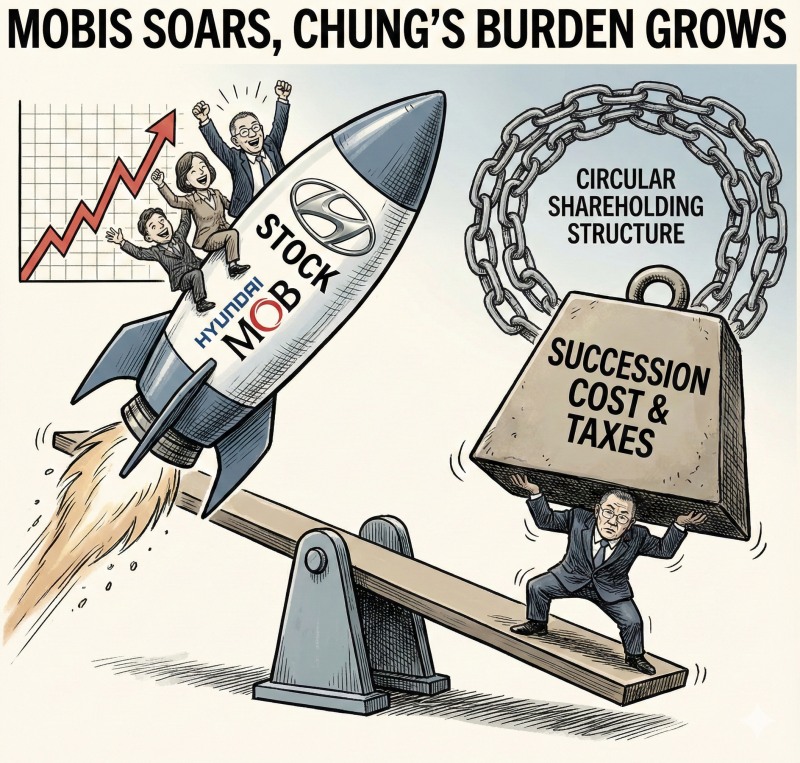

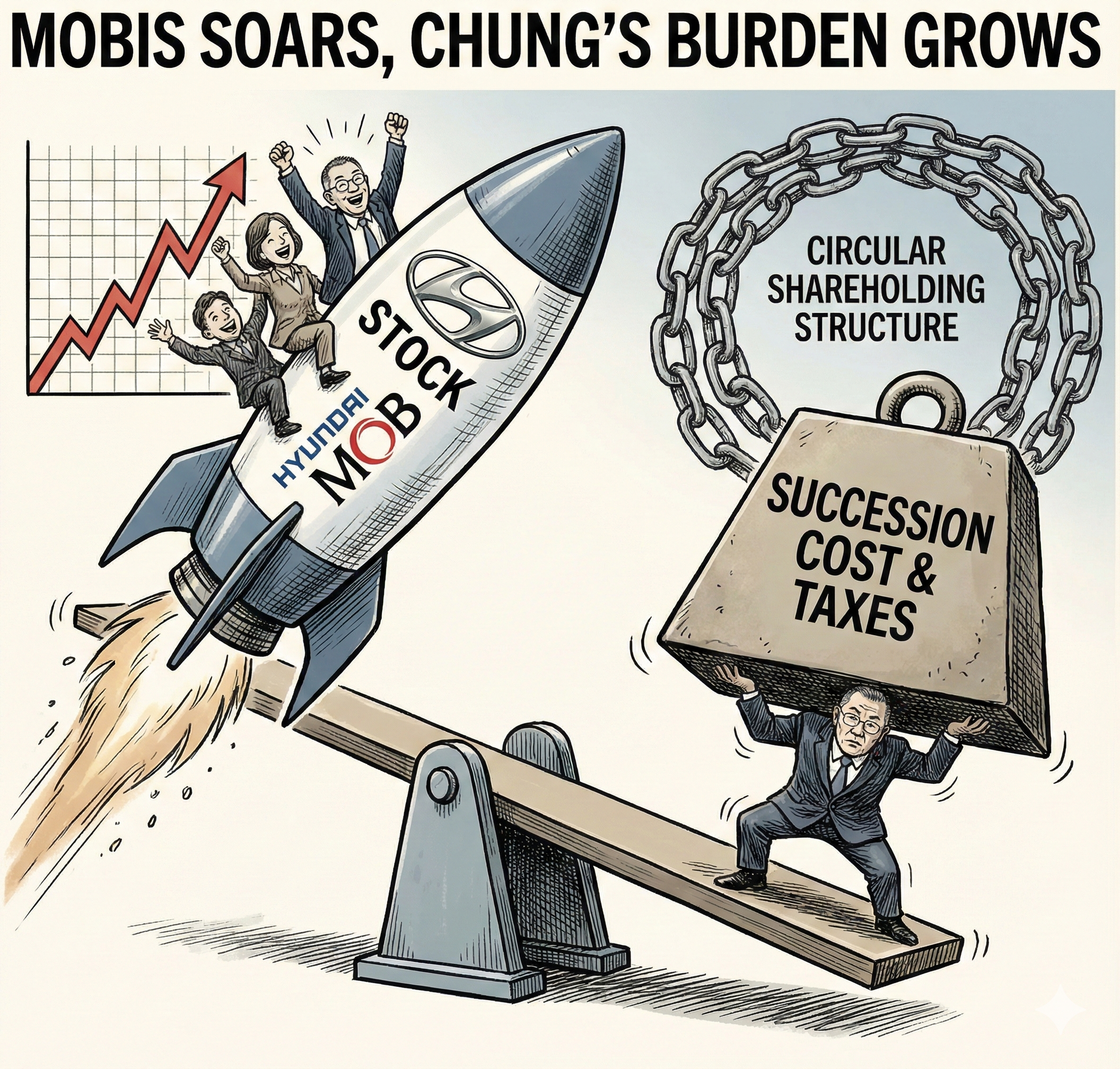

While this is very welcome news for Hyundai Mobis shareholders, Hyundai Motor Group Chairman Chung Eui-sun's position may be ambiguous. This is because securing a Hyundai Mobis stake is essential for Chairman Chung to achieve stable group succession and resolve the circular shareholding structure, which faces increasing social demands.

Korea Financial Times calculated Hyundai Mobis's cumulative Total Shareholder Return (TSR) using the corporate data platform DeepSearch. The calculation period is approximately three years from 2023 to the last trading day of November (28th) this year.

TSR is an indicator calculated by adding stock price change rate and dividend yield over a certain period divided by market capitalization, representing the total return investors can obtain from company stock.

Hyundai Mobis's cumulative TSR over the past three years was 61.60%. This means that if someone purchased KRW 10 million worth of stock in early 2023, the current value would be approximately KRW 16.1 million.

Hyundai Mobis has focused on various vehicle services including vehicle parts and after-sales service as a Hyundai Group parts affiliate. After gradually expanding into electronic equipment business such as automotive batteries from 2009, it declared the 'New Mobis' vision in 2023 to leap forward as a 'mobility platform provider' and announced expansion of electrification parts business.

The investment market also responded positively after the New Mobis declaration. Particularly, as Hyundai Motor Group is accelerating electrification business including electric vehicles, Hyundai Mobis was forecast to play a key role. In fact, Hyundai Mobis stock price closed 2023 trading at KRW 237,000, up 18.2% from the beginning-of-year price of KRW 200,500.

Additionally, the 'Commercial Act amendment' promoted by the Lee Jae-myung administration this year also boosted Hyundai Mobis stock price. Although Hyundai Mobis sits at the apex of the governance structure like a holding company, its stock price has always been undervalued in an ambiguous position due to the group's circular shareholding structure.

As the Commercial Act amendment aims to enhance shareholder value and advance governance structure, Hyundai Mobis stock price was forecast to be re-evaluated along with expectations for Hyundai Motor Group governance restructuring. In fact, Hyundai Mobis stock price broke through KRW 300,000 on a closing basis for the first time this year on July 3, when the Commercial Act amendment passed the National Assembly, and traded at KRW 309,000 even in November, the last month of TSR calculation.

Performance has also been growing since the New Mobis declaration. This is because Hyundai Mobis's external sales proportion is gradually increasing, starting with winning an order for Battery System Assembly (BSA), a core electric vehicle component, from Volkswagen in August 2023.

Hyundai Mobis set a record with consolidated revenue of KRW 59.2543 trillion in 2023. Although it decreased slightly to KRW 57.237 trillion in 2024 due to the electric vehicle chasm and other factors, operating profit set consecutive records at KRW 2.2953 trillion in 2023 and KRW 3.0735 trillion in 2024. This year's annual performance estimates for Hyundai Mobis are forecast to reach record highs of KRW 61.561 trillion in revenue and KRW 3.3646 trillion in operating profit.

This year, Hyundai Mobis is expanding its business portfolio to include robotics and software, which Hyundai Motor Group has selected as future engines. The securities industry is also presenting positive forecasts, raising Hyundai Mobis target price up to KRW 480,000.

While shareholders are cheering Hyundai Mobis stock price forecasts, Chairman Chung Eui-sun's mind may be complicated. This is because he must calculate succession funds for resolving the group's circular shareholding structure and raising succession funds due to the aforementioned Commercial Act amendment effects.

Hyundai Motor Group's governance structure is a circular shareholding structure following 'Hyundai Mobis → Hyundai Motor → Kia → Hyundai Mobis.' The major risk of such a structure is that if any one affiliate is attacked by external forces, the entire governance chain could collapse.

Additionally, while circular shareholding structures allow group chairmen to exercise control over the entire group with small stakes, they also have problems of chairman responsibility avoidance and inefficient decision-making for precisely that reason. Criticisms continue that internal transactions and corrupt practices can infringe on minority shareholder interests.

Amid such internal and external criticisms, if Hyundai Motor Group sets resolving its circular shareholding governance structure as the direction to move forward, attention inevitably focuses on Hyundai Mobis, which controls Hyundai Motor.

The most realistic plan for Hyundai Motor Group Chairman Chung Eui-sun to smoothly conclude succession issues and achieve unified governance is evaluated to be acquiring Honorary Chairman Chung Mong-koo's Hyundai Mobis stake (7.29%) and Kia's Hyundai Mobis stake (16.9%) to raise it to the stable stake level of 25%.

The higher Hyundai Mobis stock price rises, the more succession funds and inheritance taxes Chairman Chung Eui-sun must bear inevitably increase.

A business community official said, "The rise in Hyundai Mobis stock price may not be particularly welcome for Chairman Chung Eui-sun, for whom securing (Hyundai Mobis) stakes is urgent for stable succession and resolving circular shareholding structure," but added, "However, unlike the past, as shareholder rights and voices have increased, and given Chairman Chung Eui-sun's tendencies, he appears likely to choose a frontal approach such as utilizing held assets."

Kim JaeHun (rlqm93@fntimes.com)

![[DCM] ‘미매각 악몽’ 이랜드월드, 재무 부담 가중…고금리 전략 ‘의문부호’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012909073902617a837df64942115218260.jpg&nmt=18)

![[DCM] 심상치 않은 증권채…속내는 ’진짜’ IB 출현 기대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012818485407194a837df6494123820583.jpg&nmt=18)

!['운명의 날' 함영주 하나금융 회장, 사법리스크 벗을까 [금융사 CEO 이슈]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012823385403246b4a7c6999c121131189150.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)