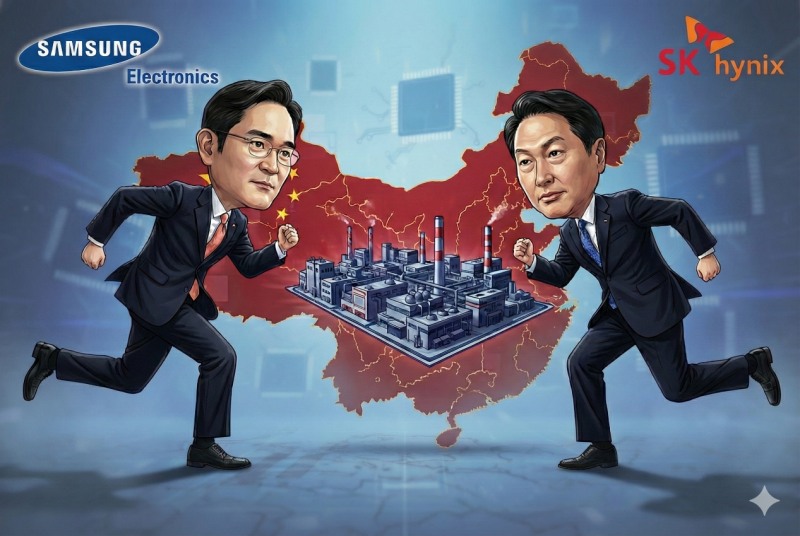

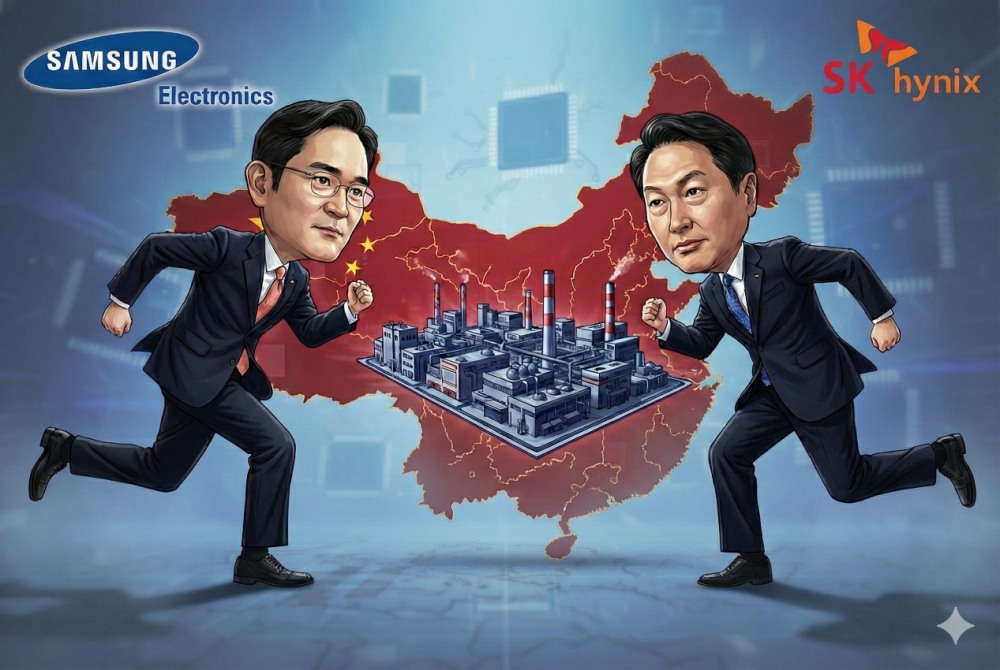

While SK hynix is posting record-breaking performance riding the "semiconductor boom," there are clear temperature differences among overseas subsidiaries. SK hynix America, the US sales subsidiary, recorded cumulative sales of KRW 40 trillion through the third quarter of last year, growing more than five times compared to two years ago (KRW 7.78 trillion). During the same period, sales at the Wuxi, China sales subsidiary increased 1.9 times from KRW 5.3 trillion to KRW 10 trillion, but recorded slight negative growth year-over-year last year. This is interpreted as the result of big tech companies with active demand for high-bandwidth memory (HBM) for AI being concentrated in the United States.

SK hynix's China operations appear to have contracted due to the US government's semiconductor regulations against China. Until recently, the US prohibited the import of American semiconductor equipment and parts into Chinese factories. The Wuxi manufacturing subsidiary responsible for SK hynix's China DRAM production and the Chongqing semiconductor packaging subsidiary saw sales decrease by 18% and 16%, respectively, last year compared to two years ago.

Although its share has decreased due to geopolitical risks, China remains an important base for SK hynix. Chairman Chey Tae-won of SK Group, who is accompanying President Lee Jae-myung on his visit to China as part of an economic delegation, held a Korea-China Business Forum where business leaders from both countries gathered on the 5th. Opening the forum, held for the first time in nine years, in his capacity as Chairman of the Korea Chamber of Commerce and Industry, Chey emphasized, "Let's respect our differences but prioritize seeking common goals and interests."

Samsung Electronics faces similar circumstances. Samsung Electronics' DS (Device Solutions, semiconductor) division has the Shanghai sales subsidiary (SSS), Xi'an NAND manufacturing subsidiary (SCS), and Suzhou packaging subsidiary (SESS).

SSS and SCS saw their performance decline by double digits year-over-year last year. SSS recorded cumulative sales of KRW 20.6 trillion and operating profit of KRW 311.2 billion through the third quarter of last year, decreasing by 13% and 14%, respectively. During the same period, SCS saw sales of KRW 6.6 trillion and operating profit of KRW 702.3 billion, down 23% and 20%.

Analysts suggest that the recent US government decision to open the door for NVIDIA to supply AI accelerator "H200" to China could present an opportunity for Samsung Electronics. The H(opper)200 applies the previous generation architecture. It is known to be equipped with HBM3E. It is anticipated that this could be an important opportunity for Samsung Electronics, which entered the market late due to delays in NVIDIA's HBM quality certification, to expand related sales.

Gwak Horyung (horr@fntimes.com)

![기관 '알테오젠'·외인 '에코프로'·개인 '리노공업' 1위 [주간 코스닥 순매수- 2026년 2월19일~2월20일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022023314903795179ad4390711823566145.jpg&nmt=18)

![[주간 보험 이슈] 보험사에도 행동주의 펀드 목소리…얼라인파트너스 DB손보 공개서한·에이플러스에셋 주주제안 外](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250915111248076232a735e27af12411124362.jpg&nmt=18)

![기관 '삼성전자'·외인 'SK하이닉스'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2026년 2월19일~2월20일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022023232506292179ad4390711823566145.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220164037004135e6e69892f2114827133.jpg&nmt=18)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220161811090515e6e69892f2114827133.jpg&nmt=18)

![24개월 최고 연 3.10%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220162010050335e6e69892f2114827133.jpg&nmt=18)

![24개월 최고 연 5.15%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220164219002235e6e69892f2114827133.jpg&nmt=18)

![12개월 최고 연 3.30%…참저축은행 '비대면 회전정기예금' [이주의 저축은행 예금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220180505017526a663fbf34175192139202.jpg&nmt=18)

![12개월 최고 연 5.00%…세람저축은행 '펫밀리 정기적금' [이주의 저축은행 적금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220184140081126a663fbf34175192139202.jpg&nmt=18)

![24개월 최고 연 3.25%…흥국저축은행 '정기예금(강남)' [이주의 저축은행 예금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220183141006236a663fbf34175192139202.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)