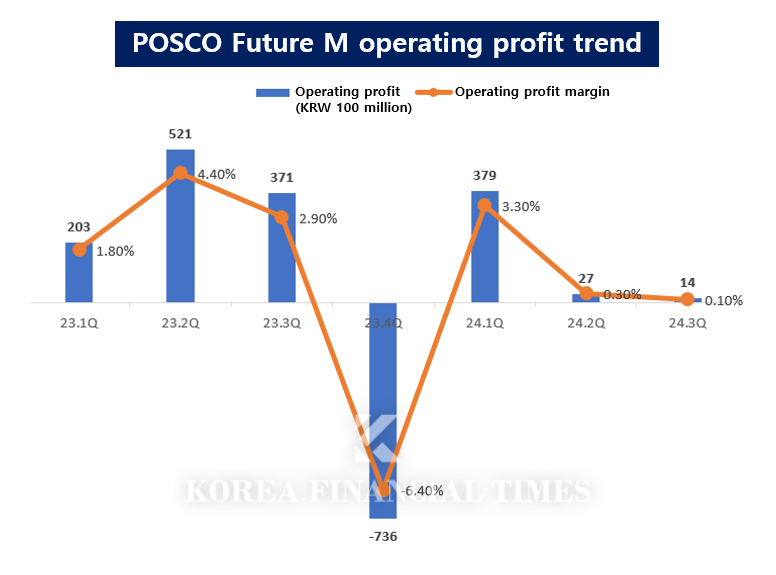

POSCO FutureM is recording operating profit of KRW 42 billion in the first to third quarters of 2024. This is a 61.6% decrease from the first to third quarters of 2023. It is only a quarter of the first to third quarters of 2022 (KRW 162.5 billion), which were on a roll. The profitability of the anode and cathode materials business deteriorated significantly due to the electric vehicle chasm and the plunge in raw materials.

Graph = Korea Financial Times / Source = Financial Supervisory Service Electronic Disclosure

이미지 확대보기Due to poor performance and deteriorating financial stability, pressure to lower the credit rating (AA-, stable) is also increasing. Korea Ratings presents 'Net debt/EBITDA (operating profit before interest, taxes, depreciation, and amortization) exceeding 4 times' as a factor for reviewing POSCO Future M's credit rating. POSCO Future M had already exceeded the standard at the end of last year. In addition, it has also surpassed 'debt ratio of 150% or more', a factor for downward consideration presented by Korea Ratings.

Expectations for an improved electric vehicle market outlook next year are also low, but POSCO Future M is still supported by the POSCO Group.

Last month, POSCO Future M announced that it will issue a new type of bond-type capital security (perpetual bond) worth KRW 600 billion on the 18th. Of this, KRW 500 billion will be acquired by the holding company POSCO Holdings. Perpetual bonds are recognized as capital in accounting, which has the effect of improving the financial structure. Accordingly, POSCO Future M’s debt ratio is also expected to drop to around 150%. The group's emergency transfusion of funds will put out the fire.

It has decided to adjust its own speed by reducing or postponing planned investments. The company has decided to reduce its target production of negaitive electrode materials, which are currently in deficit, to 113,000 tons in 2026, half the previous level. It has also reduced its target production of positive electrode materials for the same period by about 13% to 395,000 tons.

Gwak Horyung (horr@fntimes.com)

![서울 중구청장, 여야 모두 출마 러시…격전 예고 [6·3지방선거]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020909055800601b372994c951245313551.jpg&nmt=18)

![12개월 최고 연 3.20%…NH저축은행 'NH특판정기예금' [이주의 저축은행 예금금리-2월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260207205859051226a663fbf34175192139202.jpg&nmt=18)

![‘롤러코스터' 삼전닉스…‘방어주 매력' 따져보니 [정답은 TSR]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020723524103702dd55077bc221924192196.jpg&nmt=18)

![[데스크 칼럼] 구본준의 ‘반도체 꿈ʼ](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020823315604228dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)