

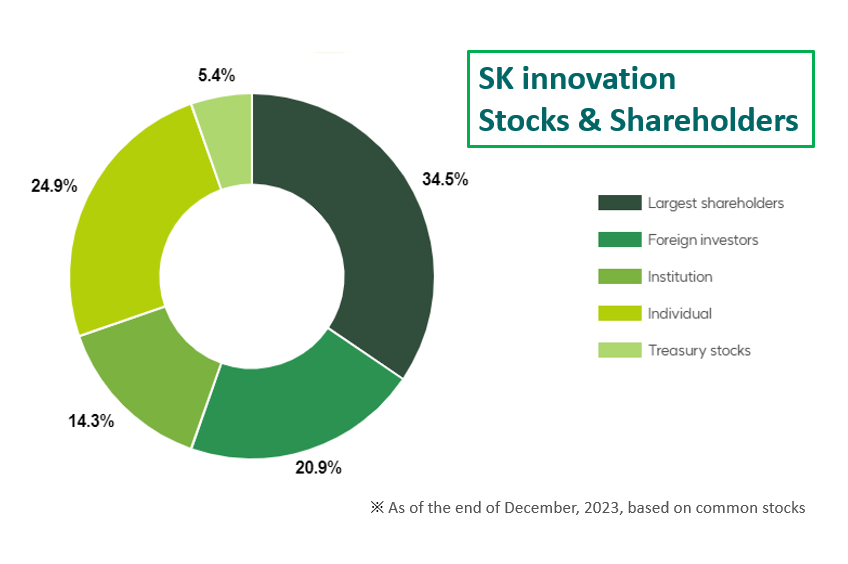

In particular, 95 percent of foreign shareholders attending the meeting voted in favor. Foreign investors account for about 21% of SK Innovation's total shares.

This can be explained by the fact that ISS and Glass Lewis, two of the world's largest proxy advisory firms, recommended in favor of the merger. Foreign investors tend to follow the opinions of these organizations.

ISS and Glass Lewis have recommended in favor of the merger because they believe that SK Innovation's management's reasons for the merger, such as financial stabilization and increasing future corporate value, are well-founded. They did not take issue with the “damage of shareholder value” due to the merger ratio set at the reference price, which was criticized by the National Pension Service and some minority shareholders.

Earlier, SK Innovation announced that the merger synergy effect will generate more than KRW 2.2 trillion in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) as of 2030. Based on this, SK Innovation President Park Sang-kyu stressed, "We will make a leap into a comprehensive energy company worth KRW 20 trillion in EBITDA in 2030."

SK Innovation's financial stabilization is repeatedly mentioned because of its battery subsidiary, SK On. While SK On is struggling with accumulating deficits due to large-scale investments and short-term business uncertainty due to the EV chasm, its parent company SK Innovation is also under financial pressure. SK E&S is one of the group's strongest privately held companies, with annual operating income of more than 1 trillion won.

The merger of the two companies is scheduled for Nov. 1. If successfully launched, the combined entity will be the largest private energy company in the Asia-Pacific region with assets of KRW 100 trillion and sales of KRW 88 trillion.

Even though the merger has passed the shareholders' meeting, SK is not completely at peace. The exercise of the stock purchase right scheduled until the 19th of next month remains. This is the right of shareholders to demand that the company buy their shares after the merger is approved. If the amount of the exercise exceeds the limit set by SK (800 billion won), the merger could be scuttled. Although it is considered unlikely, it is also in the spotlight whether the National Pension Service, which voted against the merger, will exercise its claim. The National Pension Service's stake in SK Innovation is valued at around 650 billion won. For SK Innovation's management, the challenge is to boost the stock price, which is below the amount of the claim exercise (111,943 won).

Apart from the SK Innovation-SK E&S merger, SK On is scheduled to merge with SK Trading International and SK Enterm. It is a measure to improve SK On's cash flow, but it is not a fundamental solution.

SK On raised funds through a pre-IPO and promised investors an IPO in 2026. At the time of listing, the company has a valuation target of 100 trillion won, three times its current valuation. To achieve the goal, the battery sector's sales performance itself will need to be boosted.

Gwak Horyung (horr@fntimes.com)

![서울 중구청장, 여야 모두 출마 러시…격전 예고 [6·3지방선거]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020909055800601b372994c951245313551.jpg&nmt=18)

![12개월 최고 연 3.20%…NH저축은행 'NH특판정기예금' [이주의 저축은행 예금금리-2월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260207205859051226a663fbf34175192139202.jpg&nmt=18)

![‘롤러코스터' 삼전닉스…‘방어주 매력' 따져보니 [정답은 TSR]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020723524103702dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)