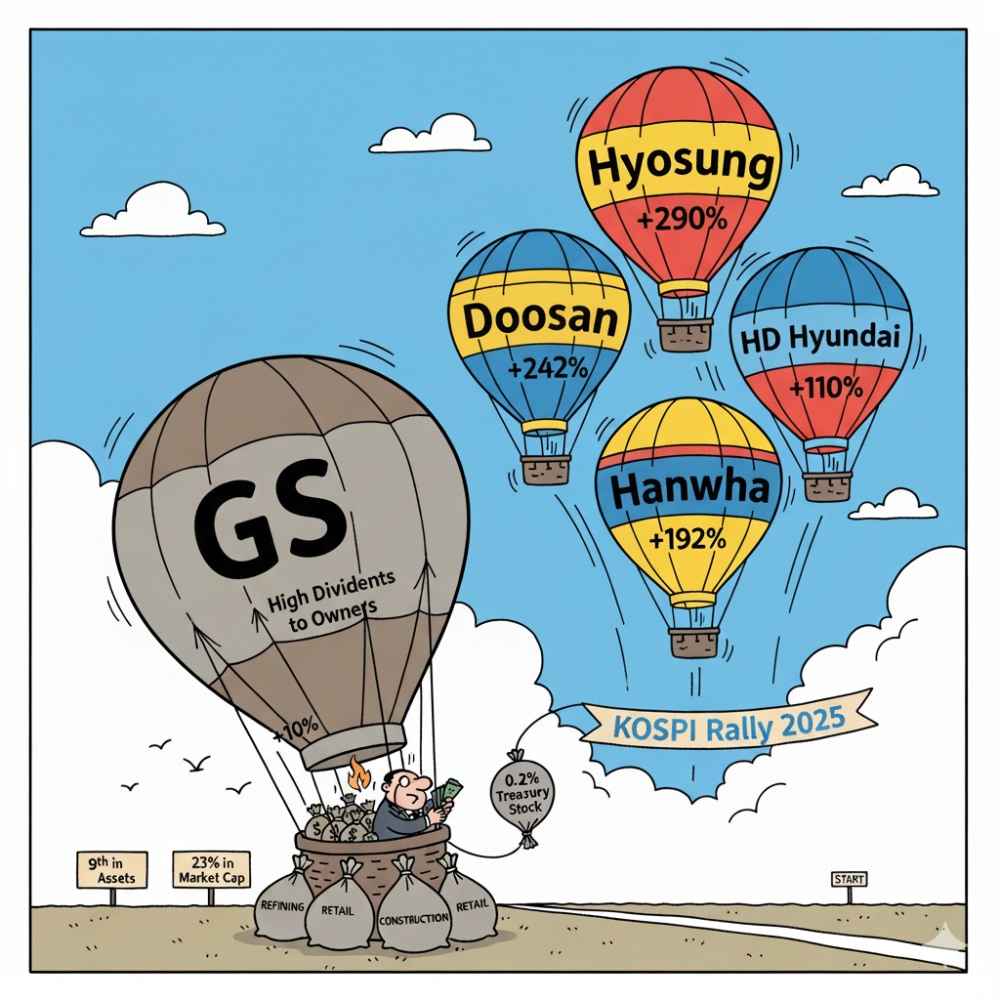

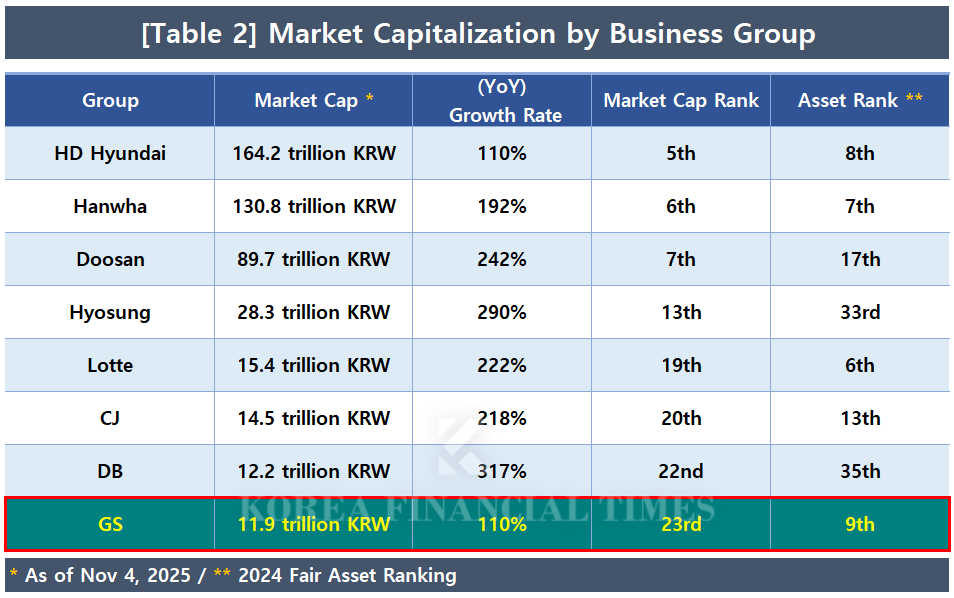

Specifically, during this period, the combined market capitalization of eight listed GS affiliates rose 10%. This is a lackluster performance compared to HD Hyundai (110%) and Hanwha (192%) among the top 10 groups, and even Lotte (22%), which is struggling to find future growth drivers. It also lagged behind Hyosung (290%) and DB (32%), which rank in the 30s in conglomerate rankings, in terms of market capitalization.

GS Group's poor stock performance appears to be due to lowered profit expectations from recessions in core business sectors (refining, retail, construction). The bio sector, which it strategically entered, has also underperformed.

HD Hyundai, Hanwha, Doosan, and Hyosung, which have more than doubled their market capitalization this year, share the common trait of having at least one business sector among those leading the domestic stock market, such as shipbuilding, defense, and power equipment.

However, even considering this, it is difficult to understand why GS is failing to achieve even one-fifth of the KOSPI's growth rate.

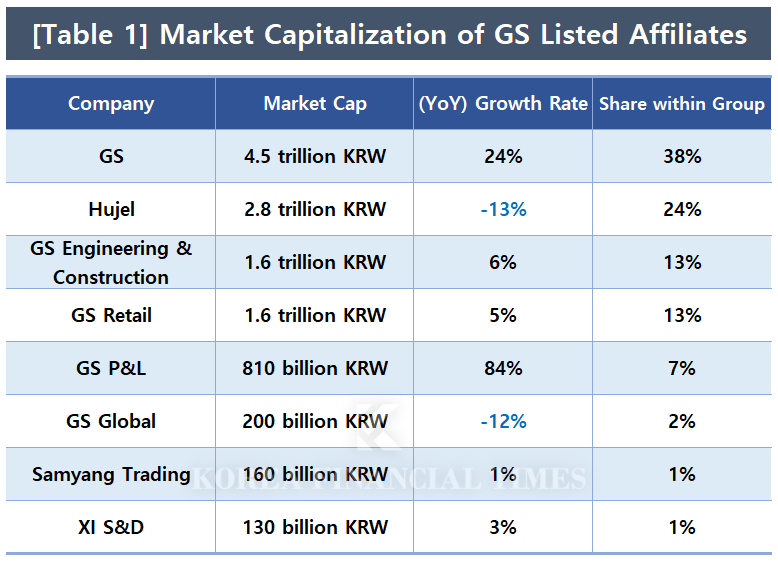

The largest holding in GS Group is GS Corp. (38%). GS Corp. is both a holding company and a company with a significant refining business. It directly controls 100% of unlisted GS Energy, which serves as an intermediate holding company for energy affiliates.

GS Corp. has risen approximately 24% this year. According to FnGuide, this falls far short of the average growth rate (73%) of domestic holding companies since the beginning of the year. It is also lower than the growth rate (38%) of S-Oil, which has a similar business structure to GS Caltex.

It's not that GS Corp. lacks positive factors. In particular, if the third commercial law amendment, which is expected to include separate taxation on dividend income, is implemented, it could be considered a beneficiary stock. This is because GS Corp. is a representative high-dividend stock.

GS Corp.'s average dividend yield (based on common stock) over the three years through 2024 reached 6.1%. While there are disclosed dividend standards, they essentially only present minimum dividend amounts, and the company consistently pays a cash dividend of KRW 2,500 per share annually, largely regardless of performance fluctuations.

The background to GS Corp.'s high dividend policy can be linked to its unique governance structure. GS was established when the grandsons of Huh Man-jung, co-founder of (former) LG, separated and became independent from LG. The number of specially related parties holding GS Corp. shares (totaling 53.61% of the equity) reaches 55, including fourth-generation managers who are in the process of sequential management succession.

Because so many people share ownership, it is analyzed to be a structure where it is difficult for any one person's judgment to change the high dividend policy needed to obtain satisfactory dividend income for each individual. If dividend separate taxation is implemented here, the tax burden on the Huh family is expected to decrease significantly.

Nevertheless, investors are paying more attention to owner management's passive shareholder return intentions. This means low expectations for additional shareholder return measures to boost stock prices beyond maintaining the current dividend policy.

In fact, GS Corp. was the last among the top 10 groups to participate in the "value-up" disclosure promoted by Korea Exchange recommendation. The value-up policy content is also not significantly different from before. It contains the statement, "Return at least 40% of average net income (excluding one-time and non-recurring profits) on a separate basis for 2025-2027," and "Minimum dividend is KRW 2,000." The dividend standard is completely identical to the previous 2022-2024 period.

While treasury stock purchases and cancellations to boost stock prices were conducted at some affiliates such as Hugel, GS Corp. has never officially implemented them. With a low treasury stock holding ratio (0.2%), even if the "mandatory cancellation of existing treasury stocks" provision passes in the third commercial law amendment, the effect is not expected to be significant.

Gwak Horyung (horr@fntimes.com)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![펩타이드 기술 강자 ‘이 회사', 비만·안질환까지 확장한다 [시크한 바이오]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821300702131dd55077bc221924192196.jpg&nmt=18)

![‘IB 명가' 재정비 시동…NH투자증권, 김형진·신재욱 카드 [빅10 증권사 IB 人사이드 (6)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603103406515dd55077bc221924192196.jpg&nmt=18)

![건강보험 손해율 악화·법인세 인상에 보험사 주춤…현대해상·한화생명 순익 반토막 [2025 금융사 실적 전망]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260219205719063188a55064dd1121160100217.jpg&nmt=18)

![압도적 ‘양종희' vs 성장의 ‘진옥동' 밸류업 금융 선두 다툼 [KB·신한 맞수 대결]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603032808988dd55077bc221924192196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)