NHN has expanded into various information technology sectors beyond its core gaming business, moving into music streaming, payment services, and cloud computing. The company’s share price remains in the high KRW 20,000 range, closing at KRW 27,800 on August 12. This marks a steep decline of around 81% from its KRW 149,500 valuation at the time of its 2013 spin-off from Naver.

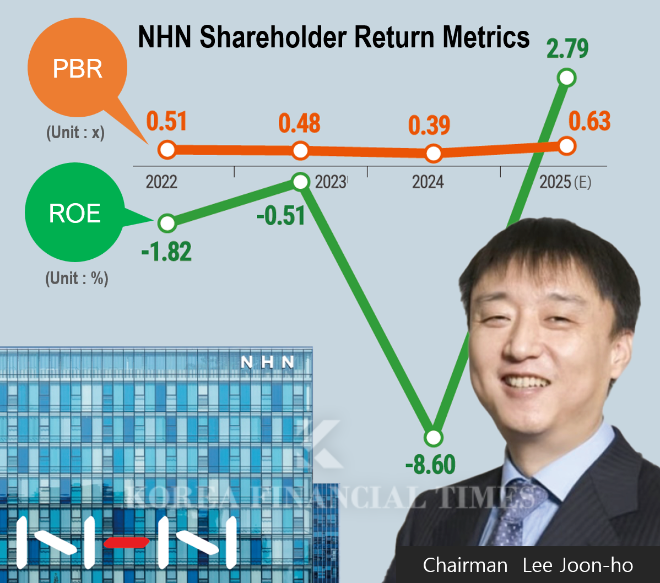

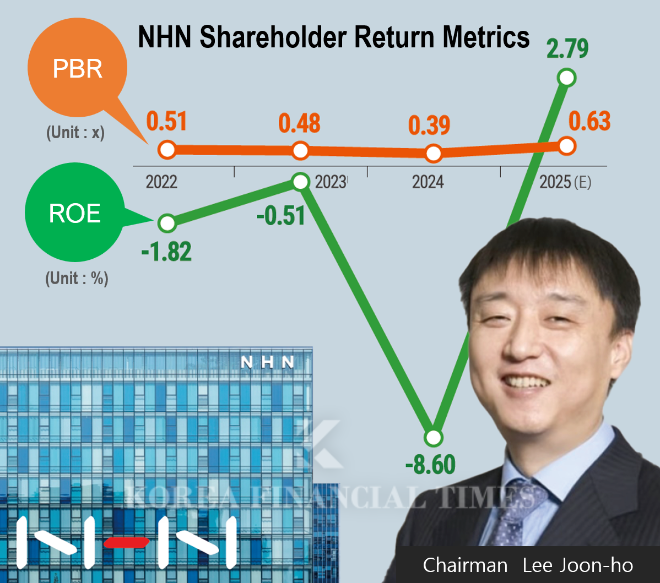

On July 29, the price briefly rose to KRW 36,200, fueled by optimism after NHN Cloud was selected as the primary operator for a government GPU infrastructure project. Despite this, the company’s price-to-book ratio (PBR) stood at just 0.63 x as of Q3 2025—a figure significantly lower than the average 2.10 x for major KOSPI-listed IT firms like Samsung SDS, LG CNS, and Hyundai Autoever.

PBR represents the ratio of a company's market value to its book value. A PBR below 1 suggests that the stock is undervalued relative to its assets, potentially making it attractive to investors.

NHN was created through the spin-off of Naver’s gaming division. Since then, Chairman Lee Joon-ho, who also serves as chairman of the board, has sought to transform NHN into a comprehensive IT firm—reducing its reliance on gaming while pursuing aggressive mergers and acquisitions to diversify.

CEO Chung U-jin, in his twelfth year at the helm, has faithfully carried forward Lee’s ambitions. The number of subsidiaries grew from 39 at his appointment to 89 in 2022. Notable subsidiaries formed during this period include NHN KCP (a digital payments company), NHN Payco, NHN Bugs, and NHN Cloud.

Nevertheless, performance has worsened since 2022. According to the company’s reports, consolidated operating profit came in at KRW 39.1 billion in 2022 and KRW 55.6 billion in 2023, turning to an operating loss of KRW 32.6 billion last year. Net losses amounted to KRW 31.8 billion in 2022, KRW 23.1 billion in 2023, and KRW 192.6 billion in 2024.

In 2022, Chung announced a structural efficiency strategy, aiming to reduce consolidated subsidiaries to around 60 by 2024, focusing on five core businesses: gaming, technology, payments, commerce, and content. As of March this year, NHN had scaled down to 69 subsidiaries.

Instead, it has been reinforcing its core operations by focusing on selected key areas. NHN KCP has maintained a steady cash flow, generating operating profits of KRW 44.2 billion in 2022, KRW 42 billion in 2023, and KRW 43.8 billion in 2024. NHN Cloud, regarded as the company’s future growth engine, has accumulated KRW 91 billion in operating losses over the past three years but has secured growth potential with the government GPU project deal.

During the Q1 2025 earnings call, Chung remarked, “We are accelerating structural improvements by concentrating resources on our core services.”

In 2022, NHN introduced a three-year shareholder return plan allocating 30% of EBITDA to shareholder rewards.

Accordingly, the company retired more than 3.75 million treasury shares — equivalent to 10% of its outstanding stock — between 2022 and last year. However, since NHN began paying regular dividends two years ago, the market has grown increasingly curious about the motives behind the move.

NHN initiated its first dividend of KRW500 per share in 2023, marking the tenth anniversary of its spin-off. The company maintained the same dividend amount last year (2024), despite posting net losses in both years—which resulted in a negative dividend payout ratio.

According to an industry insider, “Even with consecutive losses, NHN’s commitment to dividends over the past two years has been remarkably strong. Chairman Lee Joon-ho is expected to receive billions of won in dividend income annually.”

In reality, Chairman Lee Joon-ho’s direct stake in NHN has grown from 3.74% in 2013 to 28.76% as of 2025. Including JLC (9.92%) and JLC Partners (8.88%), both wholly owned by Lee, along with family affiliates holding 7.05%, Lee and related parties together control 54.61% of the company.

In April 2022, controversy flared over Chairman Lee Joon-ho’s growing influence during the physical spin-off of NHN Cloud. Minority shareholders fiercely objected, arguing that by carving out the company’s prized cloud business in this manner, only Lee’s control was strengthened while the interests of shareholders were disregarded.

The shareholders at the time argued, "If the IPO of the cloud division is pursued, it would intentionally undermine the value of the parent company," further claiming that "this is evidence that share price support is being avoided to facilitate succession."

Lee’s son, born in 1992, joined NHN in 2021 to head a new business task force but left in 2024 to study abroad. NHN has countered claims of succession planning, stating that it had established provisions for allocating shares of any newly-listed subsidiary to parent company shareholders and that no second-generation succession is currently under consideration.

Jeong Chaeyun (chaeyun@fntimes.com)

![기관 '한미반도체'·외인 'NAVER'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013022473402636179ad439071182357237.jpg&nmt=18)

![[DCM] 한화시스템, FCF 적자 불구 시장조달 자신감](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020204171101504a837df6494123820583.jpg&nmt=18)

![기관 '에코프로'·외인 '에코프로'·개인 '알지노믹스' 1위 [주간 코스닥 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013022563407542179ad439071182357237.jpg&nmt=18)

![12개월 최고 연 3.20%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 1주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260130181142061535e6e69892f18396169112.jpg&nmt=18)

![[주간 보험 이슈] 예별손보 예비입찰자 한투·하나금융·JC플라워…완주 가능성은 外](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260201205414020408a55064dd1106248197152.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)