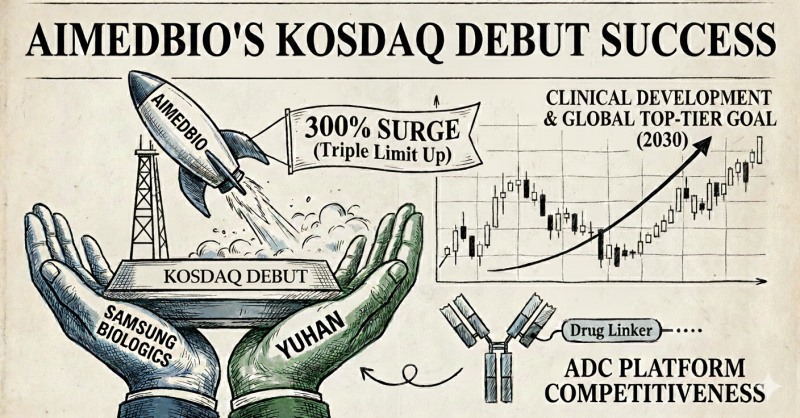

According to the industry on December 8, AIMEDBIO entered the KOSDAQ market on December 4. The company closed its first trading day at the upper price limit of KRW 44,000, up 300% from the offering price of KRW 11,000. On December 5, the second trading day, it also jumped to the price limit, closing at KRW 57,200, up 30% from the previous day.

AIMEDBIO attracted high interest during its Initial Public Offering (IPO) demand forecasting. A total of 2,414 domestic and foreign institutional investors applied for 3,240,623,000 shares, recording a competition ratio of approximately 672 to 1. Based on total participation quantity, 99.9% offered prices above the top of the band. Additionally, 1,935 (80.2%) of the 2,414 institutions participating in demand forecasting pledged mandatory holding.

The company was established in 2018 by Professor Nam Do-hyun, an expert in brain diseases who researched brain tumors as a neurosurgeon at Samsung Medical Center, as a spin-off from Samsung Medical Center.

AIMEDBIO develops antibody-drug conjugate (ADC) candidates through its 'P-ADC platform.' This platform can consistently perform from target discovery to antibody development, linker-payload optimization, and preclinical validation.

Samsung Life Science Fund (SVIC 54 and 63), jointly invested by Samsung C&T, Samsung Biologics, and Samsung Bioepis, participated as a strategic investor (SI) in AIMEDBIO. SVIC 54 was invested by Samsung C&T and Samsung Biologics, while 63 was invested by Samsung Bioepis. This is the first case of Samsung Life Science Fund investing in a domestic company.

As of the end of last year, SVIC 54 held KRW 3.5 billion in Redeemable Convertible Preferred Stock (RCPS) and KRW 1.8 billion in Convertible Preferred Stock (CPS). Fund 63 also holds RCPS (KRW 0.8 billion) and CPS (KRW 0.4 billion).

Samsung Biologics, along with equity investment, conducts joint research on ADC toolbox development with AIMEDBIO. The company plans to collaborate in various areas, including performing Contract Development Organization (CDO) tasks for monoclonal antibody-based atopic dermatitis and dementia treatments (AMB001).

Yuhan invested KRW 3 billion in AIMEDBIO in 2021 to acquire 1,179,709 common shares (3.0% stake), followed by an additional KRW 1 billion investment last year to secure 390,000 redeemable convertible preferred shares (1% stake). A company official explained the reason for investing in AIMEDBIO as "strategic investment through open innovation."

Before listing, AIMEDBIO succeeded in technology transfer of preclinical-stage ADC candidates developed through the P-ADC platform. The company transferred technology for FGFR3 (Fibroblast Growth Factor Receptor 3) targeted therapeutic 'AMB302' to U.S.-based Biohaven in December last year.

In January this year, it signed a technology transfer option contract with SK Plasma for 'AMB030,' a candidate for refractory cancer treatment. Subsequently, in October, it successfully contracted to transfer ADC candidates to Germany's Boehringer Ingelheim for KRW 1.4 trillion, achieving total technology transfer results exceeding KRW 3 trillion in the pre-listing stage alone. Based on technology transfer contract results, it successfully turned to operating profit in the second half of last year and continued operating profit in the first half of this year.

Huh Nam-gu, CEO of AIMEDBIO, said, "With listing as an opportunity, we will break away from a technology transfer-centered structure and expand into a biotech with clinical development capabilities," adding, "Our goal is to leap forward as a global top-tier ADC company by 2030."

Yang Hyunwoo (yhw@fntimes.com)

![[DCM] LX하우시스, 비건축부문 선방...사업포트폴리오 파워 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012216215009465a837df64942115218260.jpg&nmt=18)

![[DCM] 롯데쇼핑, 강도 높은 구조조정...투자 효율성 제고 절실](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012213330402565a837df64942115218260.jpg&nmt=18)

![[프로필] 장민영 기업은행장, 생산적금융 '적임' 자본시장 전문가 [2026 금융공기업 CEO 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012315011700719c1c16452b012411124362.jpg&nmt=18)

![[DCM] 10년물 회사채 2300억 몰렸다…LG유플러스, 통신 본업이 만든 신뢰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123111549027717fd637f543112168227135.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)