The domestic petrochemical industry downturn results from a complex combination of China-driven oversupply and downstream demand slowdown caused by US-China trade disputes. This has left virtually all domestic petrochemical companies experiencing their most challenging period ever.

However, Lotte Chemical's struggles appear particularly pronounced due to its business structure concentrated in commodity products. Commodity products are basic chemicals used to manufacture plastics commonly found in daily life, such as microwave containers, packaging materials, and disposable items. Since 2020, China, the largest consumer market, has expanded self-sufficiency, significantly reducing opportunities for domestic companies.

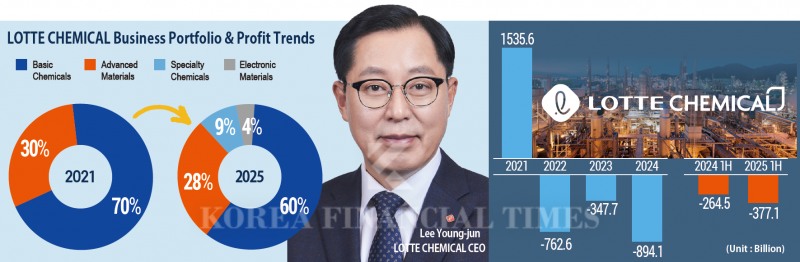

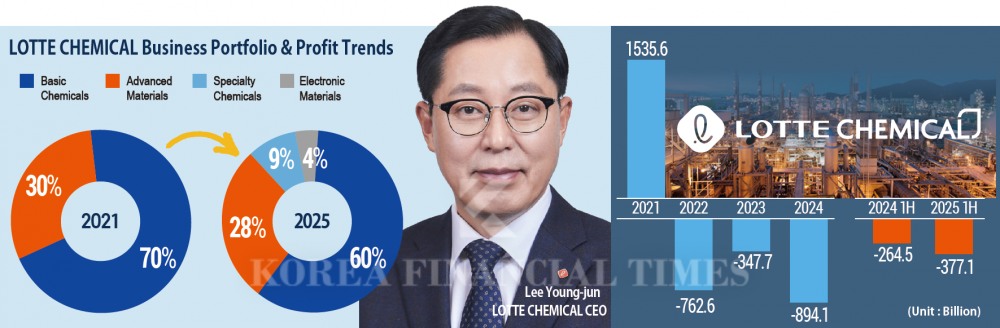

According to Lotte Chemical's semi-annual report, the basic chemicals division handling commodity products accounted for 60 percent of consolidated sales by business segment in the first half of this year. The advanced materials division producing specialty products for home appliances, IT, automotive, and medical devices represented only 28 percent.

Lotte Chemical has set a plan to reduce the commodity proportion to 30 percent by 2030. In contrast, LG Chem, despite having the largest domestic NCC production capacity, diversified early into batteries and other sectors. Petrochemicals account for just 38 percent of total sales, and this includes all petrochemical products including specialty products. The NCC-based commodity proportion is estimated at approximately 14 percent.

The appointment of CEO Lee Young-jun as Lotte Chemical's chief executive in November last year sent a strong message about transforming the commodity-focused business structure. Unlike his predecessor, who was an expert in large-scale M&A, CEO Lee is recognised as a specialty field expert.

He worked at Samsung General Chemicals, Cheil Industries, and Samsung SDI before joining Lotte Group through the 2015 Samsung-Lotte big deal, and has led the advanced materials division at Lotte Chemical. Indeed, the advanced materials division he leads has maintained 5-6 percent operating margins despite demand slowdown from US-China trade disputes and weak selling prices.

However, immediately after taking office, he had to focus on addressing the urgent issue of rapidly deteriorating financial structure rather than expanding advanced materials. Lotte Chemical's net borrowings surged 24-fold from KRW 296 billion at the end of 2021 to KRW 7.154 trillion at the end of 2024.

To reduce this burden, he implemented an 'asset light' strategy through asset sales. From October last year to March this year, he secured approximately KRW 1.3 trillion by selling a 40 percent stake in the US subsidiary (LCLA), 25 percent stake in the Indonesian subsidiary (LCI), the entire 75 percent stake in the Pakistani subsidiary, and the entire 4.9 percent stake in Japan's Resonac.

Another challenge remaining for CEO Lee is domestic NCC restructuring. In August, 10 NCC companies including Lotte Chemical joined a government-led 25 percent voluntary reduction plan. However, specific implementation measures have not yet emerged due to differing interests among companies.

Lotte Chemical favours horizontal integration that reduces costs by consolidating operations with peer companies. The company is reportedly discussing consolidation with HD Hyundai Chemical and Yeochun NCC.

If he survives year-end personnel changes, CEO Lee's real test is expected to come next year.

Securities firms recently mention the possibility of Lotte Chemical returning to annual profits next year, viewing the petrochemical industry as having passed the bottom.

However, opinions differ on the timing and pace of recovery. Meritz Securities diagnosed that "demand remains cautious as US-China tariff negotiations continue, with wait-and-see attitudes likely to persist." Shinhan Investment Securities assessed that "while second-half market uncertainties remain, the downcycle trough has passed" and "recovery gradients may not be steep, but possibilities for further slowdown are limited."

Gwak Horyung (horr@fntimes.com)

![이재용 회장 ‘삼성의 미래ʼ PICK “올해 일 낸다” [K-휴머노이드 대전] ② 휴머노이드 원조 레인보우로보틱스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022214532407407dd55077bc221924192196.jpg&nmt=18)

![패시브 일색에 '메기' 등판…韓 액티브 ETF '새 바람' ['완전한' 액티브 ETF 초읽기 (상)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022200461200626dd55077bc221924192196.jpg&nmt=18)

![기관 '알테오젠'·외인 '에코프로'·개인 '리노공업' 1위 [주간 코스닥 순매수- 2026년 2월19일~2월20일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022023314903795179ad4390711823566145.jpg&nmt=18)

![[DQN] '비은행' 지각변동…임종룡號 우리금융 '약진' [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022201050403250dd55077bc221924192196.jpg&nmt=18)

![다날, 보안 인증 확보·스테이블코인 인프라 확장 '병행' [PG사 스테이블코인 도입]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022315503502880957e88cdd521123419530.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)