Investor attention on KT is growing following recent unauthorized microtransaction hacking incidents.

KT shares closed at KRW 49,850 on September 23. This represents approximately 15.8% below the year's intraday high of KRW 59,200 reached on July 15.

Behind this share price adjustment lies a mysterious unauthorized microtransaction incident. According to KT, unauthorized payments for mobile gift card purchases occurred during dawn hours from August 27 to September 6, targeting KT subscribers in Soha and Haan districts of Gwangmyeong, Gyeonggi Province, and Geumcheon and Yeongdeungpo districts of Seoul. Illegal ultra-small mobile base stations (femtocells) infiltrating communication networks were identified as the cause.

KT maintained its position that "there was no personal information leakage through femtocells" during the damage period, but faced criticism for delayed response after reporting the breach to the Ministry of Science and ICT and Korea Internet & Security Agency approximately 12 days after the first damage report.

According to the Ministry of Science and ICT, KT's unauthorized microtransaction damages totaled 362 cases worth KRW 240 million as of September 19.

Additionally, personal information leakage affecting 5,561 people, including International Mobile Subscriber Identity (IMSI), was confirmed, reproducing a similar pattern to SK Telecom's SIM hacking incident that occurred in late April.

A total of 20,000 customers received femtocell signals, and the number of customers suffering personal information leakage damage is expected to increase based on future investigations.

Industry observers point to this KT incident more seriously given that actual financial damage occurred. Under these circumstances, possibilities of expanded KT share price volatility and investment risks are being raised.

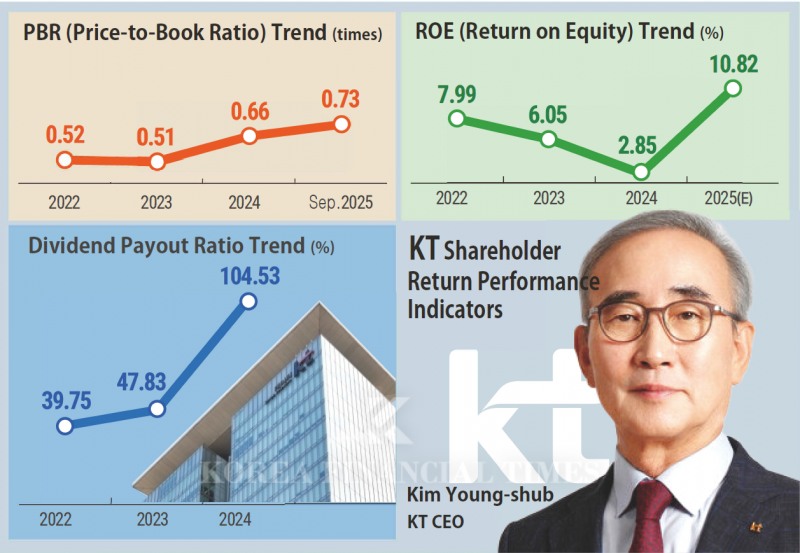

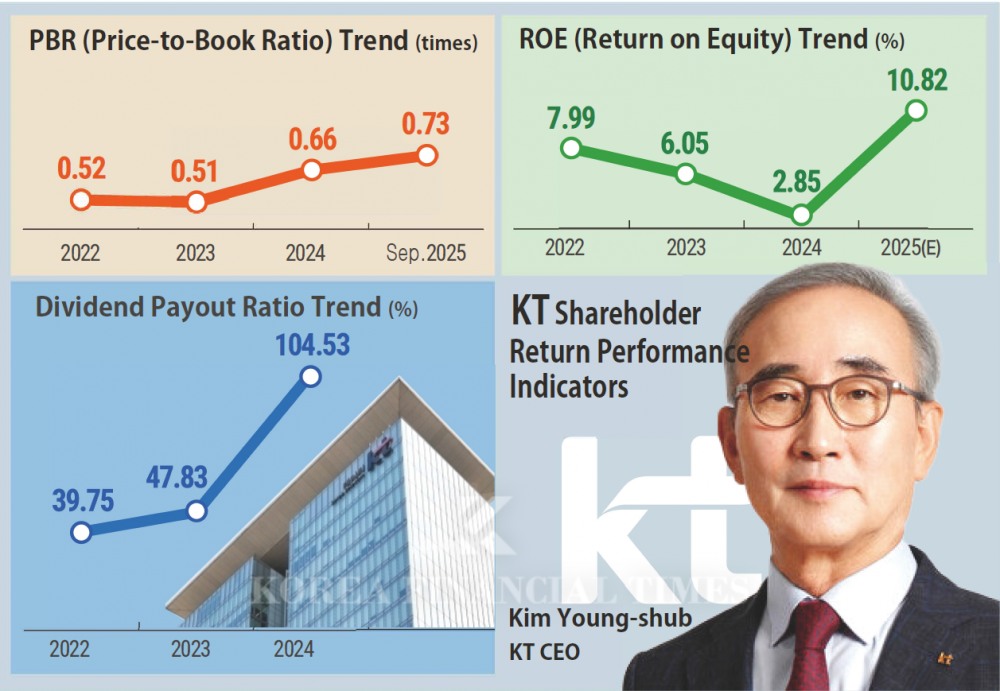

KT has maintained stable dividends and high dividend propensity while showing improved valuation trends compared to the past. The price-to-book ratio (PBR) recently stands at 0.73 times, continuing an upward trend from 0.52 times in 2022, 0.51 times in 2023, and 0.66 times last year. KT previously announced its corporate value enhancement strategy including mid-to-long-term financial targets and shareholder return plans in November last year.

With such shareholder return policies and mid-to-long-term profitability expectations, KT overtook SK Telecom to become the telecommunications sector "blue chip" for the first time in 22 years based on market capitalization at the end of January this year.

On January 24, KT shares closed trading at KRW 47,000, up 2.96% from the previous day, recording a market capitalization of KRW 11.845 trillion. SK Telecom closed at KRW 54,800 (-0.18% from the previous day) with a market capitalization of KRW 11.7704 trillion.

ROE, which KT emphasized for enhancing shareholder returns, is a key indicator showing how efficiently a company utilizes equity capital to generate profits. From shareholders' perspective, ROE becomes a criterion for investment decisions.

Securities firms project KT's year-end ROE at 10.8%. While it declined from 7.99% in 2022 to 2.85% last year, approximately triple growth is expected this year. The secret was stable dividends.

KT, which introduced quarterly dividends from last year, decided on a quarterly dividend per share of KRW 600 for the second quarter this year, a 20% increase from the same period last year. The total second-quarter dividend amount is KRW 144.7 billion.

Furthermore, KT applied the "dividend first, investment later" system, previously only used for settlement dividends, starting from the second quarter this year. Through this, investors can know dividend status and amounts in advance, receiving praise for enhancing predictability. From shareholders' perspective, stable cash flow is guaranteed without dividend uncertainty.

The second quarter earnings surprise also became the foundation for KT's shareholder return policies. Second-quarter consolidated operating profit surged 105.4% year-on-year to KRW 1 trillion. Revenue increased 13.5% to KRW 7.4 trillion.

KT's policy is to clean up low-profitability businesses and utilize improved cash flow not only for investment in new growth businesses like AI and IT but also as resources for shareholder returns.

Share buybacks and cancellations totaling KRW 1 trillion by 2028 are also being pursued. A KT official emphasized, "Announcing KRW 1 trillion in share buybacks and cancellations along with dividend-first, investment-later demonstrates strong shareholder return commitment."

However, a sudden bolt from the blue struck what seemed like a smooth path ahead. The view is that short-term impact from this unauthorized payment damage incident is inevitable. Given actual financial damage occurred, investigation results, additional responses, user trust recovery, and potential cost burdens have emerged as variables.

Securities firms are discussing possibilities of KT share price adjustments of up to 12% in the short term due to this incident's fallout. However, they also present "buying opportunity amid negative news" strategies based on prospects for expanded shareholder returns ahead.

Third-quarter earnings consensus expects revenue of KRW 6.8882 trillion and operating profit of KRW 548.1 billion with little change. Annual operating profit is also projected to grow significantly year-on-year to KRW 2.6581 trillion.

Kim Hong-sik, researcher at Hanwha Securities, diagnosed, "If this incident's impact expands, KT shares could fall to the KRW 45,000-48,000 range," but added, "A strategy of treating this negative news as a buying opportunity would also be good."

Jeong Chaeyun (chaeyun@fntimes.com)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)