CJ CheilJedang (CEO Kang Shin-ho), which has taken the global dining table by storm with its Bibigo brand, has suddenly fallen into a period of low growth. The company’s core bio business, especially in China, has suffered amid challenging market conditions. In response, CJ CheilJedang is refocusing on its main business of “K-food,” while building large-scale production bases in Western markets such as the United States and Europe. At the same time, the company has ramped up dividends to elevate what it sees as an undervalued stock price and to strengthen shareholder returns.

Samyang Foods became a “blue-chip” trading above KRW 1 million per share and broke through the KRW 10 trillion market cap barrier, while Orion reached a record-high operating profit margin and market capitalization of KRW 4 trillion. During this period, CJ CheilJedang’s shares declined, reducing its market cap to the KRW 3 trillion range.

Domestically, prolonged consumption stagnation has weighed on earnings. CJ CheilJedang’s domestic food sales dropped from KRW 5.9231 trillion in 2022, to KRW 5.8783 trillion in 2023, and KRW 5.7716 trillion in 2024.

In contrast, overseas food sales have steadily risen: KRW 5.1811 trillion in 2022, KRW 5.3861 trillion in 2023, and KRW 5.5814 trillion in 2024. With the domestic business still accounting for more than 50% of sales, the consumption slump has dampened overall performance.

Beyond weak domestic demand, a sluggish bio business has also been a significant drag. The company’s green bio operations, notably affected by the Chinese economy, specialize in feed amino acids such as lysine and threonine. Both of its production facilities are located in China, where local companies have ramped up lysine output, leading to oversupply. As a result, bio business sales fell from KRW 4.854 trillion in 2022 to KRW 4.2095 trillion in 2024, down 13.3% over two years.

This has fueled persistent rumors about possible sales of the bio division. In fact, CJ CheilJedang attempted to sell its Brazilian subsidiary, CJ Selecta—which it had acquired in 2017—but withdrew after the potential buyer failed to meet preliminary contract terms.

A CJ CheilJedang official stated, “There are currently no plans to sell the bio business,” emphasizing, “Strategic alternatives are being considered for CJ Feed & Care’s business restructuring, but nothing has been finalized.”

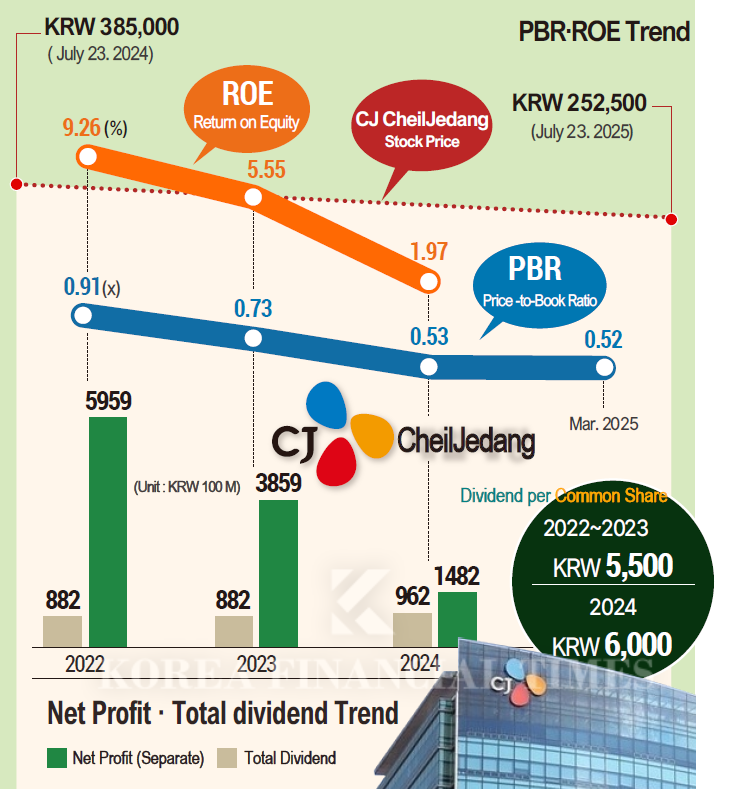

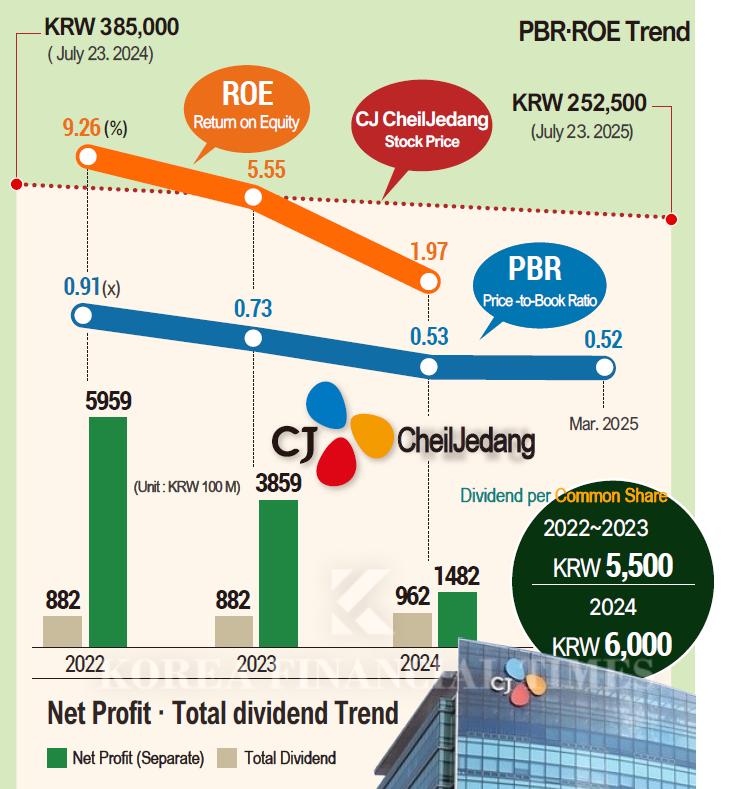

Despite these challenges, CJ CheilJedang has continued a policy of high dividends, consistently increasing payouts. Since 2022, the company has implemented quarterly dividends.

The payout ratio has mostly stayed around 50–55% of the annual dividend amount, but from this year, the company plans to raise this to around 75%. Further, over the next three years, CJ CheilJedang has pledged to return at least 25% of separate net income (excluding non-recurring items) to shareholders. The annual dividend will be determined by taking into account investments, financial structure, and management conditions, with an emphasis on stability.

Indeed, the payout ratio (consolidated basis) surged from 14.8% in 2022 to 22.9% in 2023, and 64.9% in 2024. As earnings slowed, net income (attributable to owners of the parent) plunged from KRW 595.9 billion in 2022 to KRW 148.2 billion in 2024. Yet, dividend payments rose from KRW 88.2 billion to KRW 96.2 billion.

Including CJ Logistics, total sales over the past three years were relatively flat: KRW 30.0795 trillion in 2022, KRW 29.0235 trillion in 2023, and KRW 29.0359 trillion in 2024.

CJ CheilJedang’s return on equity (ROE) declined steadily from 9.26% in 2022, to 5.55% in 2023, and 1.97% in 2024. Conversely, its price-to-earnings ratio (PER) rose from 10.46 times in 2022, to 13.75 in 2023, and 28.25 in 2024.

ROE measures how effectively a company generates profits from its own capital; a higher figure indicates greater profitability. PER indicates whether a stock is undervalued or overvalued relative to its earnings: a lower PER suggests undervaluation, while a higher figure implies overvaluation.

Based on this, it appears that CJ CheilJedang’s decade-long high dividend policy has propped up the PER, regardless of the company’s performance.

CJ CheilJedang’s retained earnings remain robust, at KRW 5.4515 trillion in 2022, KRW 5.7315 trillion in 2023, and KRW 5.7471 trillion in 2024.

Nonetheless, the share price has continued to struggle amid this low-growth phase, falling from KRW 378,500 (closing price, July 25, 2024) to KRW 249,000 on July 25, 2025—a 34.2% decline over the year.

Though long considered a prime beneficiary of value-up trends in the food sector, CJ CheilJedang failed to make the “Korea Value-Up Index” due to an excessively low ROE. Despite this, the company remains committed to its high-dividend policy.

CEO Kang Shin-ho said, “We will enhance corporate value by achieving financial results and upgrading our long-term business portfolio, while actively communicating with shareholders and expanding return policies. To strengthen market confidence, we have established a new dividend policy for the three-year period from 2024 to 2026, increasing both the payout ratio and the weight of quarterly dividends.”

Son Wontae (tellme@fntimes.com)

![[DCM] JTBC · HL D&I 7%대...재무 취약기업 조달비용 급등 [2025 결산⑥]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013013251003407141825007d12411124362.jpg&nmt=18)

![NH투자증권, 순이익 '1조 클럽' 기록…윤병운 대표 "전 사업부문 경쟁력 강화" [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025021021370308671179ad439072211389183.jpg&nmt=18)

![다올투자증권, 연간 흑자 달성 성공…황준호 대표 실적 안정화 견인 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025081416515608997179ad439072111812010.jpg&nmt=18)

![[DCM] 이랜드월드, KB증권 미매각 눈물…NH증권이 닦았다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013006550302626a837df6494123820583.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)