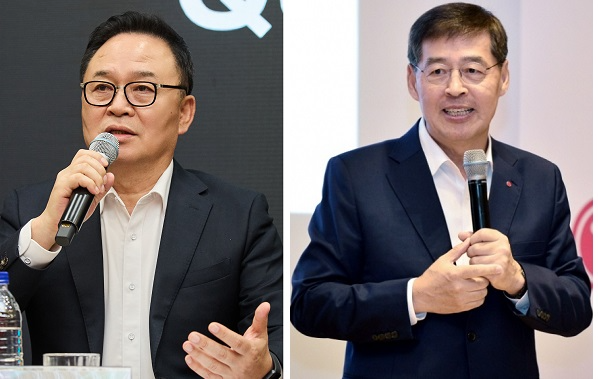

Jang Yong-ho, Executive President of SK Innovation (left), and Shin Hak-cheol, Vice Chairman of LG Chem

On July 30, SK Innovation announced a surprise merger between its EV battery-making subsidiary SK on and SK Enmove, which operates the group’s lubricants business.

The move is widely seen as a lifeline for SK On. In 2022–2023, SK on raised large-scale investment from financial investors, including Korea Investment Private Equity, through a pre-IPO placement to fund battery production capacity. Initially, SK on planned to repay these funds via a 2026 IPO, but the company’s schedule was pushed back due to a prolonged “EV chasm” — a slump in global demand. SK Innovation has instead decided to improve its financial position by raising around KRW 5 trillion in capital to repay those earlier investments.

SK Enmove, regarded as a cash cow within the group, has generated nearly KRW 1 trillion in average annual operating profit over the past three years, providing a stable profit stream that can offset SK on’s substantial losses. While SK Enmove had previously explored an IPO, it will now remain as a steady cash generator until SK on is back on a solid footing.

SK on aims to cut its debt ratio from the current 251% to below 100% by 2030, while targeting EBITDA above KRW 10 trillion.

SK Innovation affiliates have also begun replacing their fleet with Hyundai and Genesis electric vehicles equipped with SK on batteries — a symbolic move reflecting commitment to the EV future. “We will focus on enhancing SK on’s fundamental competitiveness,” said Jang Yong-ho, Executive President of SK Innovation.

Like SK, LG Chem also places a high value on the future of its battery business. Even with a need for short-term funding, the company has chosen to sell a lucrative unit while retaining its core asset — its stake in LG Energy Solution.

Market expectations since last year had suggested that LG Chem might sell part of its stake in battery subsidiary LG Energy Solution (LGES) to raise cash. LG Chem currently owns 81.8% of LGES, and analysts projected it could sell 10–20% — a level that would not impair control — to ease its rising financial burden.

Instead, the company chose to dispose of a non-core asset. On August 7, it agreed to sell its aesthetics business, focused on dermal fillers and housed within its Life Sciences division, to private equity firm VIG Partners for about KRW 200 billion.

The unit generates roughly KRW 100 billion in annual sales and around KRW 30 billion in EBITDA, and is valued more for future growth than for current earnings. LG Chem had originally sought about KRW 500 billion, but ultimately accepted less than half that amount. While noting that the aesthetics market has significant growth potential, driven by rising demand for beauty and anti-ageing treatments, the company said the sale was a strategic choice to concentrate on strengthening its core businesses and new growth engines.

This is not LG Chem’s first disposal of non-core assets. In October 2023, it sold its in-vitro diagnostics device business for KRW 150 billion, followed by the sale of its display polarizer and materials unit for KRW 1 trillion in December 2024 and the advanced materials water solutions business for KRW 1.4 trillion in June 2025. Proceeds have been reinvested into battery materials and pharmaceuticals.

An industry insider said the decision reflects a bet on the rising value of equity holdings as the battery market expands, adding that it demonstrates confidence in the long-term outlook for the battery business.

Gwak Horyung (horr@fntimes.com)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![펩타이드 기술 강자 ‘이 회사', 비만·안질환까지 확장한다 [시크한 바이오]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821300702131dd55077bc221924192196.jpg&nmt=18)

![‘IB 명가' 재정비 시동…NH투자증권, 김형진·신재욱 카드 [빅10 증권사 IB 人사이드 (6)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603103406515dd55077bc221924192196.jpg&nmt=18)

![압도적 ‘양종희' vs 성장의 ‘진옥동' 밸류업 금융 선두 다툼 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603032808988dd55077bc221924192196.jpg&nmt=18)

![리딩뱅크 승부처 기업금융…이환주 vs 정상혁, 정면승부 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603191602818dd55077bc221924192196.jpg&nmt=18)

![영업익 1조 눈앞 KB증권, 성장세 신한투자증권…"非은행 존재감 확대" [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603142504338dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)