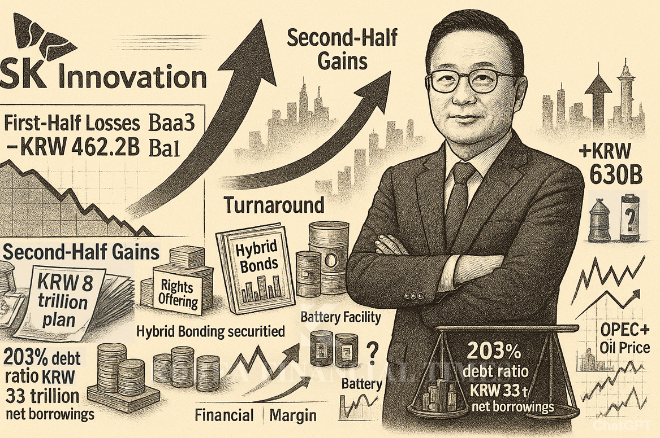

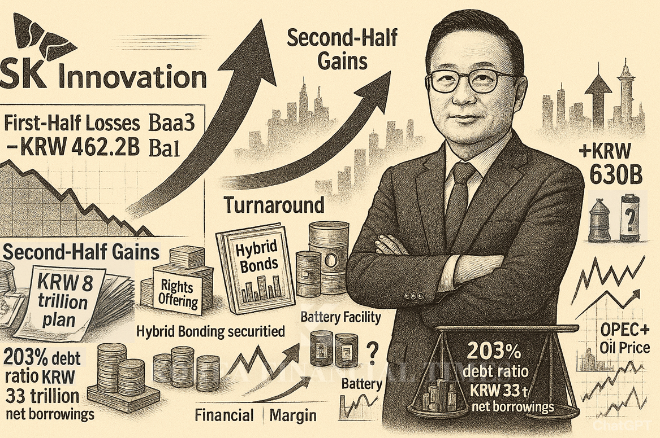

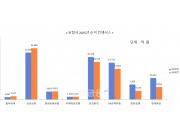

According to financial information company FnGuide's compilation on the 29th, the consensus (average estimate) for SK Innovation's second-half operating profit is KRW 368 billion. Securities firms that recently issued reports estimate this higher at KRW 600-630 billion. The refining division is particularly expected to lead the turnaround, buoyed by improved refining margins.

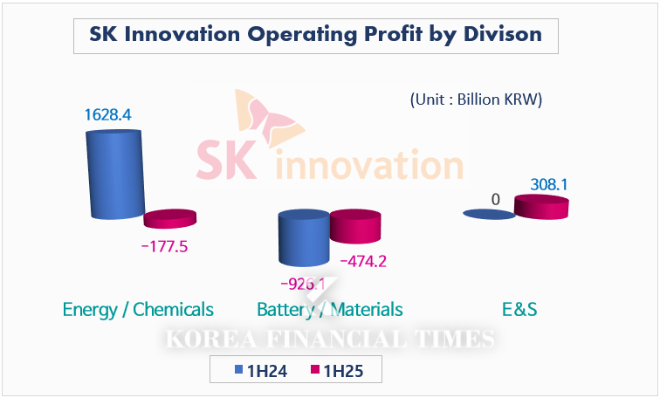

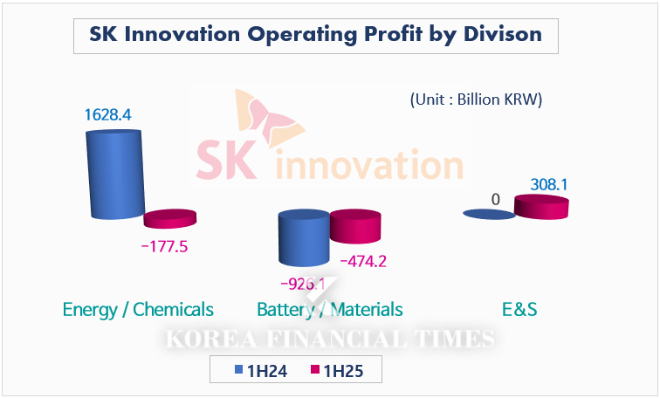

SK Innovation recorded an operating loss of KRW 462.2 billion in the first half of this year, turning to deficit from an operating profit of KRW 578.9 billion in the first half of last year.

Losses in the battery and materials business divisions, including subsidiaries SK On and SKIET, were halved to KRW 474.2 billion compared to last year. There was also the effect of SK Innovation E&S, which merged in November last year (operating profit of KRW 308.1 billion).

However, the energy and chemicals division (refining, petrochemicals, lubricants, etc.) posted a loss of KRW 177.5 billion in the first half of this year from an operating profit of KRW 1.628 trillion in the first half of last year. In particular, the core refining business recorded a loss of KRW 466.3 billion in the second quarter, significantly deteriorating overall performance. US tariff threats and OPEC+ production increase stance pulled down international oil prices, which led to inventory losses for SK Innovation's refining operations.

Financial-related losses were KRW 685.6 billion, down KRW 320 billion from a year earlier. This was due to increased foreign exchange gains from won weakness, but interest expenses alone increased 21 percent to KRW 794.6 billion. Net borrowings surged from KRW 19 trillion at the end of the first half of last year to KRW 33 trillion at the end of the first half of this year, and the debt ratio increased 42 percentage points to 203 percent.

As the financial structure deteriorated, Moody's lowered SK Innovation's credit rating from 'Baa3' to 'Ba1' in March. In response, Jang Yong-ho, CEO of SK Inc., was appointed to concurrently serve as chief executive president of SK Innovation in May. Chief executive president Jang is an SK Group rebalancing expert, and this was a bold move of replacing the chief executive officer for financial improvement.

Under President Jang's regime, SK Innovation established and executed an KRW 8 trillion capital raising plan. First, it announced a KRW 5 trillion funding injection plan at the end of July. This included SK Innovation rights offering of KRW 2 trillion and hybrid bonds (perpetual bonds) of KRW 700 billion, SK On rights offering of KRW 2 trillion, and SK IE Technology rights offering of KRW 300 billion. Then on the 25th of this month, it secured an additional KRW 3 trillion by securitising two LNG subsidiaries.

However, the burden of SK On's accumulated losses remains a persistent challenge. The rebound timing continues to be postponed. SK On is expected to see expanded losses in the third quarter due to initial operating costs at the US Ford joint venture plant. Additionally, with the early termination of US electric vehicle purchase subsidies from the 30th, it is difficult to guarantee a return to profitability next year.

Chief executive president Jang also sees that SK On will need time. Along with the capital expansion plan, SK Innovation purchased all convertible preferred shares (CPS) held by SK On's financial investors (FI). This eliminated the obligation for SK On's initial public offering (IPO) promised for 2026. In November, SK On will be merged with lubricant subsidiary SK Enмove to improve the financial structure. Jang said "SK On needs to focus on maximising profitability and strengthening fundamental competitiveness for the time being. Currently, there are no IPO plans."

Gwak Horyung (horr@fntimes.com)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![펩타이드 기술 강자 ‘이 회사', 비만·안질환까지 확장한다 [시크한 바이오]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821300702131dd55077bc221924192196.jpg&nmt=18)

![‘IB 명가' 재정비 시동…NH투자증권, 김형진·신재욱 카드 [빅10 증권사 IB 人사이드 (6)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603103406515dd55077bc221924192196.jpg&nmt=18)

![압도적 ‘양종희' vs 성장의 ‘진옥동' 밸류업 금융 선두 다툼 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603032808988dd55077bc221924192196.jpg&nmt=18)

![리딩뱅크 승부처 기업금융…이환주 vs 정상혁, 정면승부 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603191602818dd55077bc221924192196.jpg&nmt=18)

![영업익 1조 눈앞 KB증권, 성장세 신한투자증권…"非은행 존재감 확대" [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603142504338dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)