Through last month, the company had issued a total of KRW 380 billion in commercial paper (CP). By March, the company had repaid KRW 70 billion of CPs that had matured, leaving a current outstanding balance of KRW 310 billion. All of the CPs issued so far have a maturity of six months or less.

“The purpose of issuing CPs is to raise operating funds,” said a company official.

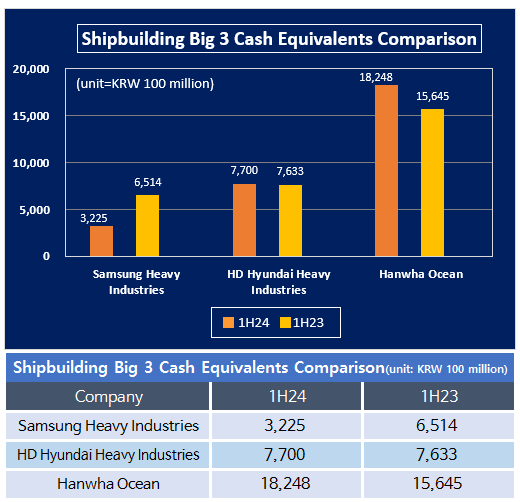

Graphing and tabulation = Korea Finacial Times Finance Institute

Samsung Heavy Industries's borrowings in the first half of this year totaled KRW 3.62 trillion, up 14.3% year-on-year. During this period, short-term borrowings increased, while long-term borrowings decreased. Short-term borrowings increased by 18.4% to KRW 2.2 trillion over the year, while long-term borrowings decreased by 36.7% to KRW 197.2 billion.

The continued borrowing is linked to the increase in orders. Typically, shipbuilders receive ship contracts in installments depending on the stage of construction, but the initial down payment is not enough to complete the construction of a ship, so they need to raise funds through bank loans or issuance of corporate bonds in the interim. As the number of orders increases, the company has no choice but to continue borrowing externally.

To date, Samsung Heavy Industries has secured orders for 24 ships totaling $5.4 billion (about KRW 7.3 trillion), achieving 56% of its order target of $9.7 billion (about KRW 13.1 trillion) for the year. The backlog to date stands at $31.9 billion(about KRW 43.1 trillion), representing more than three years of work.

The company recently signed a KRW 678.3 billion contract with an Asian shipowner for the construction of two liquefied natural gas (LNG) carriers. The vessels are scheduled to be delivered to the shipowners sequentially through April 2027.

However, in the first half of this year, Samsung Heavy Industries was the only one of the Big Three (Hanwha Ocean, HD Hyundai Heavy Industries, and Samsung Heavy Industries) to see a year-on-year decline in cash assets. It fell by half from KRW 654.1 billion in the first half of last year to KRW 325.5 billion at the end of June this year. This is down 44.23% from KRW 583.8 billion at the end of last year.

“While the working capital burden will persist for the time being due to an expanded order backlog compared to the past, cash inflows from improved profitability and increased delivery volumes will ease the borrowing burden in the future,” said Park Hyun-joon, head researcher at Nice Credit Ratings' Corporate Assessment Department, in a recent report on the shipbuilding industry.

Shin Haeju (hjs0509@fntimes.com)

![[DCM] JTBC · HL D&I 7%대...재무 취약기업 조달비용 급등 [2025 결산⑥]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013013251003407141825007d12411124362.jpg&nmt=18)

![NH투자증권, 순이익 '1조 클럽' 기록…윤병운 대표 "전 사업부문 경쟁력 강화" [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025021021370308671179ad439072211389183.jpg&nmt=18)

![다올투자증권, 연간 흑자 달성 성공…황준호 대표 실적 안정화 견인 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025081416515608997179ad439072111812010.jpg&nmt=18)

![[DCM] 이랜드월드, KB증권 미매각 눈물…NH증권이 닦았다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013006550302626a837df6494123820583.jpg&nmt=18)

![삼성생명 유배당 보험계약 부채 0원 두고 설왕설래…2025년 공시 촉각 [삼성생명 일탈회계 원복]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260129224736064028a55064dd118222261122.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)