LS Electric will issue KRW 150 billion worth of corporate bonds on the 31st. The company plans to use 3-year bonds worth KRW 70 billion and 5-year bonds worth KRW 80 billion for debt repayment and raw material purchases respectively. Demand forecasting targeting institutional investors will be conducted on the 24th.

LS Electric disappeared from the public bond market after 1995, returning after 28 years in 2023. The company issued bonds once last year and issued KRW 210 billion worth of corporate bonds in February this year. Including this latest issuance, total bond issuance this year amounts to KRW 360 billion, the largest since resuming public offerings in 2023. The February issuance saw funds amounting to five times the offering amount pour in, marking a successful reception.

LS Electric's credit rating is 'AA- (positive)', with NICE Credit Rating and Korea Ratings Corporation maintaining existing ratings.

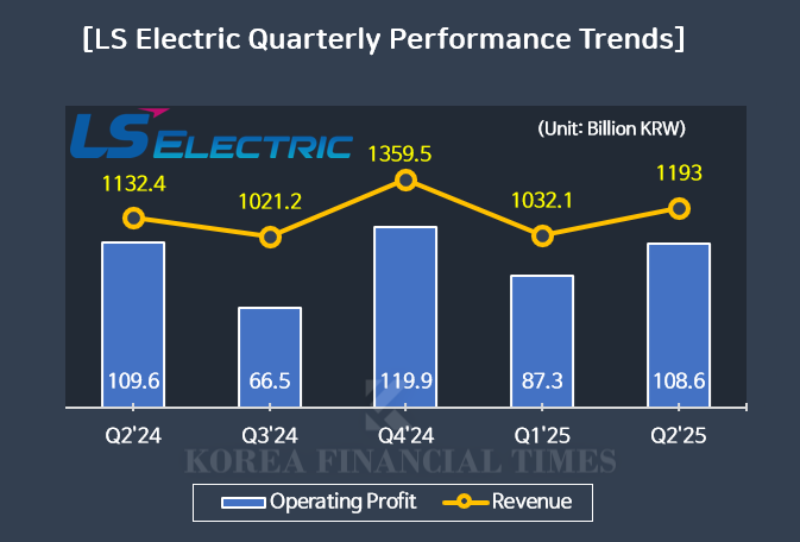

Performance continues steady growth. Operating profit increased 73.28 percent from KRW 187.5 billion in 2022 to KRW 324.9 billion in 2023. Last year recorded KRW 387.9 billion, up 19.39 percent year-on-year.

According to FnGuide consensus (securities firm performance forecasts), third-quarter sales this year are projected to reach KRW 1.217 trillion, up 19.17 percent year-on-year, and operating profit is expected to achieve KRW 112 billion, up 68.59 percent.

Interest coverage ratio also remains stable. It recorded 9.2 times in 2022, 7.7 times in 2023, and 8.9 times in 2024, and also recorded 7.2 times in the first half of this year. When the interest coverage ratio exceeds 1, it signifies the company generates profit even after bearing interest expenses.

Financial health is also sound. Though the debt ratio increased from 89.81 percent in 2021 to 114.47 percent in 2022, 116.52 percent in 2023, and 137.30 percent in 2024, it remains at a low level compared to the industry. Last year, HD Hyundai Electric recorded 151.78 percent and Hyosung Heavy Industries recorded 202.53 percent.

Order backlog as of end-June this year stands at KRW 3.7 trillion, of which high-profit products such as switchboards and extra-high voltage transformers account for KRW 2.7 trillion. LS Electric recently began joint development with global industrial automation solution company Honeywell on data power management solutions and battery energy storage systems (BESS) targeting the North American market. Next month, the company also plans to complete expansion of its Busan extra-high voltage transformer production facility.

Shin Haeju (hjs0509@fntimes.com)

![KT, ‘3년 특례’ 타고 자사주 족쇄 풀까? [자사주 리포트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260309102048042787fd637f543112168227135.jpg&nmt=18)

![속도로 기선 제압, 협업으로 쐐기…‘매출 1위ʼ GS25의 승부수 [편의점 왕좌의 게임]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030900572900258dd55077bc221924192196.jpg&nmt=18)

![삼성전기 장덕현, MLCC·기판 업고 영업익 2조 ‘정조준’ [AI특수 숨은 알짜들 ①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030900142007208dd55077bc221924192196.jpg&nmt=18)

![최우형 2기 케이뱅크, 상장 직후 주가 주춤…카뱅과 무엇이 달랐나 [인뱅은 지금]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306120713066265e6e69892f222110224119.jpg&nmt=18)

![휴머노이드 알짜는연 80%↑ 질주 ‘로봇 관절’ [K-휴머노이드 대전 ④ 액추에이터]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030900162803222dd55077bc221924192196.jpg&nmt=18)

![신한금융, 사외이사 '4연임ʼ 추진···"독립성 결여 경계해야" [2026 주총 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030821420004975dd55077bc221924192196.jpg&nmt=18)

![‘물 건너간 자사주 8천억’ KCC 정몽진 선택은? [자사주 리포트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030900184106544dd55077bc221924192196.jpg&nmt=18)

![사외이사 과반이 ‘주주추천ʼ BNK금융, 지배구조 ‘환골탈태ʼ [2026 주총 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030822300706857dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)