CJ CheilJedang's financial burden is mounting. Amid a series of mergers and acquisitions (M&A) and facility investments, poor performance has compounded the pressure. The company is accelerating financial improvements by strengthening core business competitiveness and divesting non-core businesses.

According to industry sources on Dec. 21, CJ CheilJedang's (excluding CJ Logistics) third-quarter revenue fell 1.9 percent year-on-year to KRW 4.5326 trillion. Operating profit for the same period declined 25.6 percent to KRW 202.6 billion.

The bio business struggled significantly. CJ CheilJedang's bio division recorded third-quarter revenue of KRW 979.4 billion, down 8.4 percent from the previous year, and operating profit of KRW 22 billion, down 71.9 percent. Revenue and profitability declined due to intensified market competition for high-margin products such as tryptophan, arginine, and nucleic acids, as well as deteriorating lysine market conditions in Europe.

Food business division revenue and operating profit were KRW 2.9840 trillion and KRW 168.5 billion, respectively, up 0.4 percent and 4.5 percent. The domestic food business struggled with weak domestic demand and rising raw material costs.

In contrast, the overseas food business showed growth driven by the K-food boom.

The Feed & Care division recorded revenue of KRW 569.2 billion and operating profit of KRW 12 billion. Revenue and operating profit declined due to falling feed prices in key business countries and high year-over-year base effects.

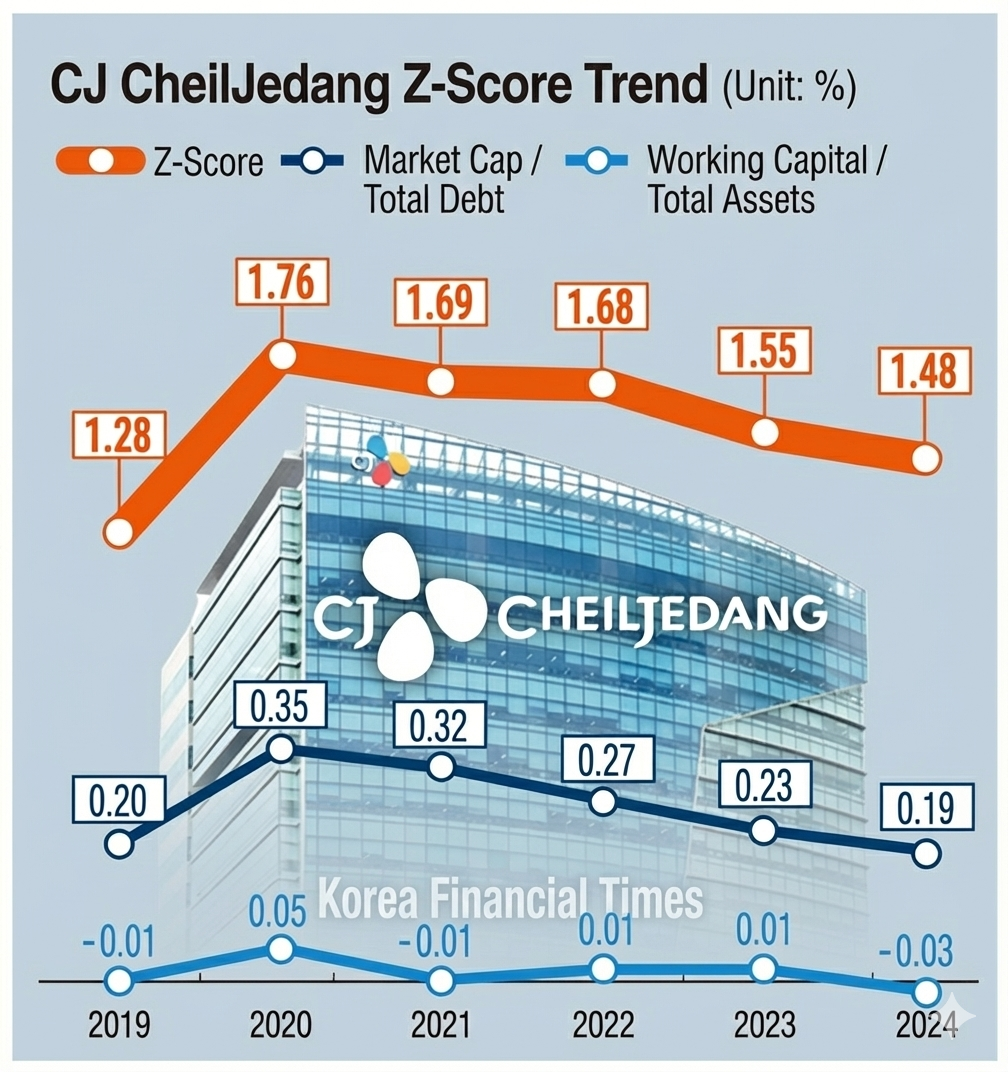

CJ CheilJedang's deteriorating performance is clearly reflected in its Altman Z-Score. The Altman Z-Score is an indicator that predicts bankruptcy probability based on corporate financial statements. It is one of various indicators that investors and financial institutions use to assess corporate credit risk or determine investment and lending decisions. For manufacturing companies, a Z-Score above 3 is considered stable, while below 1.8 indicates high bankruptcy risk.

Korea Financial Times' analysis shows CJ CheilJedang's Altman Z-Score for this year (as of third quarter) was 1.41, down 0.07 points from 1.48 last year.

Previously, CJ CheilJedang's Z-Score surged from 1.28 in 2019 to 1.76 in 2020. However, it has since declined: 1.69 in 2021, 1.68 in 2022, 1.55 in 2023, and 1.48 in 2024.

CJ CheilJedang continued performance growth from 2019 through last year.

CJ CheilJedang's (excluding CJ Logistics) revenue and operating profit were: KRW 12.7668 trillion and KRW 602.1 billion in 2019; KRW 14.1637 trillion and KRW 1.0415 trillion in 2020; KRW 15.7444 trillion and KRW 1.1787 trillion in 2021; and KRW 18.7794 trillion and KRW 1.2682 trillion in 2022. Revenue then fell to KRW 17.8904 trillion in 2023 with operating profit of KRW 819.5 billion, before operating profit rebounded to KRW 1.0323 trillion last year. Revenue declined slightly to KRW 17.8710 trillion.

During this period, CJ CheilJedang maintained relatively strong performance due to increased global food revenue based on the acquisition of U.S. frozen food company Schwan's. CJ CheilJedang acquired Schwan's for USD 1.84 billion (approximately KRW 2 trillion) in 2019. The Schwan's acquisition effect helped CJ CheilJedang's 2022 revenue (excluding CJ Logistics) reach a record high of KRW 18.7794 trillion. Operating profit that year also increased 7.6 percent year-on-year to KRW 1.2682 trillion.

Schwan's also transformed CJ CheilJedang's food revenue composition. CJ CheilJedang's overseas food revenue ratio rose from 14 percent in 2018 to over 52 percent last year. Meanwhile, domestic revenue has declined due to weak domestic demand. As of the third quarter this year, overseas revenue was KRW 1.0454 trillion, up 4 percent year-on-year, while domestic revenue was KRW 1.5286 trillion, down 3 percent.

However, investment expansion through corporate acquisitions and factory expansions has driven the Z-Score decline since 2021. From 2021 through last year, CJ CheilJedang acquired Cheonlab (now CJ BioScience) and Netherlands-based biotechnology company Batavia Biosciences, while continuing amino acid factory expansion in Brazil and investments in bio startups.

As a result, "working capital to total assets," a Z-Score component indicating liquidity and asset utilization efficiency, fell from 0.05 in 2020 to -0.03 last year and further to -0.06 this year. Net debt increased from KRW 4.2276 trillion in 2020 to KRW 6.3170 trillion last year. As of the third quarter this year, it stands at KRW 6.8187 trillion.

CJ CheilJedang has begun divesting non-core affiliates to reduce financial burden. In October this year, the company divested its feed and livestock subsidiary CJ Feed & Care. CJ CheilJedang signed a main contract with Netherlands-based Royal De Heus to sell 100 percent of its CJ Feed & Care shares. The corporate value was set at approximately KRW 1 trillion.

CJ CheilJedang expects this divestiture to help improve financial structure through accelerated growth of core businesses and reduced interest expenses from debt reduction. CJ Feed & Care was once a profitable affiliate generating annual operating profit of KRW 150 billion. However, after turning to losses in 2023, it began showing profitability improvements in the second quarter of last year.

A company official said, "The CJ Feed & Care divestiture is a 'selection and concentration' measure to focus more on high-growth core businesses, and positive effects on financial structure improvement are expected."

In September this year, CJ CheilJedang sold Youtell, a Chinese subsidiary in its bio division acquired five years ago, to U.S.-based Kemin Industries. The sale price was not disclosed. Youtell develops and produces enzymes used in feed and food industries. CJ CheilJedang acquired 100 percent of the shares for approximately KRW 60 billion at the time.

While divesting non-core businesses, CJ CheilJedang is focusing on strengthening its core food business. CJ CheilJedang completed a new dumpling factory in Kisarazu City, Chiba Prefecture, Japan this year, supplying products nationwide. Additionally, the company is investing KRW 100 billion to establish a factory in Budapest, Hungary. Schwan's is also building a "North American Asian Food New Plant" in Sioux Falls, South Dakota, with an investment of KRW 700 billion. The factory targets completion in 2027.

Recently, the company also signed a memorandum of understanding (MOU) with CP Axtra, Thailand's largest retailer, for K-food product distribution and local market expansion.

A CJ CheilJedang official said, "As a global K-food pioneer, we will continue 'new territory expansion' through various collaborations."

Yang Hyunwoo (yhw@fntimes.com)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-12월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20251219093349025015e6e69892f222110224112.jpg&nmt=18)

![‘반도체 게임체인저’ 유리기판 대전…SKC vs 삼성전기 [대결! 일대다 (下)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025122122545907776dd55077bc2118218214118.jpg&nmt=18)

![기관 '알테오젠'·외인 '에이비엘바이오'·개인 '에코프로' 1위 [주간 코스닥 순매수- 2025년 12월15일~12월19일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025121921461601587179ad4390711823510140.jpg&nmt=18)

![정상혁號 신한은행, 정보보호·내부통제 인력 확충 [인사로 본 2026 은행 전략]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025122108244903272dd55077bc2118218214118.jpg&nmt=18)

![[DQN] 바닥 다진 LG생활건강, 탄탄한 재무체력으로 반등 시동 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025122123041506583dd55077bc2118218214118.jpg&nmt=18)

![퀀텀벤처스, 퓨리오사AI 등 AI·반도체 포트사 줄상장 대기 [VC 회수 점검(7)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025122122471008474dd55077bc2118218214118.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)

![[AD]‘패밀리카 선두 주자’ 기아, ‘The 2026 카니발’ 출시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2025081810452407346749258773621116810840.jpg&nmt=18)

![[AD] ‘상품성↑가격↓’ 현대차, 2025년형 ‘아이오닉 5’·‘코나 일렉트릭’ 출시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202505131018360969274925877362115218260.jpg&nmt=18)