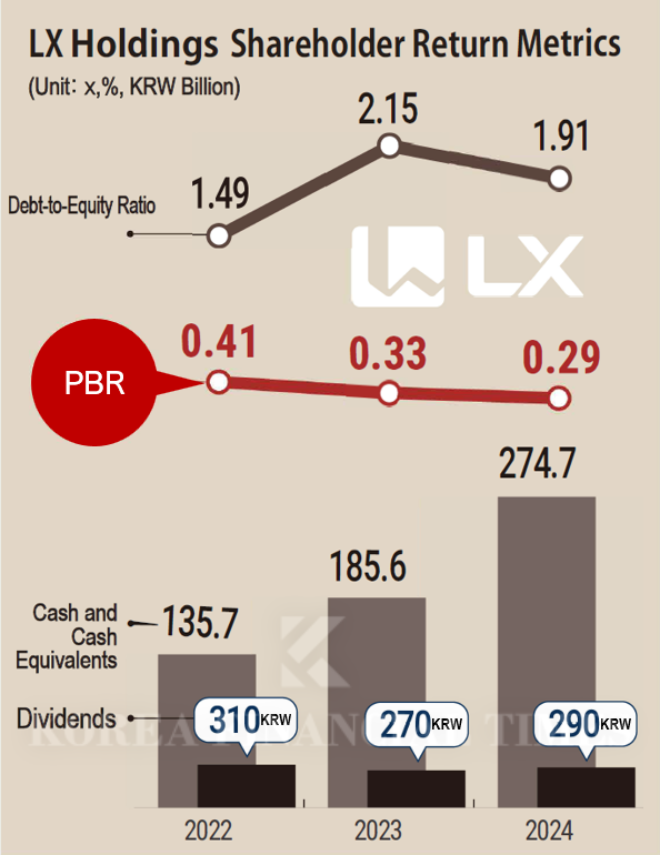

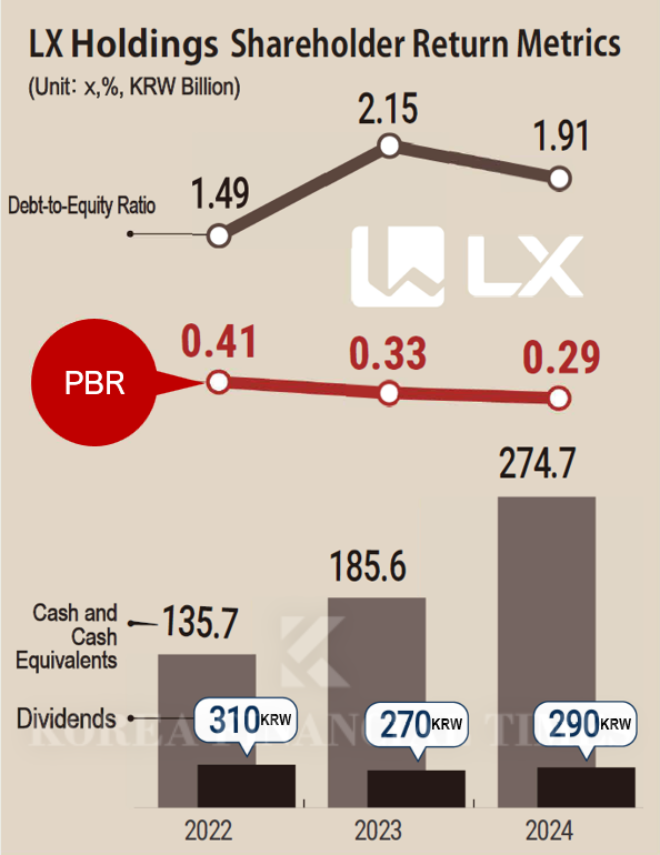

Marking its fifth year since establishment, LX Holdings remains trapped in undervaluation. As of end-June, its price-to-book ratio (PBR) stood at 0.38 times. Despite abundant cash and cash equivalents, weak subsidiary earnings are blocking any meaningful re-rating.

◇ LX Holdings moves to return cash to shareholders

The largest shareholder group of LX Holdings consists of Chairman Koo Bon-jun and 15 related parties (owner family), holding a combined 43.82%. Chairman Koo personally owns 20.37%.His eldest son, President Koo Hyung-mo, holds 11.92%, and his daughter, Koo Yeon-je, holds 8.62%. Retail investors account for 53.86%, more than half. Treasury shares are just 0.06%, and the company has yet to conduct any buybacks or cancellations. Chairman Koo serves as both CEO of LX Holdings and chair of the board.

In February, LX Holdings announced a new dividend policy: over the next three years through 2026, it will return at least 35% of the three-year average net income (on a separate basis, excluding one-offs) to shareholders. In other words, at least 35% of net income will be paid out to shareholders.

On a separate basis, the company posted net income of KRW 41.8 billion last year. Although this was down 40% year-on-year, the dividend per share still increased by KRW 20.

Since its launch in May 2021, LX Holdings has paid year-end dividends annually, distributing KRW 310 per share in 2022, KRW 270 in 2023, and KRW 290 in 2024.

Its balance sheet is solid. As of end-June, cash and cash equivalents stood at KRW 312.1 billion—nearly double the KRW 160.9 billion at inception four years ago. Retained earnings (undistributed) also jumped about 91% over the past year, from KRW 38.0 billion in June last year to KRW 72.7 billion this June.

Financial soundness remains strong. The company stays in a net-cash position, with cash exceeding debt. Its debt-to-equity ratio was 1.49% in 2022, 2.15% in 2023, 1.91% in 2024, and 2.11% in the first half of 2025. Dividend yield is relatively high compared with the KOSPI average of 1.91–2.29%.

Dividend yield is the ratio of annual total dividends to the current share price. LX Holdings posted 3.47% in 2022, 3.78% in 2023, and 4.27% in 2024. The payout ratio—total dividends divided by net income—was 14.20% in 2022, 26.62% in 2023, and 14.07% in 2024.

◇ Subsidiary Performance Is the Weak Spot

As a pure holding company, LX Holdings does not operate standalone businesses; its main income sources are dividends and trademark royalties from affiliates. Given its equity stakes and participation in governance, affiliate performance flows directly into LX Holdings’ results.Key affiliates include the listed LX International (26.8% stake), LX Hausys (33.5%), and LX Semicon (33.1%); and the unlisted LX MMA (50.0%), LX MDI (100.0%), and LX Ventures (100.0%). LX International, in turn, controls LX Pantos (75.9%), LX Glass (100.0%), and Poseung Green Power (70.0%), among others.

In the first half, LX Holdings booked KRW 72.6 billion in dividend income and KRW 15.5 billion in trademark income. Equity-method gains were KRW 117.8 billion, with KRW 741 million in equity-method losses.

For the second quarter on a consolidated basis, revenue was KRW 10.1 billion, operating profit KRW 42.5 billion, and net profit KRW 43.6 billion—down 4.7%, 27.6%, and 27.0% year-on-year, respectively—reflecting weak results at key subsidiaries.

LX International’s operating profit was halved by falling commodity prices and a slowdown in logistics, while LX Hausys swung to a loss amid softer building/interior demand and higher costs.

A weak semiconductor cycle hit LX Semicon hard, slashing operating profit by over 80%, and LX MMA’s profitability deteriorated on petrochemical softness. LX MDI and LX Ventures also remained in the red as new businesses failed to gain traction.

By the numbers, LX International posted revenue of KRW 3.8302 trillion, operating profit of KRW 55.0 billion, and net profit of KRW 56.2 billion, down 6.0%, 57.6%, and 50.3% year-on-year, respectively.

LX Hausys recorded revenue of KRW 819.5 billion and operating profit of KRW 12.8 billion, down 13.0% and 66.1%, respectively, and swung to a net loss of KRW 100 million from a KRW 31.4 billion profit a year earlier.

LX Semicon reported revenue of KRW 378.6 billion, operating profit of KRW 10.2 billion, and net profit of KRW 8.3 billion, down 21.9%, 81.8%, and 81.3%, respectively.

Among unlisted units, LX MMA delivered revenue of KRW 205.7 billion, operating profit of KRW 20.6 billion, and net profit of KRW 18.7 billion. Revenue rose 5.2%, but operating and net profit fell 35.8% and 19.7%, respectively. LX MDI and LX Ventures remained loss-making.

LX MDI posted revenue of KRW 2.2 billion, operating loss of KRW 400 million, and net loss of KRW 300 million. LX Ventures posted revenue of KRW 200 million, operating loss of KRW 300 million, and net loss of KRW 200 million.

The outlook hinges on a cyclical recovery. LX International could improve depending on commodity trends and growth at logistics arm LX Pantos.

LX Hausys also needs a rebound in building-material demand and cost stabilization. LX Semicon would benefit from a global semiconductor upturn, though that appears unlikely in the near term. LX MMA, MDI, and Ventures likewise face a tough path.

An LX Holdings official said, “We will continue striving to enhance shareholder and corporate value.”

Shin Haeju (hjs0509@fntimes.com)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![펩타이드 기술 강자 ‘이 회사', 비만·안질환까지 확장한다 [시크한 바이오]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021821300702131dd55077bc221924192196.jpg&nmt=18)

![‘IB 명가' 재정비 시동…NH투자증권, 김형진·신재욱 카드 [빅10 증권사 IB 人사이드 (6)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021603103406515dd55077bc221924192196.jpg&nmt=18)

![건강보험 손해율 악화·법인세 인상에 보험사 주춤…현대해상·한화생명 순익 반토막 [2025 금융사 실적 전망]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260219205719063188a55064dd1121160100217.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)