Koo Ja-eun, Chairman of LS Group. / Photo courtesy of LS

On August 12, LS declared it would retire 1 million treasury shares, representing 3.1% of its total outstanding stock. The shares will be retired in two phases : 500,000 shares on August 21, with the remaining 500,000 to be retired by the first quarter of 2026. LS currently holds 5,852,462 treasury shares, representing 15.1% of its issued stock.

An LS spokesperson stated, “While pending amendments to the Commercial Act may influence future plans, there is currently no intention to retire additional treasury shares beyond the announced one million.”

Some industry observers speculate that LS’s decision to retire treasury shares is ultimately aimed at defending its management rights against Hoban Group. The two conglomerates are engaged in a shareholding battle, with Hoban acquiring over a 2% stake in LS this March. Although Hoban has yet to surpass the critical 3% threshold—which would grant it rights such as inspecting LS’s accounting books and challenging director misconduct—LS remains on alert.

In particular, Taihan Cable, an affiliate of Hoban Group, and LS Cable are long-standing rivals. In April, LS Cable won a final court ruling against Taihan Cable in a lawsuit over the alleged misappropriation of bus duct technology. More recently, the two companies have been vying for contracts in the “West Coast Energy Highway” national power grid project promoted by the Lee Jae-myung administration.

This forms the basis for analysis that LS’s share retirement move is aimed at boosting its stock price to make it more difficult for Hoban Group to increase its stake. A reduction in the number of shares in circulation typically lifts earnings per share and dividends per share, increasing the likelihood of a higher stock price. This, in turn, can raise the cost for outside players to acquire additional stakes.

Despite this, LS’s share price moved in the opposite direction, closing down 0.58% at KRW 170,200 on August 12. On August 13, the price dipped further to around KRW 167,200 within two hours of market open.

An industry insider commented, “Discussions around amendments to the Commercial Act have been ongoing since the Lee Jae-myung administration took office, so expectations around treasury share retirement for holding companies might have been priced into the shares already.”

Meritz Securities analyst Jang Jae-hyeok described the move as “very positive from a shareholder value perspective,” but noted that, “Since the existing sum-of-the-parts (SOTP) valuation already factors in net asset value and treasury stock in the share count, there is theoretically no change in the fair value per share.”

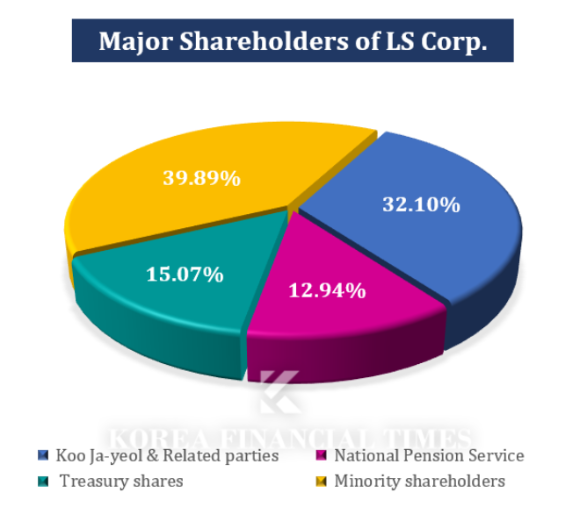

Chart prepared by Korea Financial Times / Data from the Financial Supervisory Service’s DART disclosure system

Earlier in May, LS issued KRW 65 billion worth of exchangeable bonds (EBs) backed by 387,365 treasury shares—equivalent to 1.2% of total shares—subscribed by Korean Air.

This move was widely interpreted as a defensive tactic against Hoban Group’s managerial challenge. Because treasury shares lack voting rights and cannot be used in shareholder meetings, issuing EBs linked to these shares enables LS to establish a friendly controlling interest.

Shin Haeju (hjs0509@fntimes.com)

![[현장] “전 세계 최초” 스타벅스코리아에서 ‘에어로카노’ 선보이는 이유](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022513205408493b5b890e35c21111915266.jpg&nmt=18)

![KB·신한금융, 전북 '금융허브' 구축 앞장…사무소 늘리고 상주인력 500명 확대 [은행은 지금]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025021109044107945b4a7c6999c12411124362.jpg&nmt=18)

![용산구 '현대맨숀' 57평, 26억 오른 40억원에 거래 [일일 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025061908193804321e41d7fc6c2183101242202.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602251614038388de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)