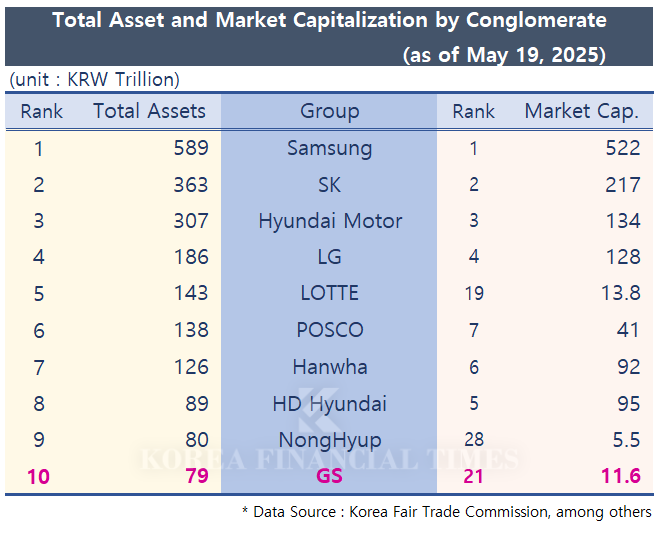

According to the '2025 Designation Status of Publicly Announced Business Groups' released by the Korea Fair Trade Commission (KFTC) on May 1, GS is now ranked 10th among business groups based on total fair assets. This year, GS ceded its 9th place position to NongHyup. In the previous 2024 survey, GS had already lost ground to HD Hyundai, marking a two-year consecutive decline in rankings.

The recent downward trend at GS can be traced to its business structure. GS is built on three main pillars: energy, construction, and distribution-traditional industries with high fixed costs and strong sensitivity to economic cycles. Compared to other conglomerates that have diversified into ICT and bio sectors, GS is seen as lacking in high-profit new business drivers.

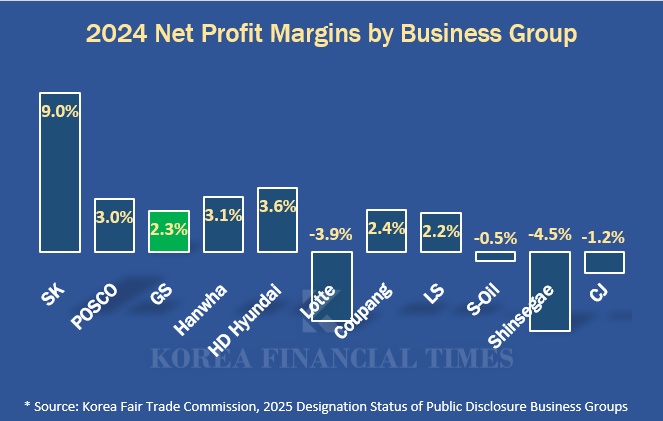

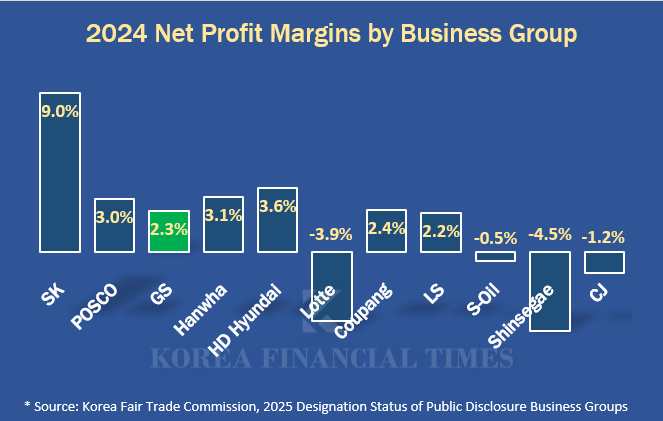

In fact, while GS ranked 6th in sales last year with KRW 81.816 trillion, its net profit was only KRW 1.9 trillion, placing it 12th. The net profit margin was 2.3%. This is lower than Samsung (10.4%), SK (9.0%), Hyundai Motor (8.1%), as well as HD Hyundai (3.6%) and Hanwha (3.1%), both of which have smaller sales volumes.

Nevertheless, some argue that GS performed relatively well given the sluggish business environment. Other energy and distribution groups recorded negative net profit margins: S-OIL at -0.5%, Lotte at -3.9%, and Shinsegae at -4.5%.

In summary, while GS may lack business expansion for future growth, it is interpreted as having stable management capabilities in its main businesses. This characteristic stems from its unique family management system. The holding company GS’s shares are divided among 53 members of the Heo family, the controlling shareholders. One of its key affiliates, GS Engineering & Construction, is directly owned in large part by the family of Chairman Heo Chang-soo, independent of the holding company.

Because the ownership structure is tightly bound by family shares, GS is passive in pursuing initial public offerings (IPOs). Of the 98 affiliates under GS Group, only 8 are listed companies. According to the Korea Exchange, GS Group’s market capitalization is about KRW 11.64 trillion, ranking 21st. Notably, Hugel-a biopharmaceutical company acquired in 2021-has the highest market capitalization at KRW 4.29 trillion. This is higher than not only GS Holdings (KRW 3.61 trillion), but also GS Engineering & Construction (KRW 1.65 trillion) and GS Retail (KRW 1.15 trillion).

An industry insider commented, “Given GS’s business structure, there is little strategic need to attract external capital, and the group likely views such moves as exposing itself to risk.”

Heo Seo-hong, CEO and Executive Vice President of GS Retail

Even so, a wind of change is being detected at GS as it enters a fourth-generation leadership transition. In particular, Heo Seo-hong, who was appointed CEO of GS Retail at the end of last year, has charted a course distinct from other fourth-generation owners. After starting his career as an analyst in the Corporate Finance Division at Samjong KPMG, he worked in the new business team at GS Home Shopping, served as head of management support at GS Energy, and led the Future Business Team at GS. He is known to have spearheaded the acquisition of Hugel during his tenure as head of the Future Business Team. This is considered a very rare M&A case that diverges from GS Group’s typically conservative investment stance.

![[DCM] LX하우시스, 비건축부문 선방...사업포트폴리오 파워 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012216215009465a837df64942115218260.jpg&nmt=18)

![[DCM] 롯데쇼핑, 강도 높은 구조조정...투자 효율성 제고 절실](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012213330402565a837df64942115218260.jpg&nmt=18)

![[프로필] 장민영 기업은행장, 생산적금융 '적임' 자본시장 전문가 [2026 금융공기업 CEO 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012315011700719c1c16452b012411124362.jpg&nmt=18)

![[DCM] 10년물 회사채 2300억 몰렸다…LG유플러스, 통신 본업이 만든 신뢰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123111549027717fd637f543112168227135.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)