CEO and President, LG Display Jeong Cheoldong

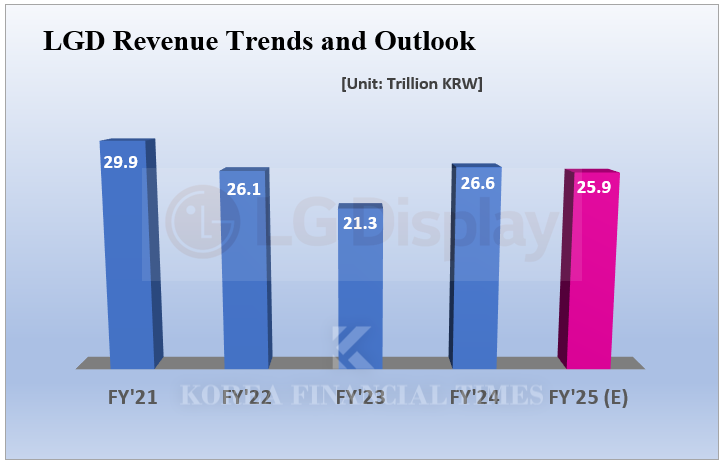

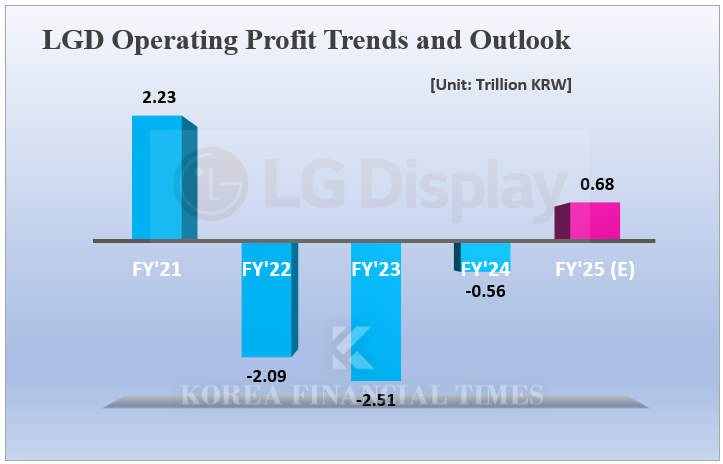

In the first quarter of this year, LG Display posted revenues of KRW 6.065 trillion and operating profit of KRW 33 billion. Compared to the same period last year, revenue increased by 15% and the company returned to profitability. However, compared to the previous quarter (Q4 2024), revenue and operating profit declined by 23% and 60%, respectively.

LG Display emphasized the significance of achieving a profit despite sunk costs from legacy LCD facilities and seasonal off-peak demand. In fact, EBITDA in Q1 stood at KRW 1.231 trillion, similar to Q4 2024, and annual cash flow continues to improve. Last year, EBITDA was KRW 4.7 trillion, up 153% from KRW 1.85 trillion the previous year.

Nevertheless, most analysts believe it is too early to say the company has fully rebounded.

The revenue share of IT panels (for monitors, laptops, and tablets) surged from 28% in Q4 2024 to 35% in Q1 2025, a 7 percentage point jump in just three months. TV panel share remained at 22%, mobile panels dropped from 42% to 34%, and automotive panels increased from 8% to 9%.

Industry insiders attribute the spike in IT panel demand to inventory buildup in anticipation of U.S. tariff policy changes, suggesting the effect may be temporary. As this one-off demand wanes, Q2 results may weaken.

In April, LG Display sold its Guangzhou LCD plant in China to CSOT, a display affiliate of TCL. This marked the company’s complete exit from the LCD TV panel business.

The results of LG Display’s transition from LCD to OLED will become evident starting in the second half of this year. During the Q1 earnings announcement in April, the company stated, “Revenue may decrease from Q2 as LCD TV panel sales are excluded, but this is a strategic choice to focus on advancing an OLED-centric business structure.”

Expectations are especially high for Apple’s iPhone 17, to be unveiled this fall. Apple plans to equip all iPhone 17 models with large OLED panels, specifically adopting LTPO (Low-Temperature Polycrystalline Oxide) technology that supports a 120Hz variable refresh rate. While Chinese manufacturers are catching up in domestic markets, they reportedly still fall short of Apple’s quality standards.

Based on these factors, securities firms project LG Display will achieve operating profit of KRW 470 billion to KRW 500 billion in Q4.

This would not only fulfill CEO and President, LG Display Jeong Cheoldong’s goal of an ‘annual turnaround’ but also mark a successful normalization of management.

Jeong, an engineer by background, became CEO of LG Display in March last year. He previously served as Chief Production Officer (CPO) during LG Display’s close collaboration with Apple from 2013 to 2016, before moving to other LG affiliates such as LG Chem and LG Innotek. He returned to LG Display after seven years, credited for boosting performance at LG Innotek.

Gwak Horyung (horr@fntimes.com)

![[DCM] 한화, 인적분할 發 신용도·주주가치 ‘동시’ 제고 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012622265605142a837df6494123820583.jpg&nmt=18)

!['친 이재명' 김윤우 유암코 대표 내정자, NPL 경력 보유 법조인 강점…회수율·자본 관리 과제 [금융권 CEO 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260127010722005846a663fbf34175192139202.jpg&nmt=18)

![모델솔루션, 로봇 장착 1년 만에 수익률 207% [정답은TSR]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=202601271518280047274925877361211627527.jpg&nmt=18)

![하나금융·한국투자, 예별손보 인수전 참전 속내는 예보 지원…완주 여부는 물음표 [보험사 M&A 지형도]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260127165113038799efc5ce4ae211217229113.jpg&nmt=18)

![[DCM] 호텔롯데, 롯데렌탈 매각 불발…불편한 ’비대칭’ 기업가치](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012716050607620a837df6494123820583.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)