According to Alteogen on May 20, the company is currently in discussions for a strategic collaboration with a global top 10 auto-injector manufacturer. After signing a Material Transfer Agreement (MTA) and conducting joint research, both companies confirmed that combining high-dose SC therapeutic formulations with an auto-injector is technically feasible.

Based on these results, Alteogen plans to proceed with a strategic partnership to secure differentiated technology. This discussion is expected to be further detailed at ‘BIO USA 2025,’ a global bio event to be held in Boston, USA, from June 16 to 19.

An auto-injector is a device that allows medication to be administered automatically by simply placing the device on the skin and pressing a button, without complicated procedures. This enables patients, rather than healthcare professionals, to easily self-administer medication. Key features include the ability to pre-set the dosage, injection speed, and depth.

Due to its user-friendly nature, the application of auto-injector technology to pharmaceuticals has been increasing in the global bio industry. In 2019, Celltrion Pharm introduced auto-injector production facilities for Remsima SC. Aprogen also attracted attention in 2022 by developing an auto-injector device for its Humira biosimilar. According to the Ministry of Food and Drug Safety, the global auto-injector market is expected to grow at an average annual rate of 11.8%, from USD 3.6 billion (approximately KRW 5 trillion) in 2021 to USD 7.9 billion (approximately KRW 11 trillion) by 2028.

Alteogen is also focusing on the convenience and market potential of auto-injectors. A company representative stated, “Currently, therapeutic drugs are generally shifting to high-dose formulations, and auto-injectors can greatly increase convenience for both healthcare professionals and patients. As partners have a wider range of formulation options for their business strategies, we believe this will enhance the practicality and scalability of the Hybrozyme platform.”

Through this collaboration, Alteogen is expected to further strengthen its licensing negotiation power. Alteogen has set a management goal of achieving more than two new technology transfer deals annually and has continued to sign large-scale technology export contracts based on its Hybrozyme platform ‘ALT-B4’. Over the past six years, the total value of technology transfer contracts for ALT-B4 has exceeded KRW 10 trillion. As SC formulation therapies, which offer greater convenience than traditional intravenous (IV) injections, become the mainstream, Alteogen’s ALT-B4 is receiving increasing attention.

An Alteogen official stated, “We aim to enhance the competitiveness of the Hybrozyme platform together with the partner company’s medical device. We expect this collaboration to contribute to effective business strategy development for both current and prospective partners and to provide new methods of drug administration.”

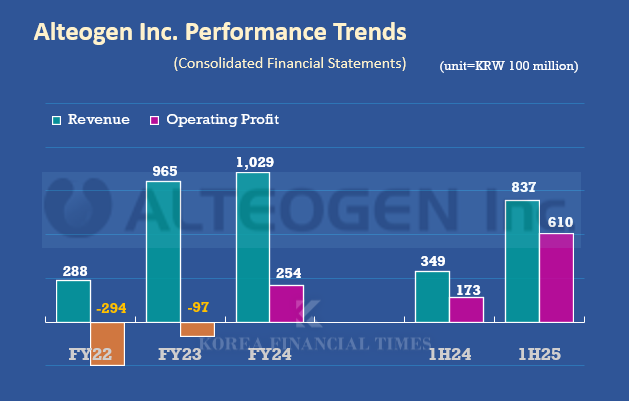

Graph=Korea Financial Times / Data Source=Financial Supervisory Service e-disclosure

Meanwhile, Alteogen continues to achieve rapid growth through technology transfer contracts. The company’s consolidated sales for the first quarter of this year reached KRW 83.7 billion, a 139.8% increase compared to the same period last year. This marks the highest quarterly performance in the company’s history. During the same period, operating profit and net profit were KRW 61.0 billion and KRW 83.0 billion, up 253.5% and 297.5% year-on-year, respectively.

Kim Nayoung, Korea Finacial Times (steaming@fntimes.com)

![외국인, 급락장에도 금융주 '신뢰'···우리금융 114만주 이상 '순매수' [금융지주 밸류업 점검]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030319193107019b4a7c6999c121131189150.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)