Gwak Noh-Jung, CEO of SK hynix

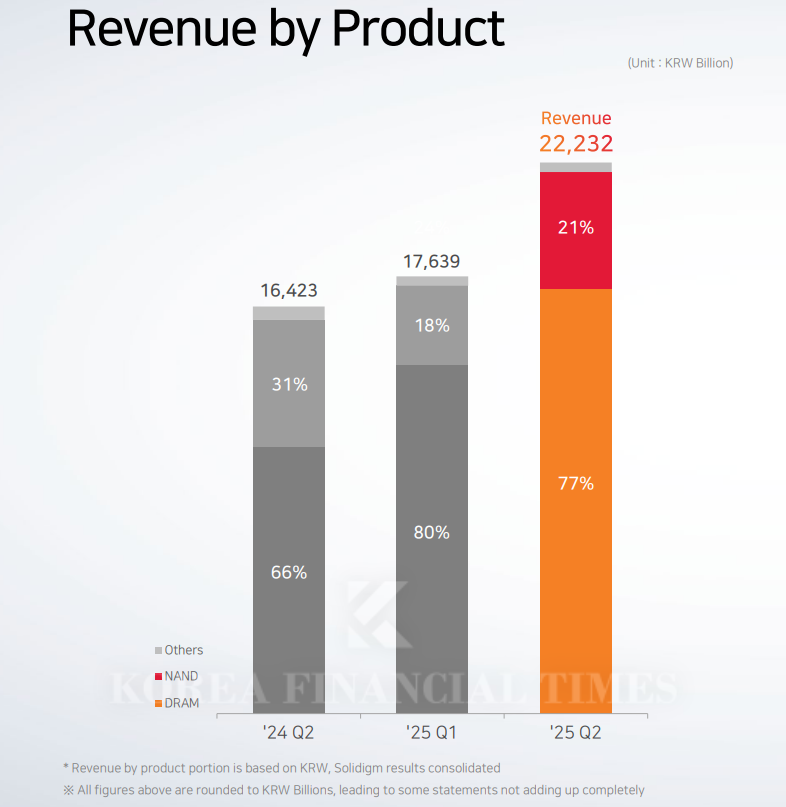

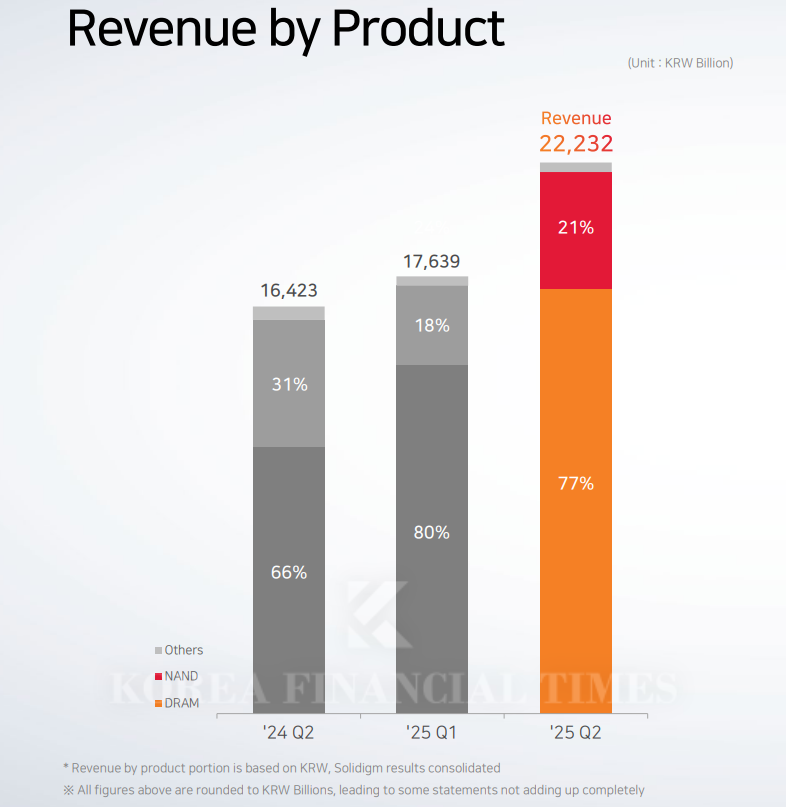

On July 24, SK hynix announced that it achieved revenue of KRW 22.232 trillion, operating profit of KRW 9.2129 trillion, and net income of KRW 6.9962 trillion in the second quarter of 2025. Both revenue and operating profit surpassed the company’s previous records set in the fourth quarter of 2024, and the operating margin reached 41%.

Compared to market expectations, operating profit met the heightened outlook after Micron’s results, while revenue exceeded market estimates by about 7%. SK hynix explained the revenue outperformance as being due to uncertainty over tariffs. Major customers purchasing semiconductors had initially planned to maintain more conservative inventory levels in response to concerns about weakening demand in the second half, but they changed their tactics to maintain adequate inventory in consideration of tariff risks.

This strong performance was again led by HBM, a memory semiconductor for artificial intelligence (AI). SK hynix stated, “As global big tech firms are actively investing in AI, demand is continuing to grow,” adding that it will maintain its plan to double year-on-year sales in the HBM sector.

SK hynix’s financial soundness has become even more solid as the company continues to post operating margins above 40%. At the end of the second quarter, cash and cash equivalents totaled KRW 16.96 trillion, marking an 75% increase from KRW 9.69 trillion a year earlier. During the same period, the net debt ratio dropped by 20 percentage points to 6%.

Market attention is now focused on next year’s outlook. U.S. investment bank Goldman Sachs downgraded its rating on SK hynix last week from “Buy” to “Neutral,” citing concerns that HBM prices could decline next year.

The next-generation HBM4, which SK hynix is set to launch in full scale in 2025, may face margin pressure. Competitive order bidding with Samsung Electronics and NVIDIA, as well as joint development efforts with TSMC, are expected to weigh on profitability.

At the earnings briefing, an SK hynix official said, “For HBM4, we will adopt a pricing policy that reflects increased costs. We will strive to sustain profitability while promoting further growth in the AI market.”

Gwak Horyung (horr@fntimes.com)

![[DCM] ‘미매각 악몽’ 이랜드월드, 재무 부담 가중…고금리 전략 ‘의문부호’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012909073902617a837df64942115218260.jpg&nmt=18)

![[DCM] 심상치 않은 증권채…속내는 ’진짜’ IB 출현 기대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012818485407194a837df6494123820583.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)