▲Park Ji-won, CEO & Chairman of Doosan Enerbility / Photo courtesy of Doosan Enerbility

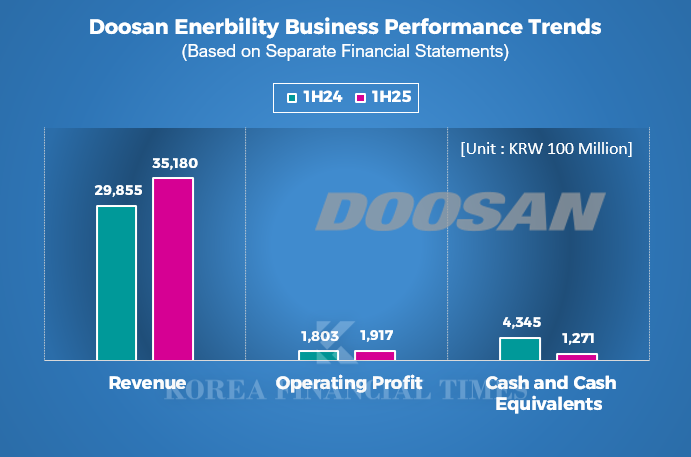

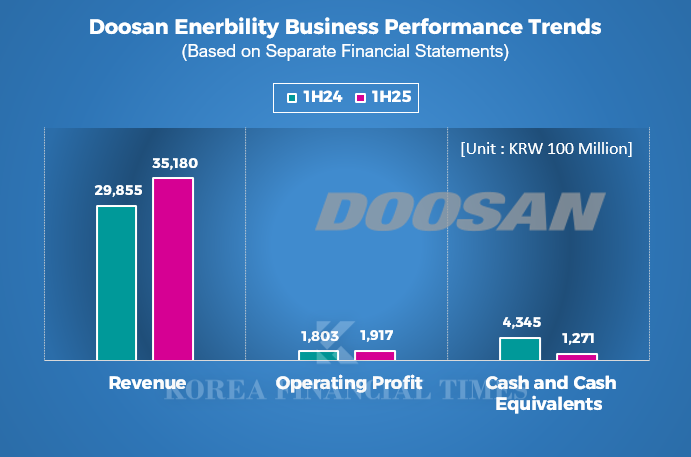

Doosan Enerbility achieved solid performance in the first half of this year. It secured orders totaling KRW 3.7573 trillion, a 98.4% increase from a year ago. On a separate financial statement basis, it recorded revenues of KRW 3.5180 trillion and operating profit of KRW 191.7 billion. These figures represent increases of 17.8% and 6.4% year-on-year, respectively.

However, its operating cash flow significantly worsened to negative KRW 947.5 billion, more than quadrupling the negative figure compared to the previous year. This deterioration is attributed to an increase in uncollected receivables and a larger proportion of unsold inventory. Accounts receivable rose by 50.7% year-on-year to KRW 765.5 billion, and inventories increased by 25.5% to KRW 457.2 billion.

Consequently, while the company reduced investments and expanded borrowings, these efforts were insufficient to boost cash reserves. As of the end of June, Doosan Enerbility's cash on hand was KRW 127.1 billion, a 70% decrease compared to the same period last year.

Cash flow from investing activities shrank by more than six times year-on-year to negative KRW 36.1 billion, while cash flow from financing activities surged by 238.8% to KRW 472.0 billion. Net borrowings increased by 41.7% year-on-year to KRW 3.5796 trillion, and the debt-to-equity ratio rose by 3.8 percentage points to 135.5% compared to the previous year.

Amidst this situation, uncertainties regarding the profitability of the two-unit Dukovany nuclear power plant project in the Czech Republic, identified as Doosan Enerbility's largest source of revenue in the second half, are also being raised.

Recently, the terms of an agreement signed between Korea Hydro & Nuclear Power (KHNP) and U.S. nuclear firm Westinghouse have been disclosed. This agreement was made as KHNP secured the KRW 26 trillion Czech new nuclear power plant construction project in June.

According to the agreement, KHNP will purchase Westinghouse equipment worth KRW 900 billion and pay KRW 240 billion in royalties for every nuclear reactor exported over the next 50 years.

The agreement is also reported to include clauses requiring technical verification for exporting South Korea's independently developed Small Modular Reactors (SMRs) and prohibiting KHNP from securing new nuclear power plant orders in Europe (excluding the Czech Republic), North America, Japan, the UK, and Ukraine.

Doosan Enerbility is currently in contract negotiations with KHNP regarding the supply of equipment and construction for the Czech nuclear power plant. The company anticipates securing contracts worth KRW 3.8 trillion in the second half of the year through these negotiations. This amount is equivalent to the total value of all projects Doosan Enerbility secured in the first half.

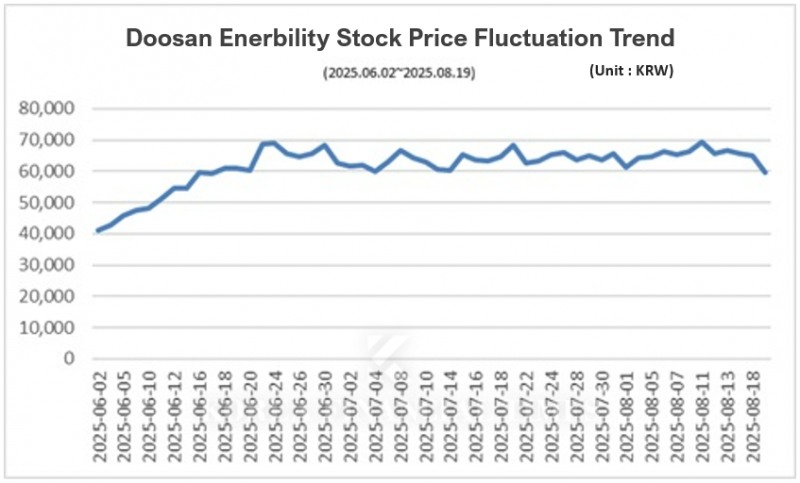

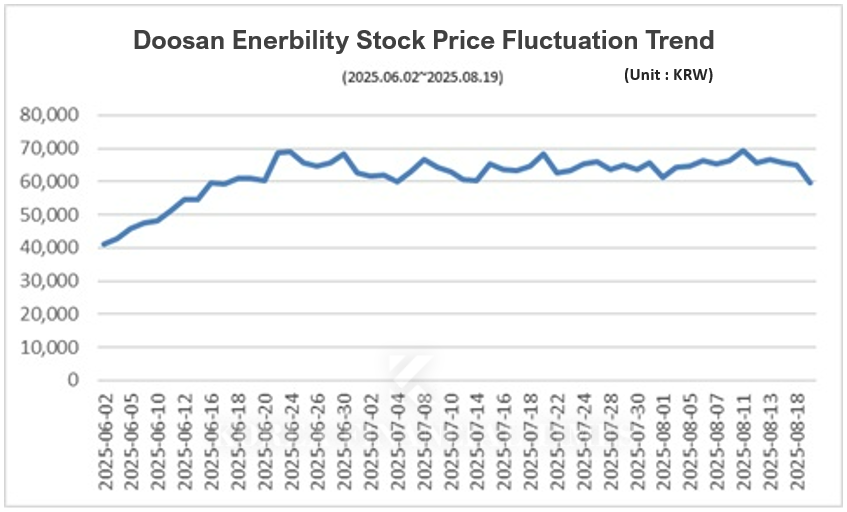

Meanwhile, as these facts became known, Doosan Enerbility's stock price plummeted by 8.6% on the 19th. On the 20th, its stock price briefly fell to KRW 51,100 in early trading, hitting its lowest point in the last three months.

Shin Haeju (hjs0509@fntimes.com)

![[부의 지도] 이상훈 에이비엘바이오 대표, 주식자산 569% '폭증'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021606565602265a837df6494123820583.jpg&nmt=18)

![[DQN] 국민은행, 4년 만에 순익 1위했지만···진정한 '리딩뱅크' 되려면 [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021604342702655b4a7c6999c121131189150.jpg&nmt=18)

![최우형號 케이뱅크, IPO 이후가 본 게임…기업금융 승부수 통할까 [금융사 2026 상반기 경영전략]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260211150253032195e6e69892f5910240225.jpg&nmt=18)

![12개월 최고 연 5.0%…세람저축은행 '펫밀리 정기적금'[이주의 저축은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021319014404723957e88cdd521123418838.jpg&nmt=18)

![[DCM] LG 3.61%로 조달금리 가장 높아…한화와 25bp 差 [1월 리뷰②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021601593602809141825007d122461258.jpg&nmt=18)

![30조 엔의 예산, 1.8조 엔의 시늉: ‘호송선단 방식’에 가로막힌 미완의 위기 대응 [김성민의 일본 위기 딥리뷰]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031321473103554c1c16452b012411124362.jpg&nmt=18)

![올해 초등학교 입학하는 자녀 독감·교통사고 걱정된다면…응급실비용 보장하는 자녀보험 [금융상품 돋보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260217134024096308a55064dd11251906169.jpg&nmt=18)

![박병희 농협생명 대표, 지급보험금 증가에 손익 주춤…킥스비율 396.7% '톱' [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025062922593508536dd55077bc25812315232.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)